You Have No Idea How Screwed OpenAI Is

Deep Dives

Explore related topics with these Wikipedia articles, rewritten for enjoyable reading:

-

AI winter

14 min read

Linked in the article (22 min read)

-

Removal of Sam Altman from OpenAI

15 min read

Linked in the article (13 min read)

-

Too big to fail

14 min read

The article's central thesis draws direct parallels between OpenAI's current positioning and the 2008 financial crisis concept of institutions becoming 'too big to fail.' Understanding the history, economics, and policy debates around this concept—including the 2008 bailouts and subsequent Dodd-Frank regulations—provides essential context for evaluating whether OpenAI truly fits this pattern.

One of the recurrent ideas I’ve been hearing lately is that everything OpenAI is doing—from total product diversification beyond chatbots, into browsers, devices, chips, social media, etc., to immense deals across the board with Nvidia, Oracle, Broadcom, AMD, Amazon, etc., to the promises of AGI, superintelligence and the singularity, to the big contracts with the DoD, to the reported $500 billion valuation, to the possible IPO at $1 trillion valuation (around 2026-2027) after restructuring itself into a for-profit company—is with the sole objective of becoming too big to fail. (That’s the title of a Wall Street Journal article that was widely shared earlier this month.)

From this view, OpenAI CEO Sam Altman would be intertwining his influence, like a master weaver, across the economic layers—from consumer to enterprise to government—and transversally throughout culture and politics, so that, even in the scenario of an industrial bubble (AI works but there’s too much money on it) or insufficient returns from datacenter CapEx (AI works but doesn’t provide enough productivity gains), his empire is bailed out.

Economist Tyler Cowen wrote a countercurrent positive take for The Free Press. He argues that it’s good that the AI industry exists as an engine for the languid American economic machine, even if it’s the last remaining of its kind, and so it “makes perfect sense” for Wall Street to be obsessed with it.

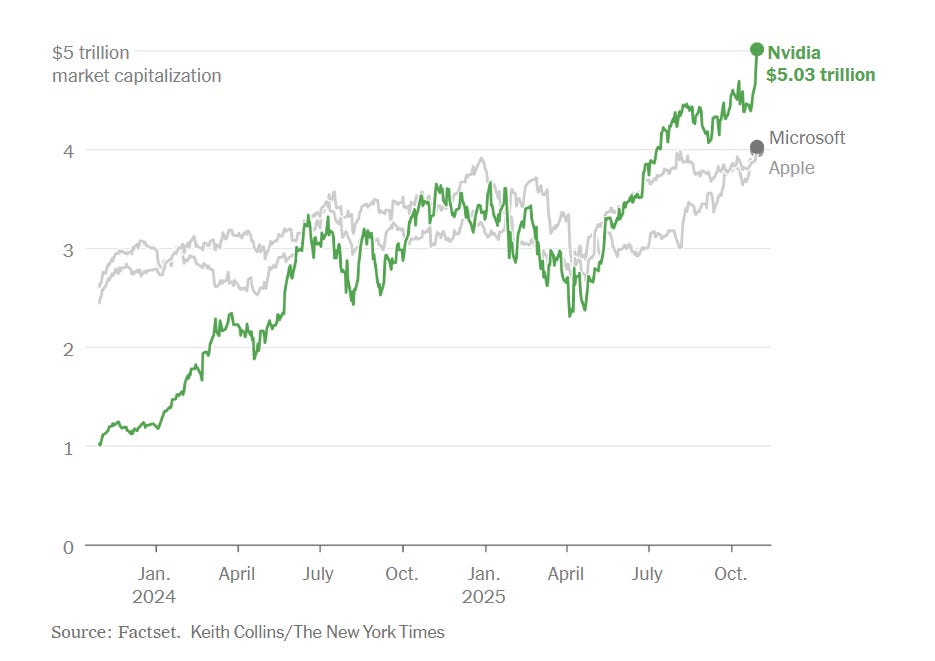

If Nvidia’s $5 trillion market cap is comparable to the GDP of Germany and Japan (I know the metrics are not apples-to-apples, who cares) or if OpenAI’s revenue is far from compensating for the losses (Microsoft’s last earnings report revealed OpenAI incurred a $12 billion loss just the last quarter), that’s not necessarily the sign of a bubble or the symptom of a recession, Cowen says, but a reminder that America specializes in turning the worst of times into the best of times.

Noah Smith—also an economist and a techno-optimist—has not been as positive lately, publishing what might very well be his most depressing piece in the last years: the world war two after-party is over. I sympathize with both Cowen’s and Smith’s views. On the one hand, it’s good to believe that AI could be the answer to the half-century-long decline of Western civilization. On the other hand, it’s hard to

...This excerpt is provided for preview purposes. Full article content is available on the original publication.