How the Financial System Invented “Climate Risk” Untethered from Climate Science

Deep Dives

Explore related topics with these Wikipedia articles, rewritten for enjoyable reading:

-

Mark Carney

17 min read

The article identifies Carney's 2015 speech as the pivotal moment that 'launched the climate-risk industrial complex.' Understanding his background as Governor of the Bank of England and Bank of Canada, and his role in shaping global financial policy on climate, provides essential context for the article's argument.

-

Stern Review

13 min read

Cited as one of three significant events in developing the notion of 'climate risk,' this 2006 UK government report on the economics of climate change was foundational to the financial framing of climate as an economic threat. Understanding its methodology and reception illuminates the intellectual origins of the climate-risk framework the article critiques.

-

Bank for International Settlements

13 min read

The article discusses how the BIS hosts the Financial Stability Board and issued the 'green swan' report. This institution, often called the 'central bank of central banks,' plays a little-understood but crucial role in global financial regulation. Readers would benefit from understanding its unique position in the international financial system.

Part 1 of the THB series on climate change and insurance focused on the recent financial performance of the insurance industry in the context of fevered claims of its looming collapse due to climate-fueled extreme events.

Today, in Part 2 I take a deeper dive into one of the issues alluded to in that post — the rise of a climate-risk industrial complex in the global financial community.

Today’s installment looks at three issues:

The Invention of a New Type of Risk: “Climate Risk”

“Climate Risk” is Measured in the Economic Costs of Extreme Weather

Claim: The Past Says Little About “Climate Risk,” thus We Need New Risk Models

In short — The global financial community adopted a bespoke definition of “climate risk,” presented as a novel type of risk that could threaten the entire global financial system. Consequently, the argument went, regulators faced an imperative in developing new requirements for financial institutions to disclose their “climate risk” and creating of new regulations to govern that risk. Because “climate risk” was deemed to be newly emergent, the argument continued, new tools beyond conventional climate science were needed to measure and quantify that risk. The result has been the rise of a climate-risk industrial complex.

The Invention of New Type of Risk: “Climate Risk”

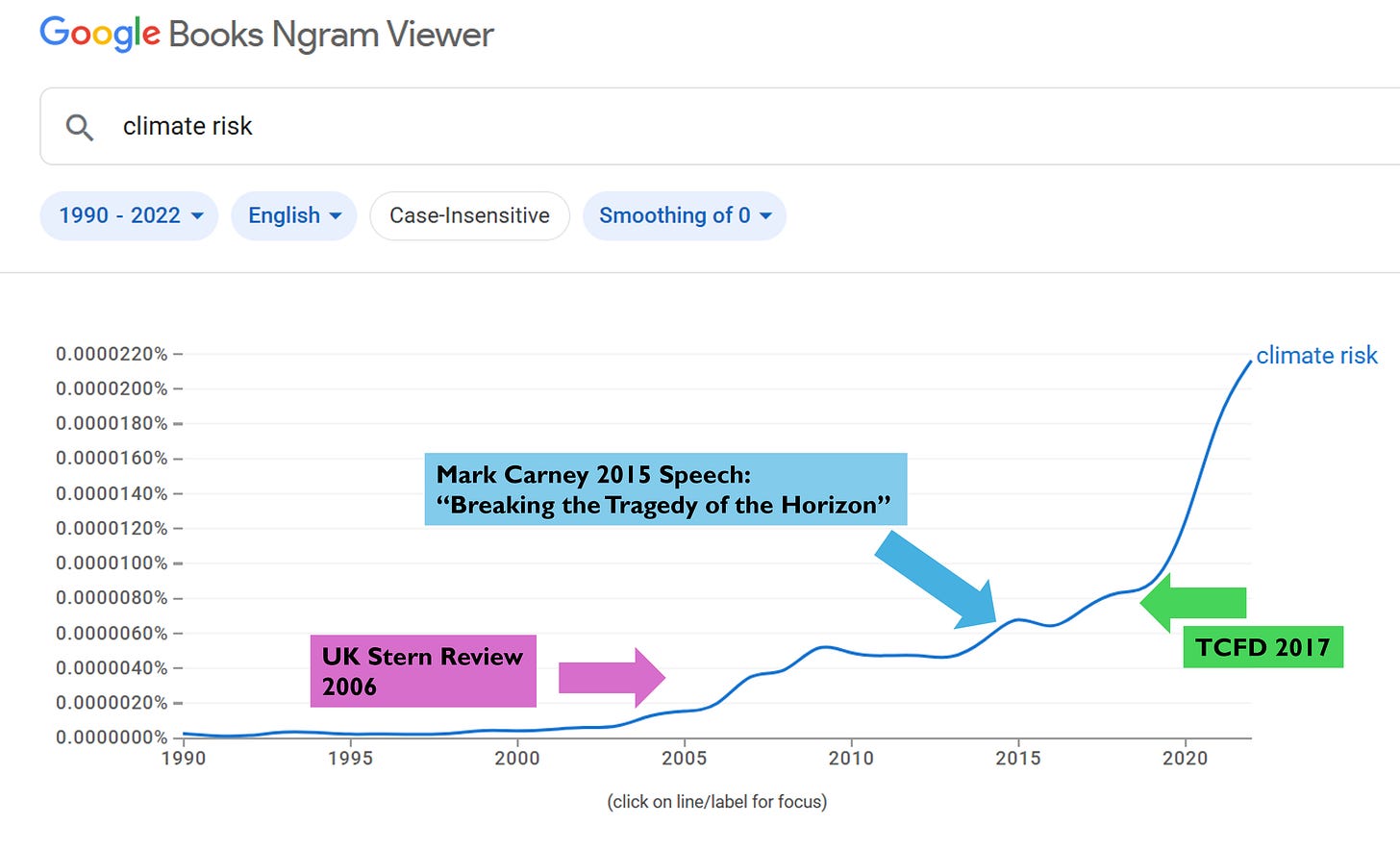

The notion of “climate risk” can be found sparingly in the literature prior to Mark Carney’s 2015 speech that launched the climate-risk industrial complex. The figure below, via Google Ngrams, shows the occurrence of the phrase “climate risk” in English language books published from 1990 to 2022.

The term was not much found prior to 2000, and subsequently followed a hockey stick pattern into the 2020s.

I have annotated the figure to point to three significant events in the development of the notion of “climate risk” — the 2006 Stern Review report from the United Kingdom (which forecast ever escalating disaster losses), Carney’s 2015 speech, and the 2017 report, Recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).1

The TCFD classified “climate risk” into two categories, which became commonly adopted throughout the financial community:

(1) risks related to the transition to a lower-carbon economy and (2) risks related to the physical impacts of climate change.

The focus of today’s post is on the latter — physical risks.

The Financial Stability Board (FSB) — which oversaw the TCFD — was created in 2009

...This excerpt is provided for preview purposes. Full article content is available on the original publication.