Rising Natural Gas Costs Make Wind and Solar More Expensive, Too

Wind, solar, and storage advocates are celebrating the news that natural gas turbine prices and fuel costs are increasing, suggesting that rising costs for electricity generated by natural gas make their preferred technologies the obvious answer for meeting new power demand for data centers and manufacturing.

What these advocates don’t seem to realize is that rising natural gas prices also make wind and solar more expensive by increasing the cost of the backup generation needed to provide power when wind and solar don’t show up to work.

These rising prices mean it makes much more sense to keep existing coal and nuclear plants online for as long as possible rather than relying on some combination of wind, solar, storage, and natural gas.

Totally Turbulent Turbine Prices

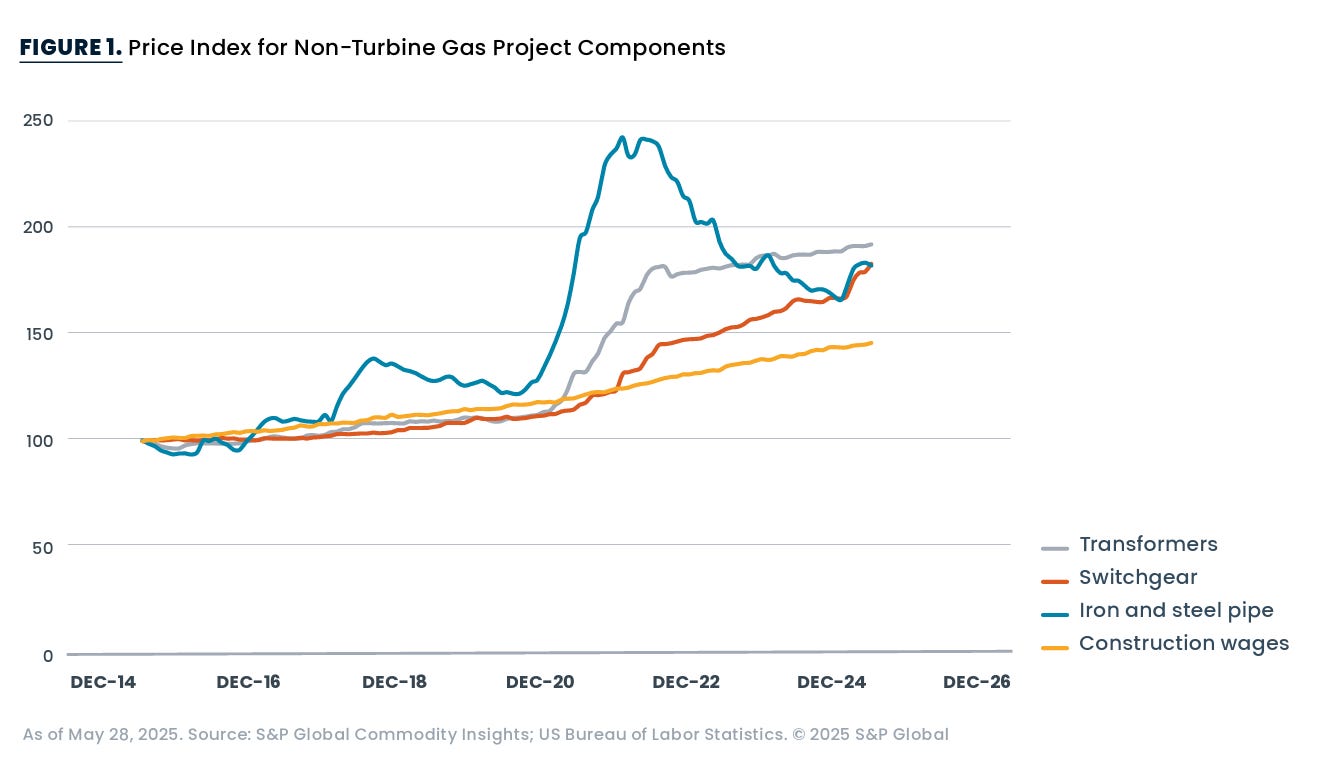

Surging demand for new natural gas generators and a bottleneck in supply —for now—have caused gas turbine prices to skyrocket. Other cost data from S&P also show higher costs for transformers, labor, switchgear, and iron and steel pipe, relative to the pre-COVID era.

CC Gas Costs

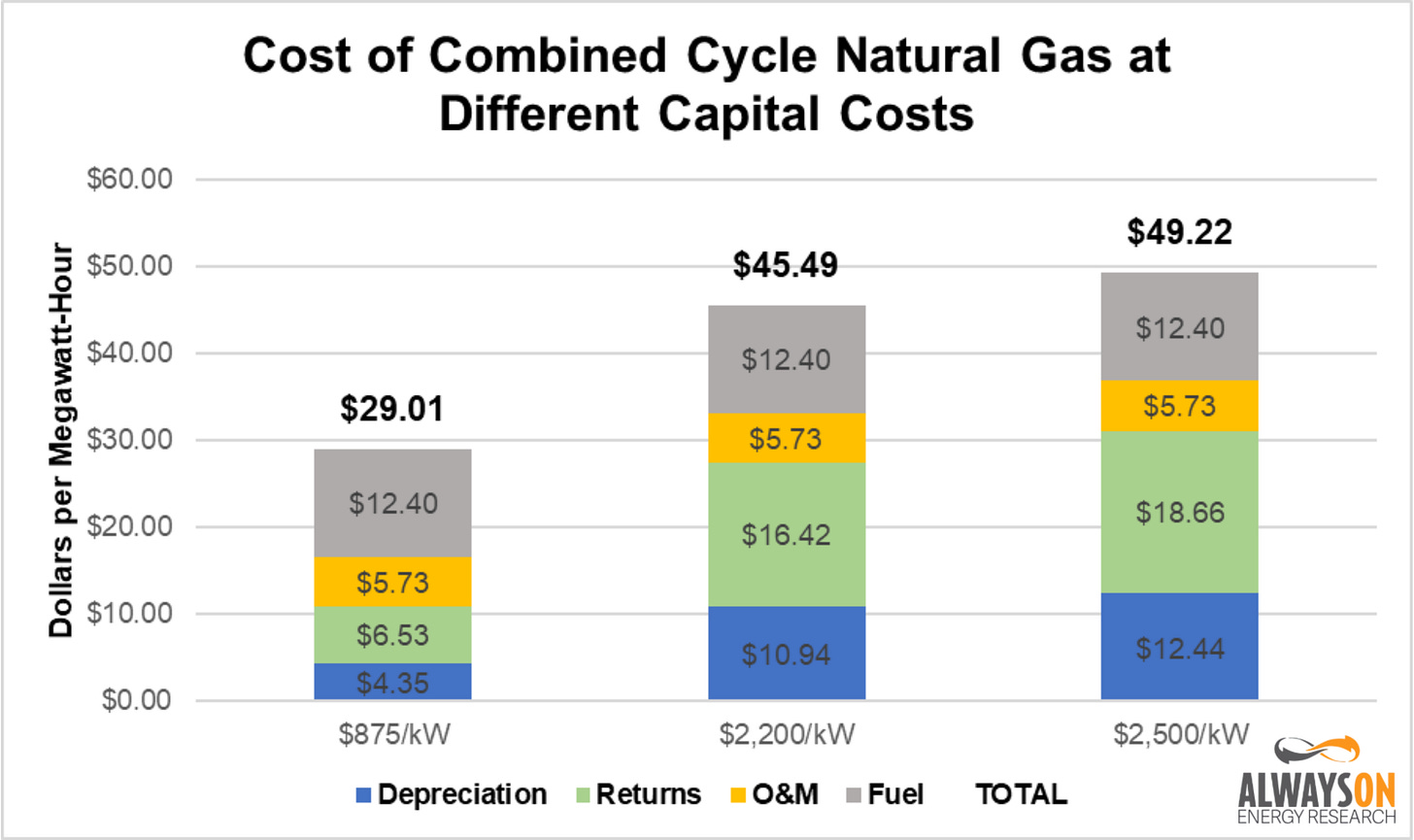

The U.S. Energy Information Administration (EIA) estimates the cost of a new combined cycle (CC) gas turbine to range from $824 to $875 per kilowatt (kW) of installed capacity. However, Utility Dive recently reported that costs have risen to $2.2 million to $2.5 million per megawatt (MW) to build a new natural gas CC plant, meaning gas turbine prices have roughly tripled compared to just a few years ago.

These increasing capital costs have important implications for the Levelized Cost of Electricity (LCOE) of new natural gas plants. The graph below shows the cost of electricity from CC natural gas plants at $875 per kW, $2,200 per kW, and $2,500 per kW, assuming a fuel price of $2 per million British thermal units (MMBtu).

As we show in the graph, a near tripling of capital costs does not result in a tripling of the LCOEs of the gas plants. The LCOE of the high-end capital cost of $2,500 per kW is $49.22 per MWh, which is a 70 percent increase compared to the low-end estimates of $29.01 for plants that cost $875 per kW.

At the low end of the capital cost spectrum, capital costs and returns—which are based on the rate of return earned by utilities on their capital expenditures— constitute just over a third of the total cost of electricity from these facilities. At

...This excerpt is provided for preview purposes. Full article content is available on the original publication.