Silicon Oasis: How Abu Dhabi Plays Both Sides of US-China

Deep Dives

Explore related topics with these Wikipedia articles, rewritten for enjoyable reading:

-

Mubadala Investment Company

11 min read

The article extensively discusses UAE sovereign wealth funds and their role in AI investment strategy. Mubadala is central to the UAE's tech ambitions, with its CEO chairing MBZUAI's board. Understanding this $300+ billion fund's structure and global investments provides crucial context for UAE's geopolitical positioning.

-

China–United States trade war

13 min read

The article's core thesis about UAE navigating between US and China requires understanding the broader context of US-China tech decoupling, chip export controls, and sanctions that drive Chinese firms to seek Middle Eastern partners and funding alternatives.

-

Huawei

12 min read

The article mentions Huawei's 5G partnership with UAE's e& telecom company as evidence of continued China-UAE tech cooperation. Understanding Huawei's global controversies, US sanctions, and role in 5G infrastructure illuminates why this partnership signals UAE's strategic hedging.

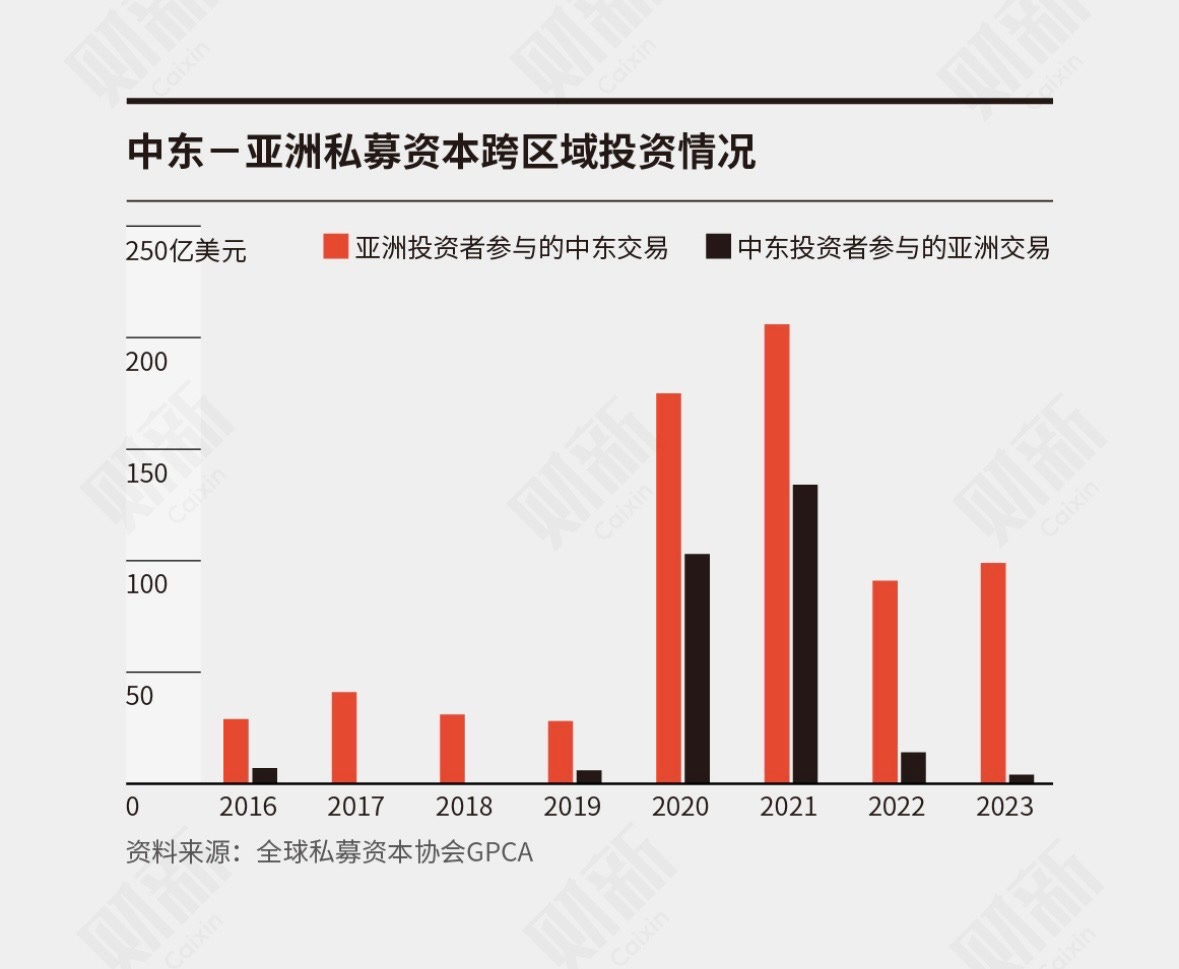

Anonymous contributor “Masa Rick” returns to ChinaTalk. Last year, Masa Rick discussed China’s growing interest in the Middle East. Today’s report assesses how the UAE in particular has been responding China’s advances toward the region.

The United Arab Emirates has emerged as a formidable player in artificial intelligence, leveraging its immense financial resources, influence over the Global South, and a deliberate balance between the United States and China.

So when Emarati tech-investment firm MGX joined the likes of OpenAI, SoftBank, and Oracle in pledging $7 billion to Stargate, the move was perceived as the UAE pivoting away from Chinese partnerships and toward the United States. Has the swing vote officially been cast?

The reality is more complex. This report examines China’s strategic interests in the UAE, the UAE’s need for Chinese expertise, and whether Abu Dhabi is genuinely decoupling from Beijing or simply playing both sides to maximize its AI dominance. The evidence shows that the UAE is still probably playing both sides: leaning toward the US for access to chips, while hedging their bets with Chinese brains.

Current landscape: why is the UAE working with China?

The stereotype in China toward the Middle East goes something like this: “the deep-pocketed, oil-rich gulf countries will invest in anything that helps them diversify their economies away from oil.” But that stereotype obscures more than it reveals. The UAE, in particular, is not simply throwing money at Chinese firms. Rather, it demands the best technology, regulatory clarity, and alignment with its national priorities to boost its domestic growth (indigenization). Chinese PE/VC executives who go to Abu Dhabi to raise capital often lament the Western preference that Middle Eastern elites seem to have: after all, most Emirati elites were educated in the UK or other Western countries.

The UAE also prefers sustainability over quick results. As Hazem Ben-Gacem, former co-CEO of Investcorp (a global-investment firm backed by the Abu Dhabi sovereign fund Mubadala), put it, Emirati investment patterns can be summed up in three concepts: “patience,” “strategically distributed,” and “long term.” That approach hardly aligns with the interests of Chinese investors, who have little interest in ending up “trapped” in the UAE.

Even so, the UAE’s pickiness does

...This excerpt is provided for preview purposes. Full article content is available on the original publication.