At least five interesting things: Future of Humanity edition (#72)

Deep Dives

Explore related topics with these Wikipedia articles, rewritten for enjoyable reading:

-

Holocene extinction

13 min read

Linked in the article (46 min read)

-

Extinction event

14 min read

Linked in the article (39 min read)

-

Holocene

11 min read

Linked in the article (21 min read)

Hi, folks! I’m back from my travels in Europe, and just getting back into the swing of blogging. I have a bunch of posts lined up, but if there’s anything you really want me to write about, just drop it in the comments!

Here’s an episode of Econ 102, where Erik and I go through a variety of topics:

Onward to the list of interesting things!

1. Liquidity and the AI “bubble”

The American economy’s future — and possibly, the future of American politics — hinges on the question of whether AI will have a big crash. In a previous post, I wrote that the question likely hinges not on traditional “bubble” processes like speculation or extrapolative expectations, but merely on whether or not people are overestimating the speed with which AI can generate real returns.

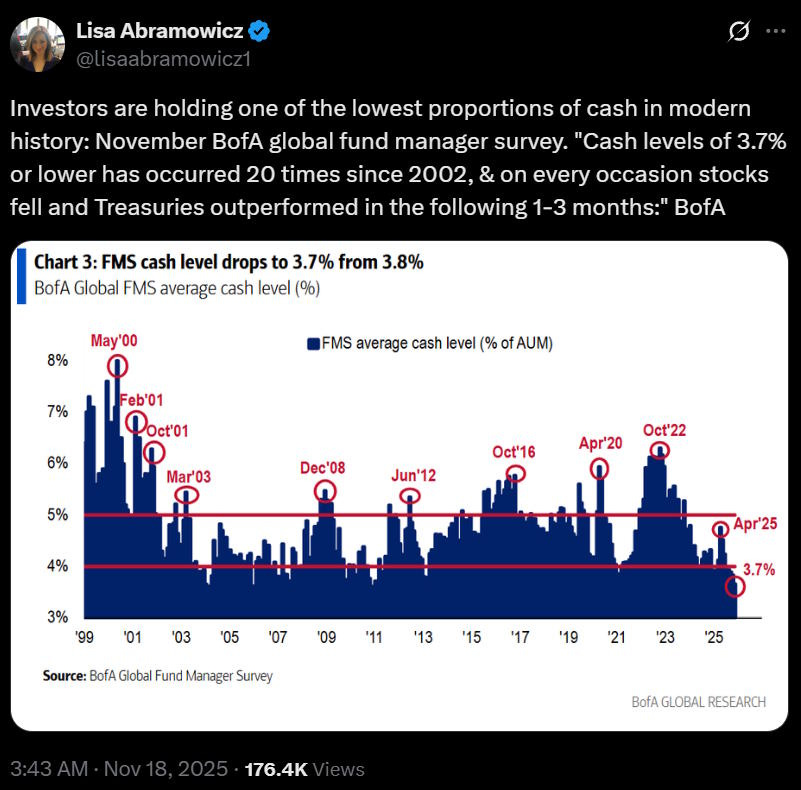

But I might be wrong about that. There might also be more traditional “bubble” processes at work — herd behavior, or speculation, or psychological FOMO, etc. — that might be driving some real AI investment. If so, one warning sign we’d want to watch out for is a drying up of investor liquidity.

In lots of economic models of financial bubbles — the extrapolative expectations model, the information overshoot model, etc. — the bubble stops when people simply run out of more cash to throw into the frenzy. So I get worried when I see stories about AI investors running out of cash:

In the recent past, big tech companies like Google and Meta funded — or at least, could have funded — their AI expansions out of their own profits. But the WSJ has a story about how data center builders are starting to have to borrow instead of just redirecting the cash from their core businesses.

That’s ominous, because that process can’t go on forever.

2. Tariffs and inflation

Economists were right about the fact that Trump’s tariffs would hurt U.S. manufacturing by making it harder to purchase intermediate goods. Trump should have listened to the economists about this.

But were economists wrong about the inflationary effects of tariffs? JD Vance seems to think so:

Now first of all, it’s pretty foolish to make sweeping claims about the economics profession based on a missed forecast. The economics profession, in general, isn’t in the business of macroeconomic forecasting (because none of its

...This excerpt is provided for preview purposes. Full article content is available on the original publication.