The Four Horsemen: Google, Microsoft, Amazon, Meta Earnings

Deep Dives

Explore related topics with these Wikipedia articles, rewritten for enjoyable reading:

-

The Four Horsemen (professional wrestling)

10 min read

Linked in the article (29 min read)

-

U.S. Sugar

9 min read

Linked in the article (5 min read)

The four horsemen just delivered another quarter of strong growth and record AI infrastructure spending. Not the Book of Revelation’s Four Horsemen, but these guys:

Notice one isn’t like the others! That matches investors reactions to earnings…

Let’s first unpack CapEx spending across the four. Then we’ll dive into the big question: when and where will all this investment earn a return?

And finally, given earnings, how should we feel about The People’s Champion?

No, not Muhammad Ali, but this guy:

CapEx

All four hyperscalers are accelerating their AI infrastructure buildouts, with 2026 spending plans set to climb even higher.

Alphabet

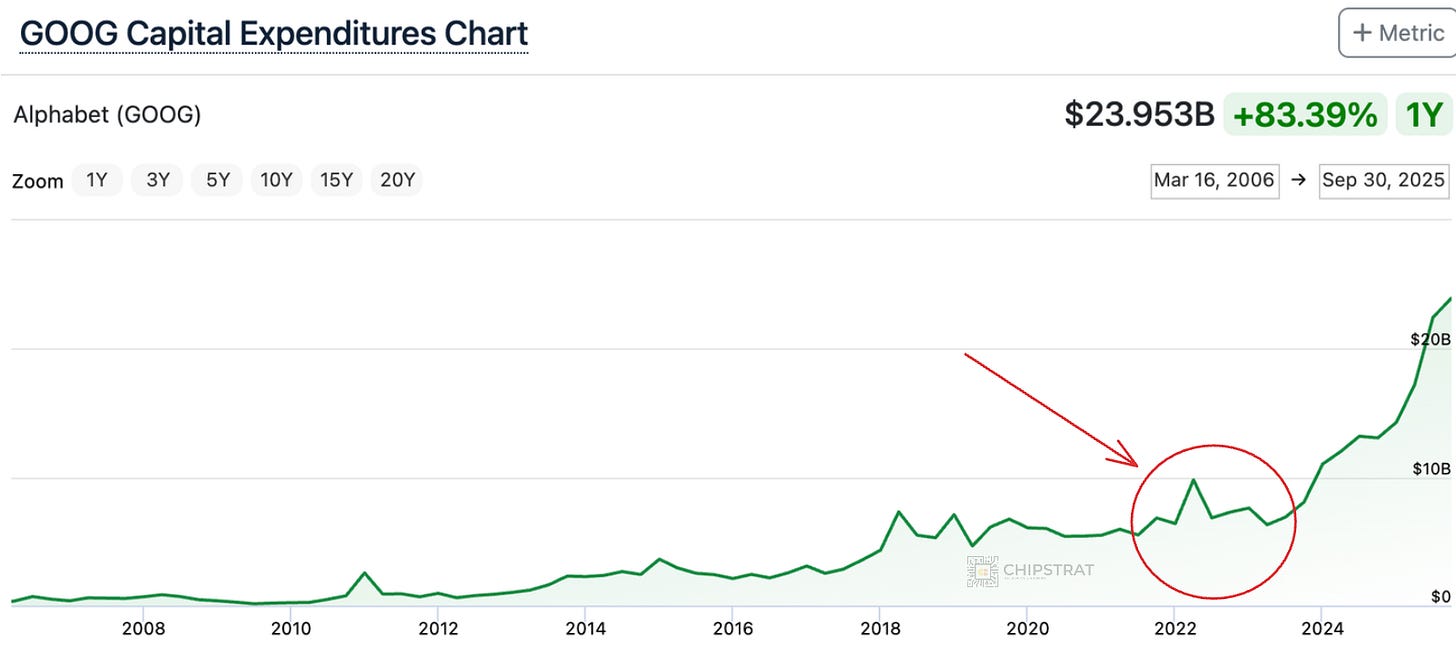

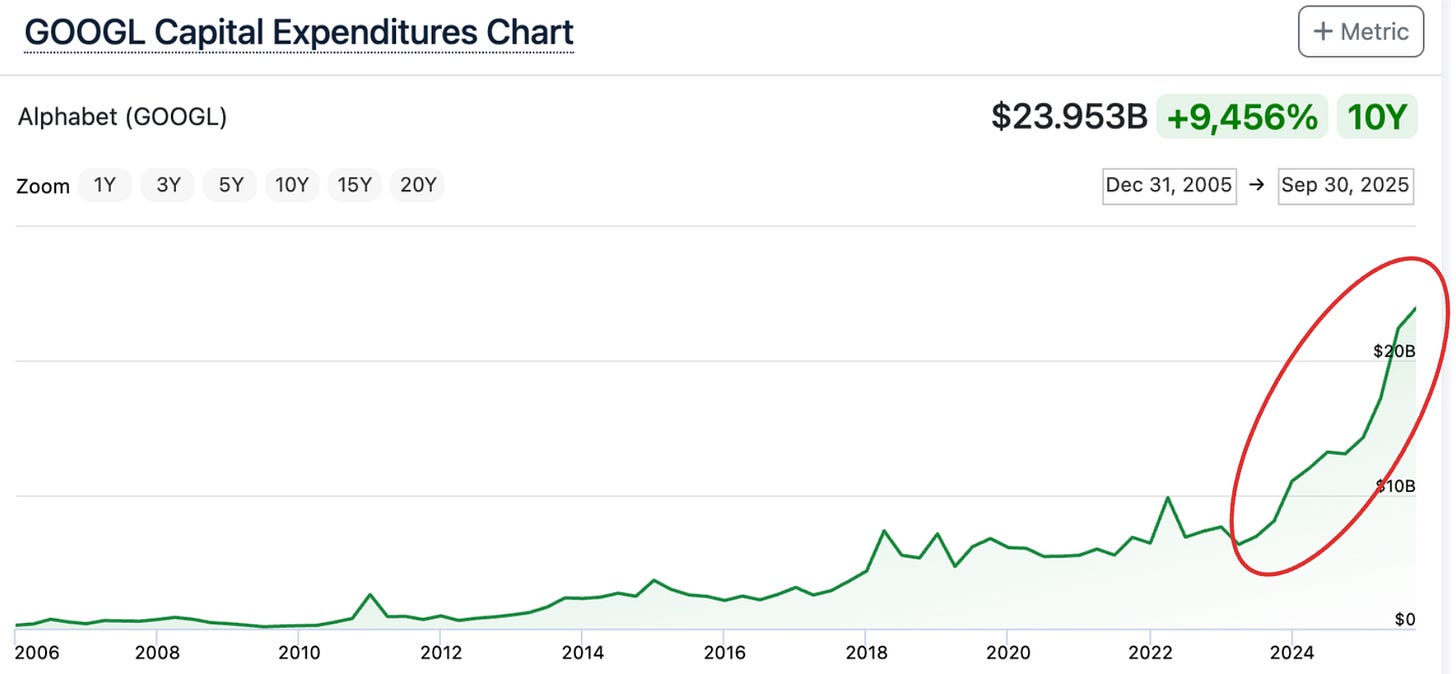

Google is investing aggressively to meet internal and external demand for AI compute, and raised FY2025 CapEx accordingly:

CFO Anat Ashkenazi: We’re continuing to invest aggressively due to the demand we’re experiencing from Cloud customers as well as the growth opportunities we see across the company. We now expect CapEx to be in the range of $91 billion to $93 billion in 2025, up from our previous estimate of $85 billion

A sign of the times: CapEx was bumped up by $6-8 billion!

While that might sound like chump change these days, it wasn’t that long ago that the total quarterly CapEx was $6-8B!

In fact, from IPO up until ChatGPT launch, Google’s quarterly CapEx only once exceeded $8B!

No wonder the entire data center supply chain is up in 2025, from memory and storage to cables and power systems. After all, Google said 60% of CapEx goes to compute (TPUs, GPUs, CPUs) while 40% covers everything else needed to house, power, and connect them.

AA: The vast majority of our CapEx was invested in technical infrastructure with approximately 60% of that investment in servers and 40% in data centers and networking equipment.

The scale and acceleration of AI infra investment shouldn’t surprise anyone. This has been the direction and explicit guidance for several years. The shift to reasoning models in late 2024 and the subsequent surge in inference demand have kicked spending into an even higher gear:

Google CapEx to the moon.

Amazon

Amazon is pouring record amounts into AI infrastructure. Like Google, that spend includes custom silicon (Trainium for AWS, TPU for Google) and the massive data centers to run them (e.g. Project Rainier).

...CFO Brian Olsavsky: Now turning to our cash CapEx, which was $34.2 billion in Q3. We’ve now spent

This excerpt is provided for preview purposes. Full article content is available on the original publication.