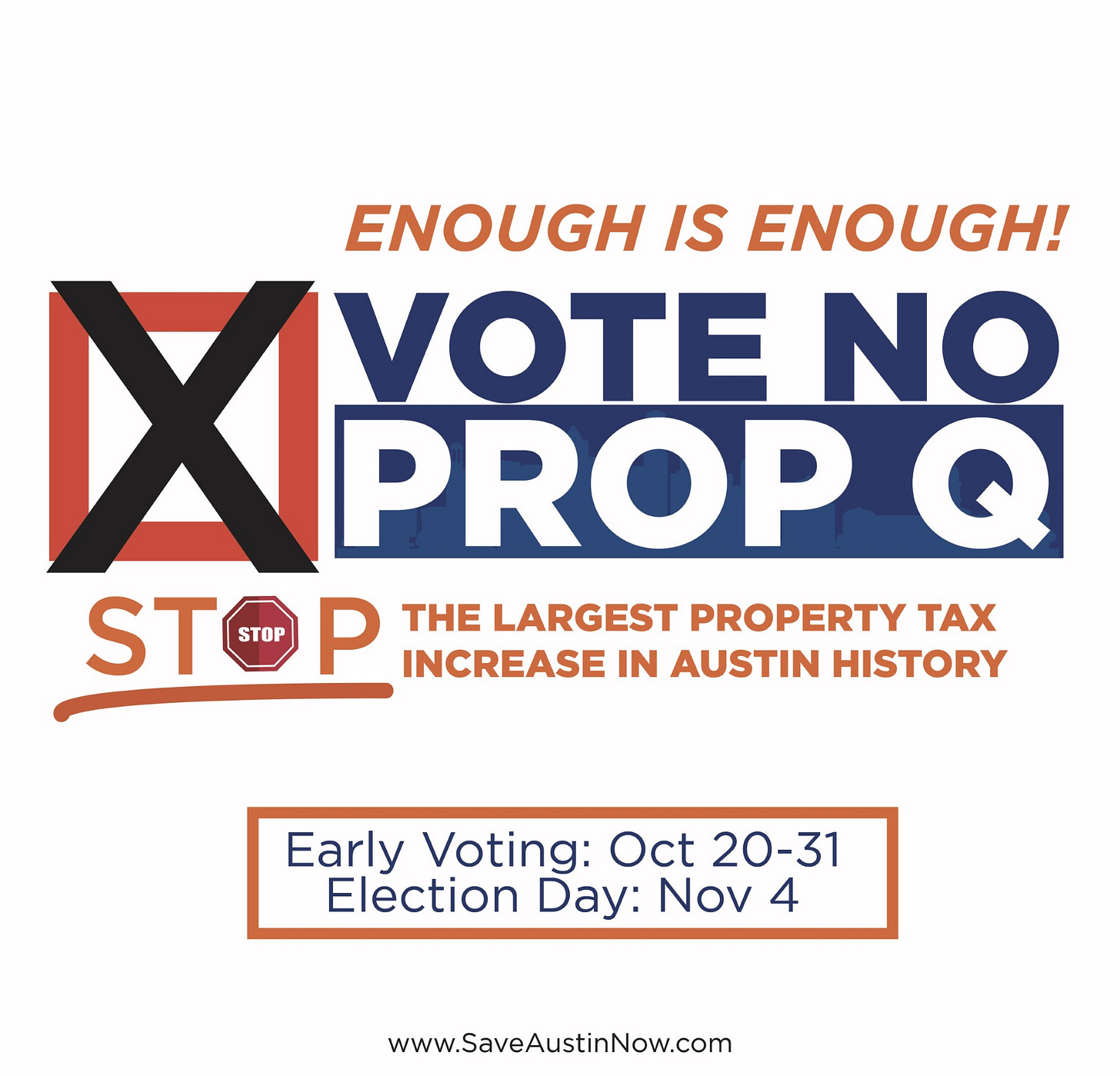

DEFEAT PROP Q: Last Day to Early Vote // 6.8% Turnout So Far // CMs Traveling Now? // Stunning Growth in City Spending // Austin Chamber BoD Opposes Prop Q // Election Night Victory Party

Deep Dives

Explore related topics with these Wikipedia articles, rewritten for enjoyable reading:

-

1978 California Proposition 13

15 min read

California's landmark property tax limitation initiative provides essential historical context for understanding modern tax rate elections like Prop Q, as it fundamentally reshaped how American cities fund services and sparked similar taxpayer revolts nationwide

-

Tax resistance

12 min read

The article centers on organized opposition to a tax increase, and understanding the history of tax revolts in American politics—from colonial times through modern ballot initiatives—provides deeper context for this local political movement

-

Council–manager government

9 min read

The article references the City Manager's budget versus Council decisions, and understanding this specific form of municipal government structure explains the power dynamics and budget authority being debated in Austin

Good (early) Friday morning --

Just a few updates today:

FUENTES, VELA TRAVELING DURING BUDGET DEFICIT

If you aren’t irate about city spending already, this should do it.

At least two of our council members are needlessly traveling RIGHT NOW:

Mayor Pro Tem Vanessa Fuentes is in Japan (info here).

Council Member Chito Vela is in Portland (info here).

No, our city does not benefit from this travel.

AUSTIN CHAMBER OF COMMERCE BOARD OF DIRECTORS OPPOSES PROP Q

Austin Chamber Board of Directors Opposes Proposition Q City of Austin Tax Rate Election

On November 4th, voters in Austin will head to the polls to consider a tax rate election that would increase property tax rates in the City of Austin by over 16%. Austin has experienced strong economic growth in recent years, but with this success has come significant challenges, chief among them is affordability.

Over the past ten years, the typical Austin homeowner’s tax bill has increased by over 65%. This trajectory is unsustainable and at a time of great economic uncertainty, it is imperative that our local governments exercise fiscal restraint.

The City Manager’s original budget stayed within the maximum allowed increase without requiring a tax rate election. That budget also fully funded core services including public safety.

Last month, the Austin Chamber wrote to Mayor Watson and Council Members urging Council to minimize property tax increases on residents and businesses. We recognize the challenging circumstances surrounding this year’s budget but were disappointed with the Council’s near unanimous decision to increase property taxes by over 16%. This increase is on top of higher than normal increases in several other taxing jurisdictions including Travis County and Central Health.

Austin must remain an attractive destination for economic development and job growth, and this dramatic increase in taxes will likely push people out of Austin and negatively impact our ability to attract new investments in our city.

Businesses in Austin experience an outsized share of rising fiscal pressures, and the Austin Chamber remains concerned that further property tax increases will lead to more businesses moving out of our city.

It is for these reasons that the Austin Chamber Board of Directors opposes the City of Austin’s Tax Rate Election on this November’s ballot. If we fail to prioritize affordability today, we risk losing the very people and businesses that have made Austin a thriving community.

Sincerely,

Mark Ramseur

Austin

...This excerpt is provided for preview purposes. Full article content is available on the original publication.