Monopoly Round-Up: Netflix Prices Have Gone Up 125% Since 2014

Deep Dives

Explore related topics with these Wikipedia articles, rewritten for enjoyable reading:

-

Clayton Antitrust Act of 1914

14 min read

The article directly references the Clayton Act as the relevant legal doctrine for evaluating the Netflix-Warner merger's legality. Understanding this foundational antitrust law helps readers grasp the legal framework being applied.

-

United States v. Paramount Pictures, Inc.

11 min read

The article discusses vertical integration in Hollywood and the threat to theatrical exhibition. The 1948 Paramount decrees, which broke up studio ownership of theaters, provide essential historical context for understanding media consolidation debates.

The monopoly round-up is out, and there’s lots of news, as usual. Judge Mehta came out with the final detailed order on the Google search monopolization trial, Michael Jordan thinks he’s going to be beat the NASCAR monopoly, and Larry Summers has been kicked out of the economics fraternity.

But this week, the big news is all about Hollywood.

On Friday, Netflix announced its $83 billion acquisition of much of Warner Bros Discovery, a deal that combines the top paid streamer and the number three streamer, by subscriber count. There are many ways to see this deal, but the starting point has to be how angry the public was when it was announced. I was surprised to see an endless series of viral comments on social media mocking Netflix’s pricing and disrespect of movies. For instance:

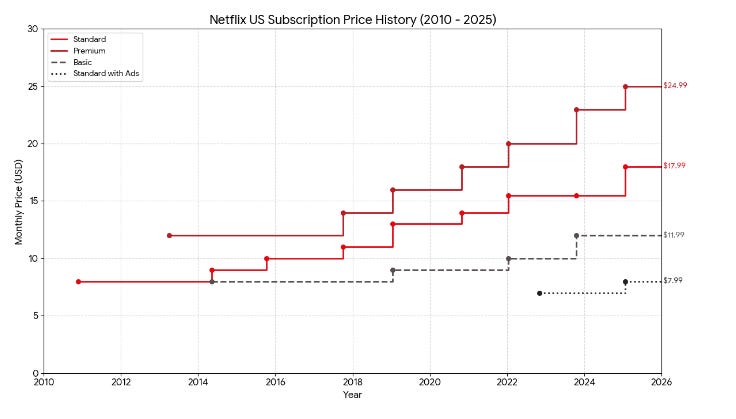

If there’s one fact to explain why people are so unhappy, it’s that Netflix subscription prices have gone up 125% since 2014, which is four times the overall rate of inflation. Americans think Netflix is greedy, and that it has exploited its market power to raise prices. Here’s a chart I put together showing the different tiers of service and the pricing changes.

It’s not lost on people that the increased prices have turned Netflix’s founder into a billionaire, and that if the deal goes through, current Discovery CEO David Zaslav will get such a big payday that he’ll become a billionaire as well.

And prices are likely to continue to go up. Why? Well, as the Entertainment Strategy Guy notes, “this deal needs to boost Netflix’s cash flow by $8 billion per year for the next 20 years to justify itself. That’s a lot of extra money to make from an acquisition.” The best way to increase cash flow is to keep increasing prices.

On Friday, I went on CNBC on Friday to explain why the deal is bad, and why Warner should remain independent. I also had a longer conversation with The Ankler’s Richard Rushfield and former FTC Commissioner Alvaro Bedoya on the topic. The more I dig into it, the weirder the deal seems.

Does Netflix Even Want to Close the Deal?

There are a few unusual aspects to this transaction. The first is something that is important to note upfront - as Nick LoPiccolo of the Hollywood Reporter observed,

...This excerpt is provided for preview purposes. Full article content is available on the original publication.