Chartbook 423 Some topical material on Venezuela. Hopefully useful.

Deep Dives

Explore related topics with these Wikipedia articles, rewritten for enjoyable reading:

-

OPEC

14 min read

Venezuela was a founding member in 1960 and OPEC's role in oil pricing and reserve classifications is central to understanding Venezuela's oil history and the shift from pre-OPEC extraction regimes

-

Oil and gas reserves and resource quantification

10 min read

The article extensively discusses how 'proved reserves' are accounting constructs rather than natural facts, and how Venezuela's reserves jumped from 80 to 300 billion barrels based on price assumptions—understanding reserve classification is key to evaluating the claims

-

API gravity

10 min read

The article references API gravity (8-14° for Orinoco vs 33-40° for Arab Light) as critical to understanding why Venezuelan oil is challenging and expensive to extract—this technical concept determines economic viability

It’s been a busy weekend which put me in mind of a classic quip:

Source: Quote Investigator

A lot of us have been learning a lot about Venezuela!

For my part I’m earnestly trying to finish a book (not about Venezuela) so I have been following what is going on out of the corner of my eye. Even so, I can’t help being struck by the frequent mixing together of interesting data with tendentious interpretive claims.

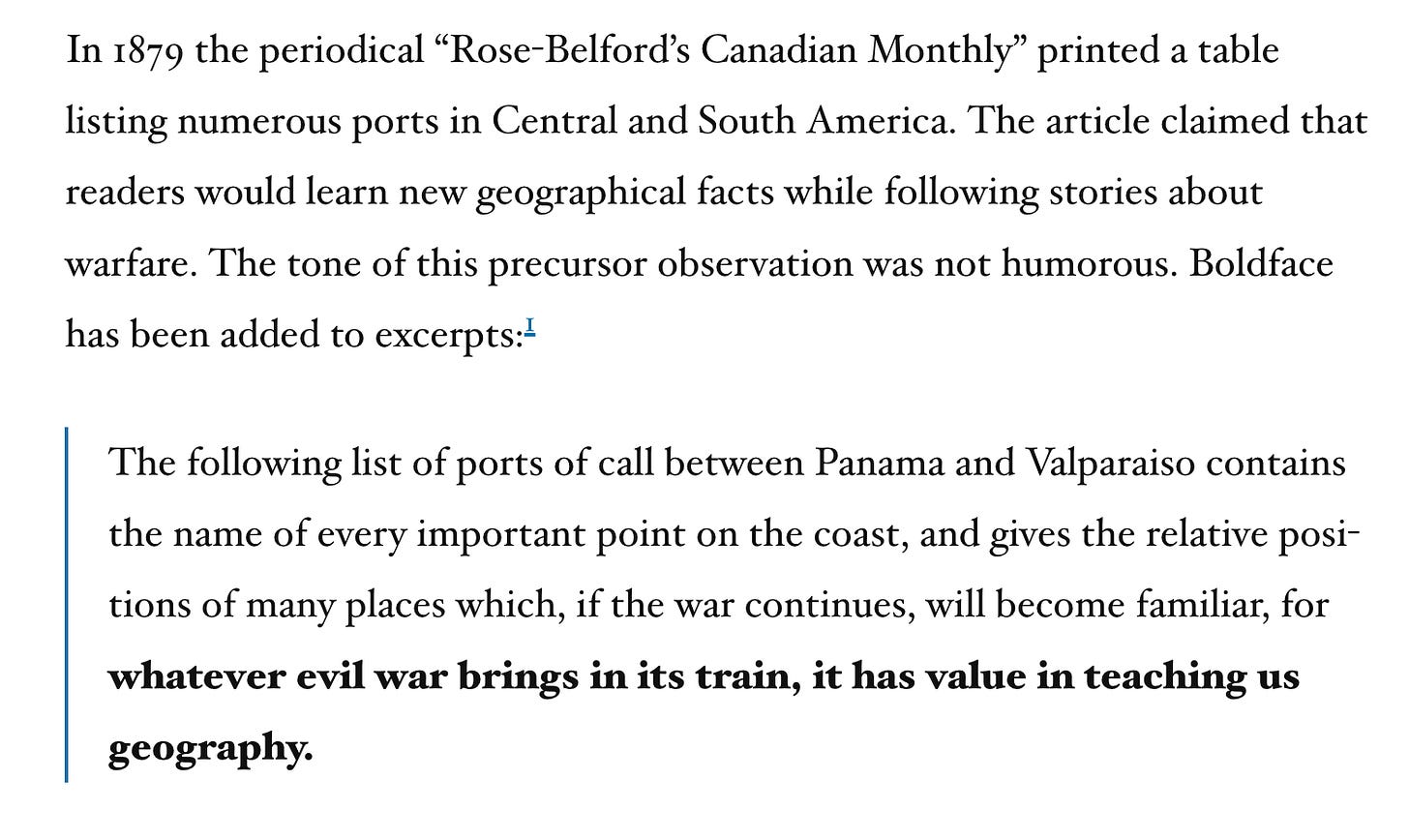

For instance: Historical data on oil rents paid by Venezuela under the pre-OPEC oil regime are very interesting. But what conclusions can you possibly draw? I was sorry to see Gabriel Zucman posting in this fashion.

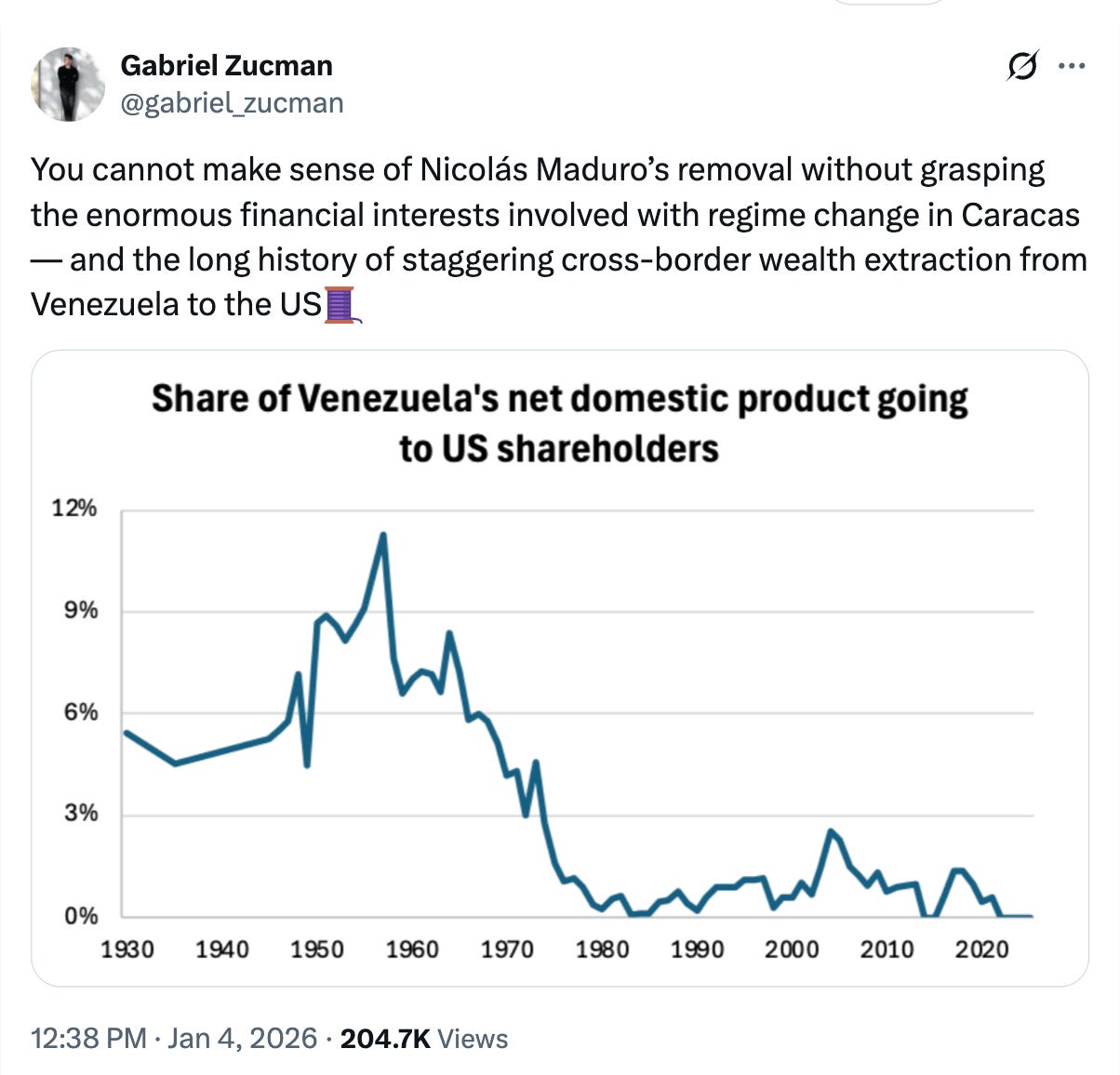

Even as far as Venezuela’s own situation is concerned, to evaluate claims about the relative merits of extractive regimes, one clearly wants an “extraction-adjusted GDP per capita” to get the full picture. And lo and behold, Twitter provides. And yes I am aware that every twitter account comes with its own politics. But this graph is excellent. Clearly, a high rent extraction regime was compatible, to say the least, with rapid economic development in Venezuela. (NOT saying anything about distributional issues, economic diversification etc etc).

BTW Venezuela back in 1960 was a founding member of OPEC along with the Gulf producers.

Oil nationalization in 1976 slashed foreign rents but that was also the moment at which economic growth in Venezuela broadly speaking came to an end. I’m not making any direct causal links. Just trying to get the chronology straight. Nationalization in 1976 seems to have gone relatively smoothly. So much so that the lack of drama disappointed more hard-core resource nationalists.

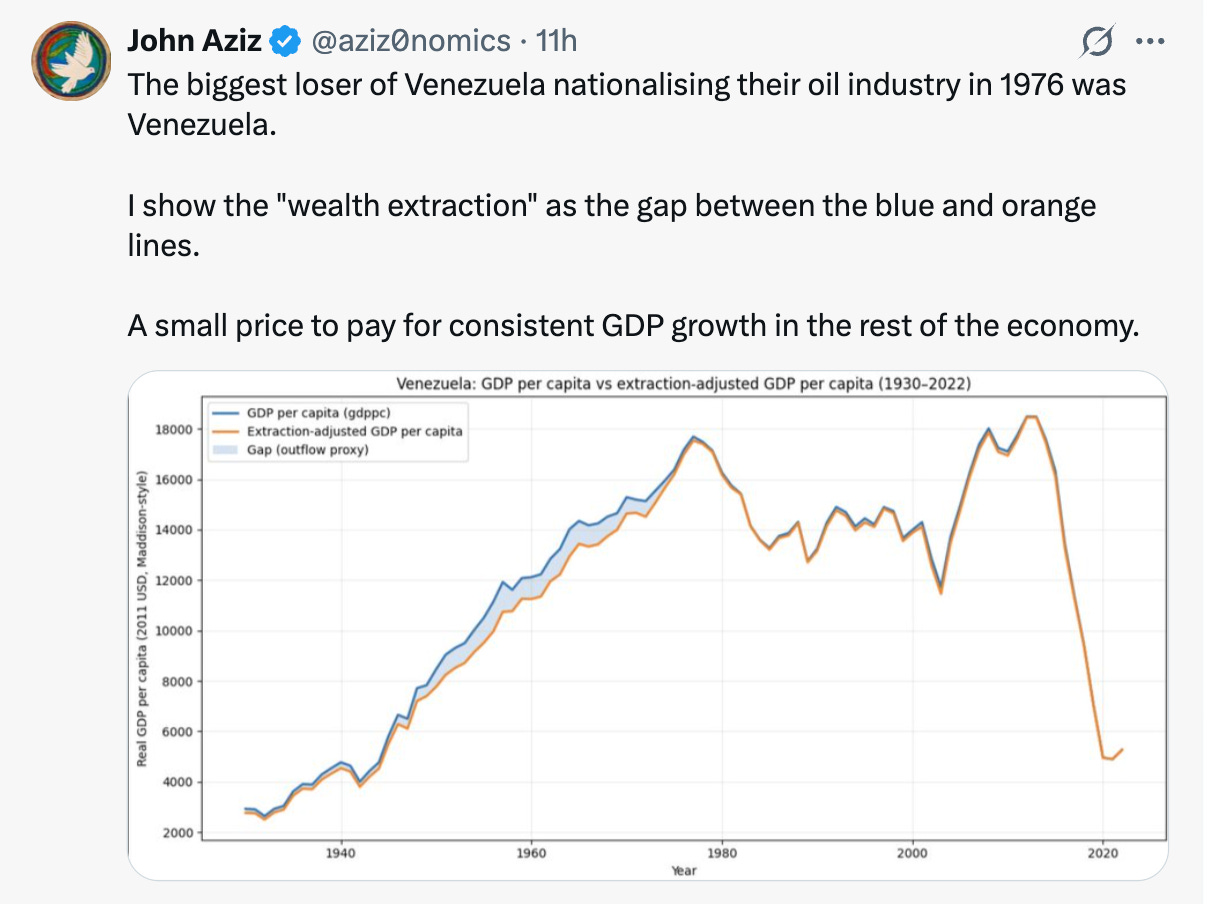

A lot of people have been talking about how much valuable oil Venezuela does or does not have and what type it is. The graph below is very illuminating as to how carefully claims to huge reserves ought to be handled. “Proved reserves” are not simply a natural fact.

There have been a large number of very long twitter comments on oil matters. I found the one below particularly useful in understanding how the extraordinary leap in Venezuela’s oil reserves happened in the 2010s. It is from Yellowbull @Yellowbull11

...There has been lots of talk about the current situation in Venezuela and what it could mean for global oil markets, so I just wanted to provide some nuance on this When people say “Venezuela has

This excerpt is provided for preview purposes. Full article content is available on the original publication.