Why Europe should resist the Second China Shock

Deep Dives

Explore related topics with these Wikipedia articles, rewritten for enjoyable reading:

-

Plaza Accord

10 min read

Linked in the article (8 min read)

-

China shock

12 min read

The article explicitly discusses the 'Second China Shock' as a sequel to the original China Shock - the economic disruption caused by China's entry into the WTO and subsequent manufacturing surge. Understanding the first China Shock's documented effects on American manufacturing employment provides essential context for evaluating the author's warnings about Europe.

-

War economy

12 min read

The article argues Europe must maintain manufacturing capacity for potential military conflict, noting how civilian industries must be repurposable for wartime production. This Wikipedia article explains how economies transform during wartime and the industrial base requirements for sustained military operations - directly relevant to the author's strategic argument.

Europe has a lot on its plate these days. It’s facing a hostile Russia that has no intention of stopping with Ukraine. It’s dealing with tariffs and various other threats from an unpredictable and hostile Trump administration. And it’s struggling with internal unrest over migration from the Middle East and Central Asia. That would be enough to keep anyone occupied. But on top of all that, Europe is being buffeted by the Second China Shock.

The Second China Shock is another name for the flood of high-tech exports that China has been sending out around the world in the last few years. China’s economy is still suffering from the prolonged effects of the real estate bust that began in late 2021. In response, Xi Jinping’s government has unleashed the most expensive and wide-ranging industrial policy the world has ever seen, promoting high-tech manufacturing across a variety of sectors. Because the economy is in the doldrums, Chinese consumers themselves aren’t able to buy all the stuff that their government is paying Chinese companies to make — electric vehicles, ships, machinery, and so on. So the companies are selling that stuff overseas, anywhere they can, for cut-rate prices.

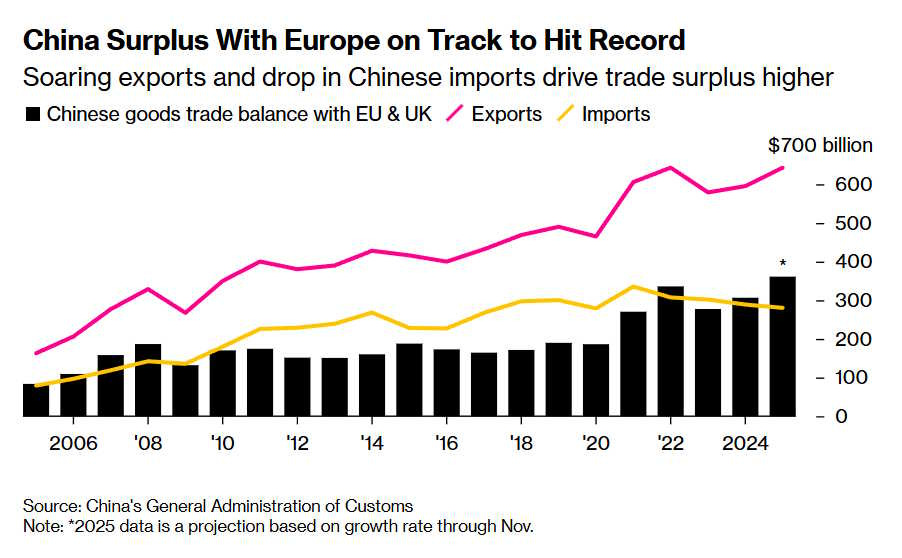

In Europe, that has manifested as a giant trade deficit with China:

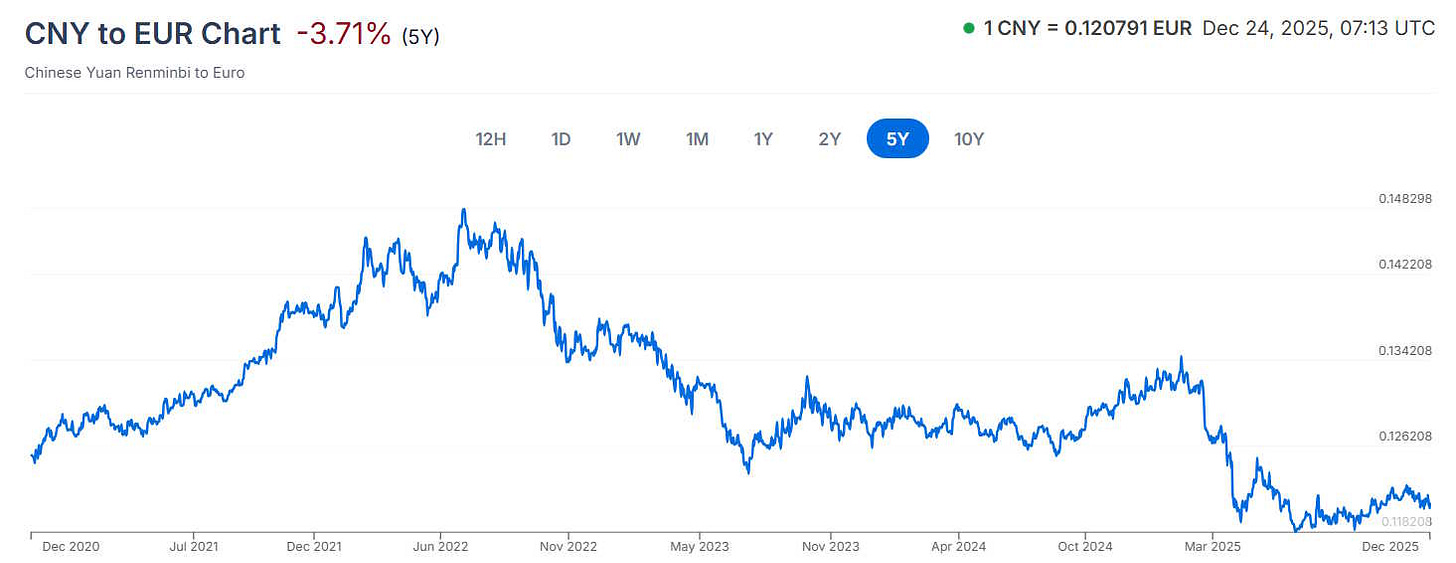

This flood of Chinese exports to Europe is being boosted by several tailwinds. First, China’s currency has gotten cheaper — partly as a result of China’s weak domestic economy, and partly because the government has pushed down the exchange rate in order to pump up exports. Shanghai Macro Strategist writes:

This combination — falling relative prices in China and a weaker currency — has made Chinese goods and services extraordinarily cheap in global terms…A vivid example: a night at the Four Seasons Beijing costs roughly $250, compared with more than $1,160 in New York. The price gap is so extreme that it no longer reflects relative productivity or income levels; it reflects a currency that has become fundamentally undervalued…At these valuations, it is virtually impossible for most countries to compete with Chinese exporters. The current level of the yuan is simply too cheap to support a sustainable rebalancing of global trade.

Here’s a chart showing the yuan’s recent depreciation against the euro:

The second tailwind is Trump’s tariffs. Although Trump has backed off of most of his threats of tariffs

...This excerpt is provided for preview purposes. Full article content is available on the original publication.