Late Britain

Deep Dives

Explore related topics with these Wikipedia articles, rewritten for enjoyable reading:

-

2024 United Kingdom general election

12 min read

Linked in the article (48 min read)

-

2024 French legislative election

14 min read

Linked in the article (68 min read)

-

North Sea oil

13 min read

The article discusses Shell and ExxonMobil selling North Sea gas fields and the impact of the Energy Profits Levy on UK hydrocarbon production. Understanding the history, scale, and strategic importance of North Sea oil to Britain's economy and energy security provides essential context for why the regulatory decisions described are so consequential.

“It is in your moments of decision that your destiny is shaped.” – Tony Robbins

In June, Prax Group, a UK energy conglomerate and fuel supplier, fell into insolvency. It didn’t take long for British authorities to uncover what appears to be significant fraud in the company’s £780 million receivables securitization facility. A “large hole” of cash is missing, leaving creditors to scramble for what residual value remains. In a statement to Prax’s administrators, former CEO Winston Soosaipillai dryly claimed, “I am without the direct knowledge necessary to concur with the outstanding balances owed to creditors.”

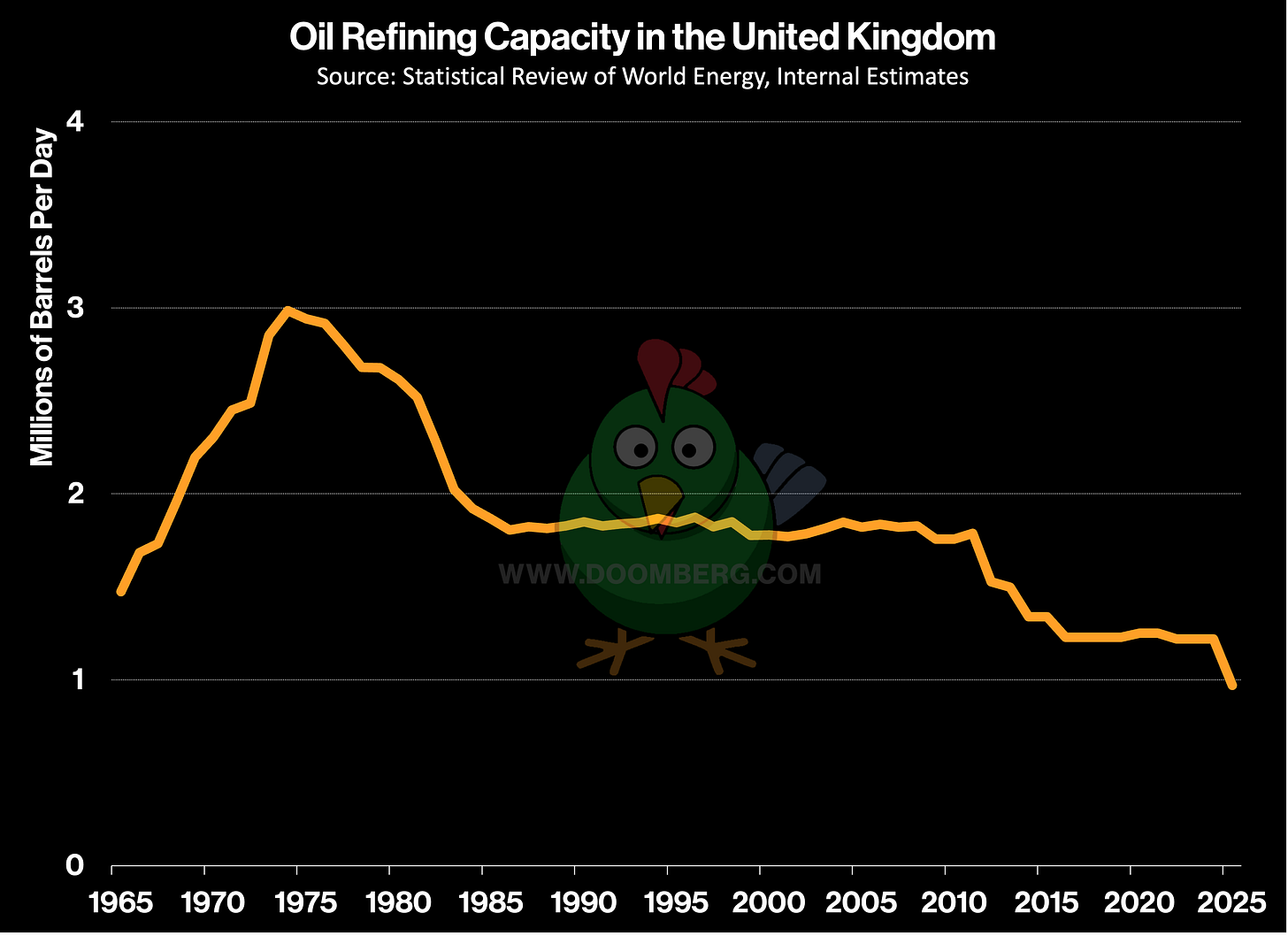

Our interest in Prax arises from the fact that the company operated the Lindsey Oil Refinery in North Killingholme, England. At the time of the filing, it was one of only five operating across the entire UK. The refinery has since ceased operations, and no bidder has emerged with a plan to reopen it—the country is now down to just four:

An underappreciated consequence of regulatory hostility toward the oil and gas sector is that it often triggers a decay in the ownership quality of critical energy infrastructure. Large, well-capitalized supermajors head for the exits, leaving firms with thinner track records and shakier balance sheets to grapple with the quagmire. The Lindsey refinery was originally built by a joint venture of TotalEnergies and Fina in 1968, and the former took full possession of the facility in 1999. After two decades of struggles, Total finally sold the facility to Prax in 2021 for a mere $167 million.

A similar situation appears to be unfolding on the gas side of the British energy ledger, where Shell and ExxonMobil are actively trying to sell several jointly owned North Sea gas fields and the strategically important Bacton gas terminal. The planned buyer is Viaro Energy, an upstart company with a controversial founder. Francesco Mazzagatti is a 39-year-old Italian energy entrepreneur currently facing several criminal and civil charges of malfeasance. According to The Telegraph:

...“These include allegations in London’s High Court that he embezzled €143m (£125m) from Singapore-based Alliance Petrochemicals Investment. He says the case is part of a vexatious, multi-jurisdictional smear campaign and that he has secured victories in related cases in the UAE and Singapore.

He is also accused of bribery and money laundering in a criminal trial in Milan. Again, Mazzagatti denies wrongdoing and the case continues. Separately,

This excerpt is provided for preview purposes. Full article content is available on the original publication.