Why Does Everything Cost So Much?

Deep Dives

Explore related topics with these Wikipedia articles, rewritten for enjoyable reading:

-

Jevons paradox

12 min read

The article discusses how technology makes things cheaper but demand increases exponentially (television example). Jevons paradox explains this phenomenon - technological efficiency gains often increase total resource consumption rather than decrease it, directly relevant to the author's point about technology, energy, and prices.

-

Energy return on investment

10 min read

The article's core argument about resource depletion requiring more energy to extract the same materials (copper ore going from 40% to 0.4%) is fundamentally about declining EROI. This concept provides the scientific framework for understanding why extraction costs rise over time.

This essay is adapted from last week’s Frankly video titled “Inflation, Deflation, & Simplification.” In the future, we’ll be adapting/updating more Frankly videos (current and historic) to written versions and posting them on Substack, so stay tuned for more.

Tens of thousands of years ago, in what’s now known as Tanzania, our ancestors’ price signals were gazelles, tubers, fruit, and other real, tangible goods. Today, our prices are the numbers listed on rent, groceries, tuition, and gas – small barcodes everywhere asking us, “Yes or no?”

How often do we ask ourselves why that number is there? What forces helped to shape what appears on the price tag?

As Milton Friedman famously said, “Inflation is always and everywhere a monetary phenomenon.” This is true. The amount of money created with respect to the economy is important, but prices in dollars (or euros, yen, rupees, etc.) represent signals from a living system that has thresholds, feedbacks, and delays. Money acts as a current in the ocean of energy, materials, technology, leverage, ecosystems, and social contracts. Ultimately, money itself is a social contract that relies on trust and shared values – a contract that will be increasingly stressed as a Great Simplification scenario approaches.

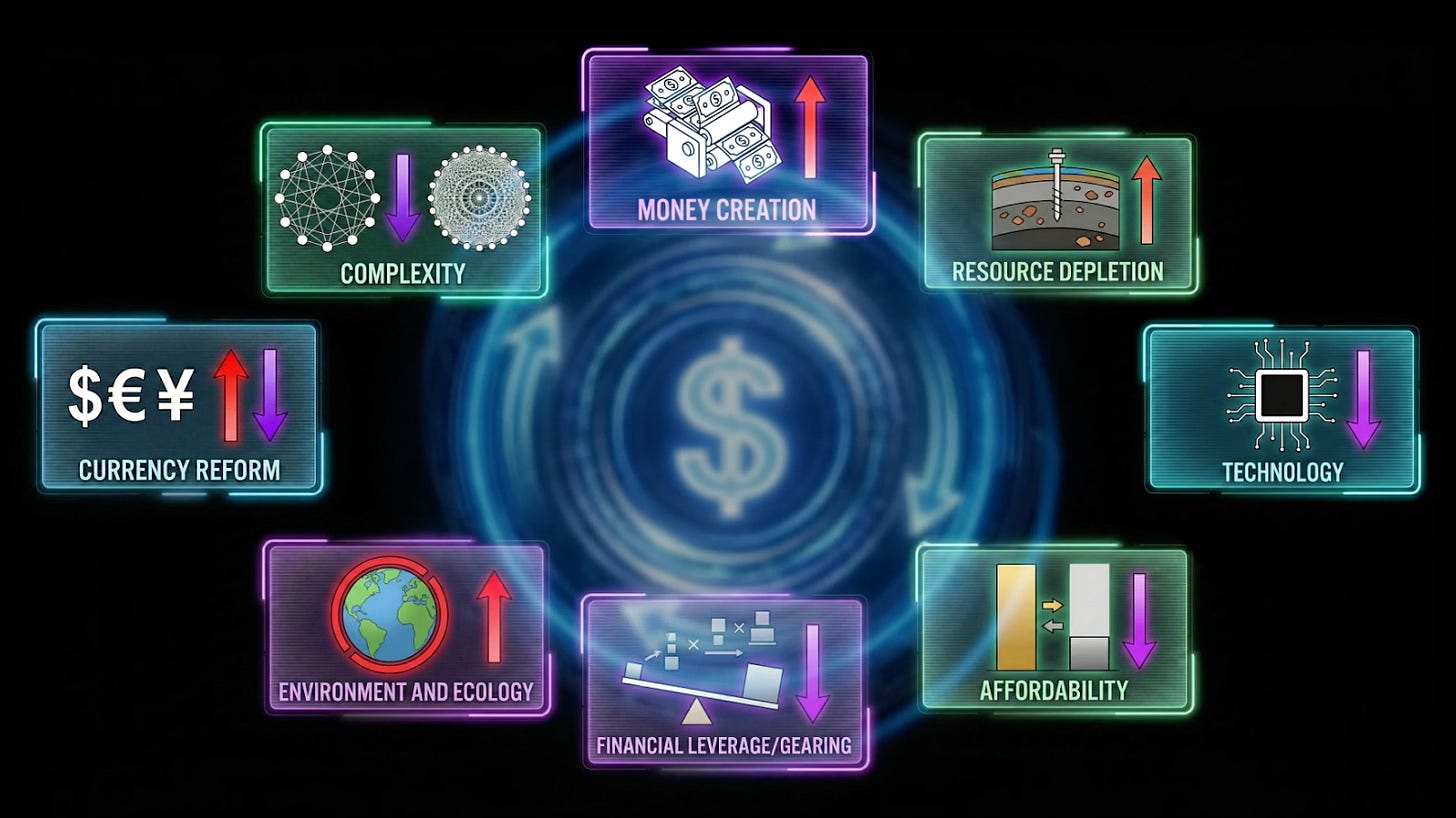

There is a wider boundary framework of how all these economic factors interrelate. In this essay, I outline eight major drivers of either inflationary or deflationary impacts on prices.

What is Money?

In order to unpack prices and the factors that influence them, first we have to understand what money is, and what purpose it serves within our society.

Economic textbooks will define money as:

A unit of account

A medium of exchange

A store of value.

This is all true. But a biophysical lens adds that money is also:

A claim on energy

An externalization of ecosystem costs such as pollution, deforestation, and species extinctions.

When spent, every dollar hires an invisible energy worker that leaves a biophysical footprint.

This leads us to ask the question: How much spendable money can realistically exist in a functioning world?

How is the Amount of Money Determined, & How Does This Affect Prices?

Money creation is the most obvious driver of inflation. When commercial banks issue new loans, they create a new deposit of money. In parallel, when central banks and treasuries coordinate stimulus, they inject new purchasing power into the system.

When we look at

...This excerpt is provided for preview purposes. Full article content is available on the original publication.