Trump’s solution to the housing crisis is a lifetime of debt

Deep Dives

Explore related topics with these Wikipedia articles, rewritten for enjoyable reading:

-

Subprime mortgage crisis

11 min read

The article discusses risky mortgage structures and underwater homes - the 2008 subprime crisis was triggered by similar dynamics of homeowners with little equity facing market downturns, providing crucial historical context for understanding why exotic mortgage products can be dangerous

-

Federal Housing Finance Agency

17 min read

Bill Pulte's agency is central to the article but readers likely don't understand FHFA's regulatory role, its creation after the 2008 crisis, or its oversight of Fannie Mae and Freddie Mac - essential context for evaluating whether this agency should be proposing new mortgage products

-

Government-sponsored enterprise

10 min read

The article references Fannie Mae and Freddie Mac without explaining what they are - understanding GSEs and their unique public-private status helps readers grasp why federal officials can influence mortgage terms and who bears the risk of policies like 50-year mortgages

There is a housing crisis in the United States.

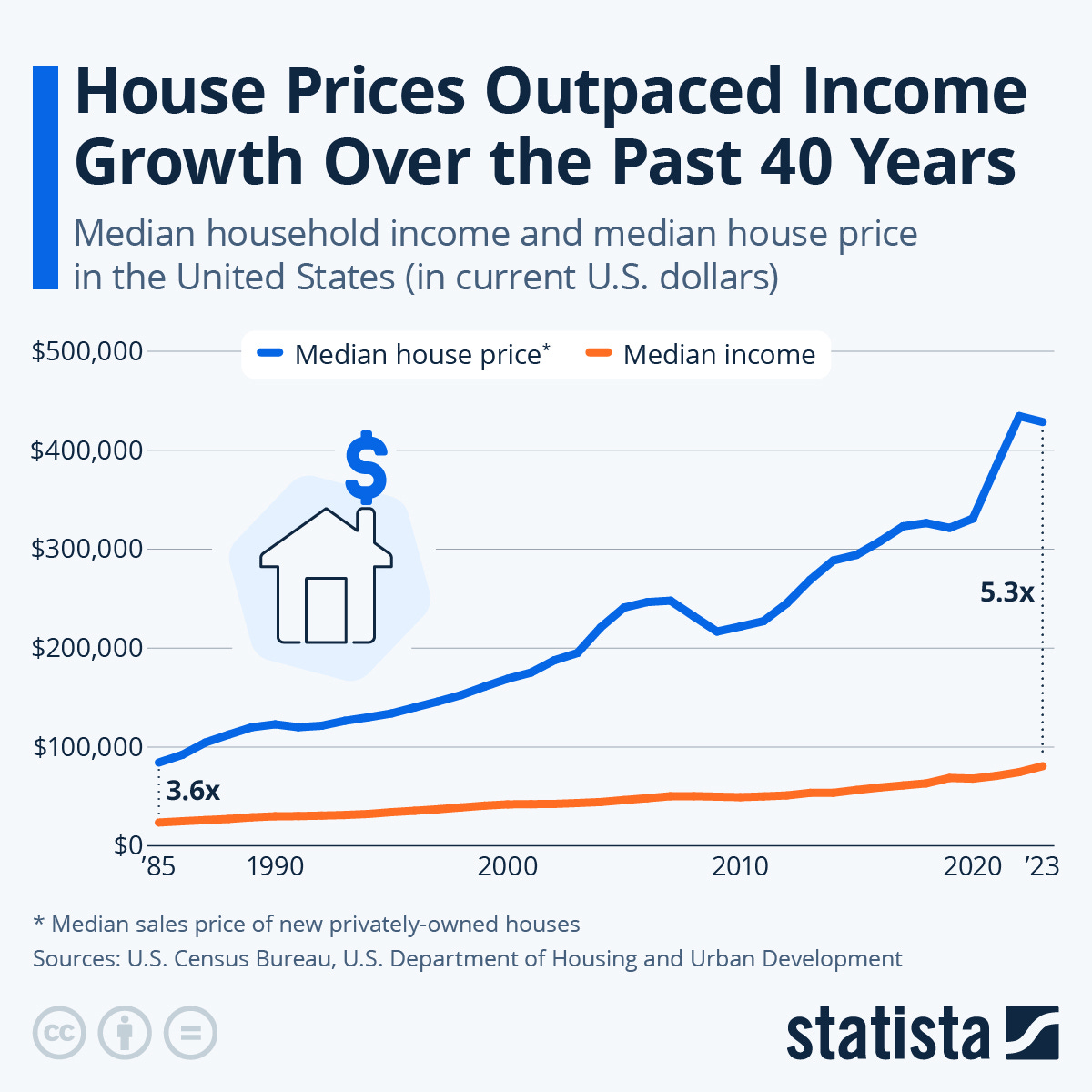

In 1985, the median income was $23,620, and the median price of a home was $84,300. So the typical house was 3.6 times the typical income. By 2023, the median price of a home was $428,600, which was 5.3 times the median income of $80,061.

In some metro areas, median home prices are more than eight times higher than the average income. In Los Angeles, San Francisco, and Honolulu, the price-to-income ratio exceeds 10. Home prices rose dramatically over the last five years, with the median cost of a single-family home increasing 48% between 2019 and 2024.

A severe shortage of homes is driving prices higher. A July 2025 analysis by Zillow found that “America’s housing shortage grew to an all-time high of 4.7 million units.”

According to Bankrate’s 2025 Housing Affordability Study, Americans need an income of about $117,000 to afford an average home. In 2020, the income needed to afford an average home was $78,000. Those figures reflect the increasing price of homes and higher interest rates.

Over the weekend, President Trump teased a new policy on social media to address the issue: a 50-year mortgage.

Bill Pulte, Director of the Federal Housing Finance Agency (FHFA), confirmed that this was a real proposal. “Thanks to President Trump, we are indeed working on The 50 year Mortgage — a complete game changer,” Pulte wrote on X.

But while the introduction of a 50-year mortgage would be a windfall to the financial industry, it would do little to make housing more affordable and saddle a generation of Americans with a lifetime of debt.

Similar monthly payments, massive interest

The idea of a 50-year mortgage is that by spreading the cost of a home over 20 more years, you can reduce the monthly mortgage payment. But in practice, those savings are modest.

First, just as a 30-year mortgage has a higher interest rate than a 15-year mortgage, a 50-year mortgage will have a higher interest rate than a 30-year mortgage. Experts estimate that a 50-year mortgage would be about .5 points higher than a 30-year mortgage. Since the current 30-year mortgage rate is about 6.3%, a 50-year mortgage would have an interest rate of 6.8%.

So homebuyers using a 50-year mortgage would pay a higher interest rate over a much longer time period. This limits the reduction

...This excerpt is provided for preview purposes. Full article content is available on the original publication.