Why Silicon Valley Can't Afford Its Own Revolution

Deep Dives

Explore related topics with these Wikipedia articles, rewritten for enjoyable reading:

-

Dot-com bubble

15 min read

The article explicitly compares the current AI investment frenzy to the dot-com collapse of the 2000s, making this historical financial crisis directly relevant for understanding the parallels and differences the author is drawing

The central pillar of the generative AI narrative—the one psychological safety net that separates the current frenzy from the disastrous dot-com collapse of the 2000s—has always been the “Adults in the Room” theory.

We are told that this time is different because the companies leading the charge are not fragile startups burning venture capital on pet food delivery websites. They are Nvidia, Google. Microsoft, Meta, and Amazon (not Apple), and, to the extent that the remaining leaders are, in fact, startups burning capital—as OpenAI and Anthropic are—they’re effectively protected by their deals with and acquisitions by Big Tech.

These are sovereign states disguised as corporations, sitting on cash reserves so deep—or so they say—that they could fund the entire revolution out of pocket change. We have been led to believe that their liquidity is a bottomless well, guaranteeing that the AI buildout will continue uninterrupted until the superintelligence arrives (or until it doesn’t, for it amounts to the same insofar as they get their return).

Even if there’s over-investing in AI infrastructure, even if AI doesn’t provide the short-term productivity gains that have been promised, even if… none of that really matters, they say, because, as of now, the revenue paying for all this is secured and independent from AI itself (AI-adjacent at most, as is the case with cloud platforms).

They can go on like this for a long time, they say. But if you take a closer look at the financial plumbing of Silicon Valley, you will see that this safety net is no longer such. The adults in the room are running out of allowance.

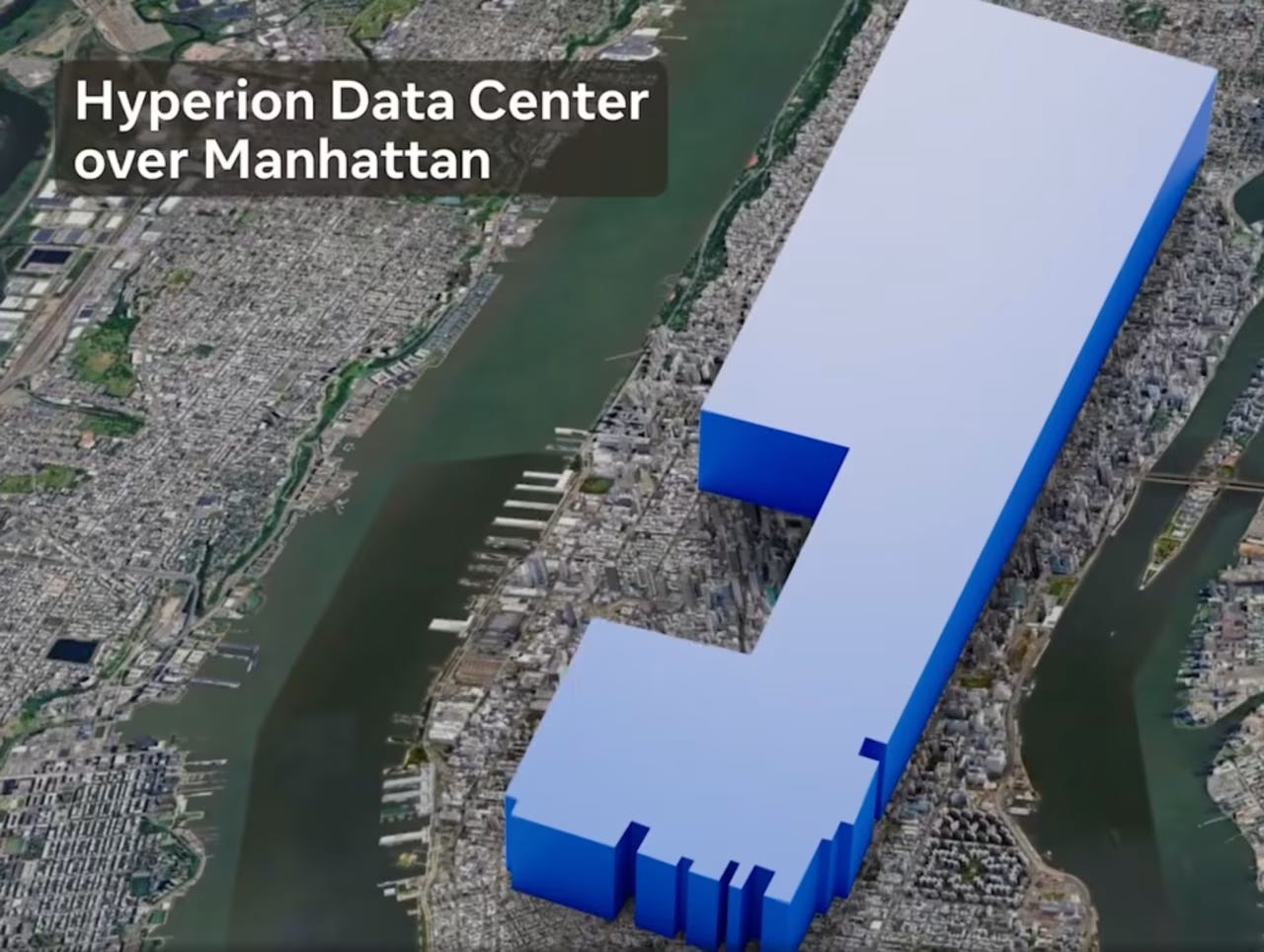

A recent report from the Wall Street Journal exposed a shift that should make even the greediest investor reconsider: For the first time in this cycle, the companies building datacenters can’t rely solely on their own internal profits to feed the insatiable hunger of this technology. The money—even for the most profitable companies in history, that is—is effectively drying up relative to the costs. Or, to be more precise, their liquid cash flow is no longer sufficient to cover the astronomical price tag of Nvidia H100 chips (soon B200 chips), copper, cooling systems, and land without putting their wider businesses at risk.

Perhaps the most important advantage Google has over the competition is having invested heavily early on in developing its own AI hardware, TPUs,

...This excerpt is provided for preview purposes. Full article content is available on the original publication.