AWS Is Missing the AI Infra Moment

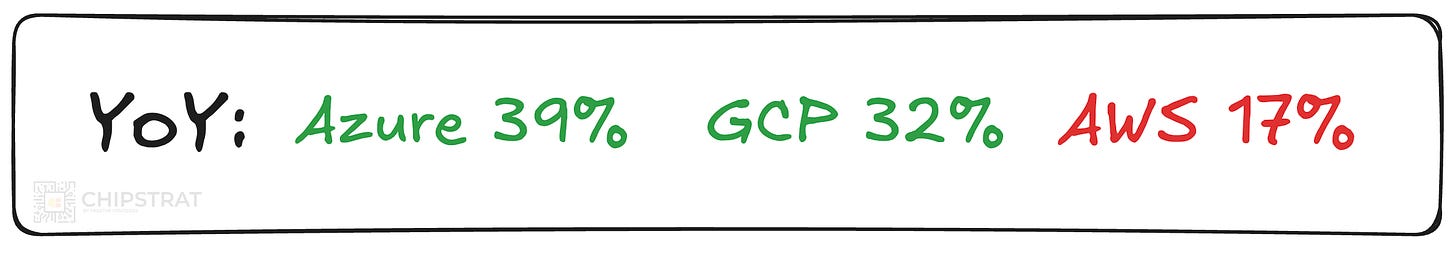

The cloud wars are heating up, and it’s not looking good for AWS.

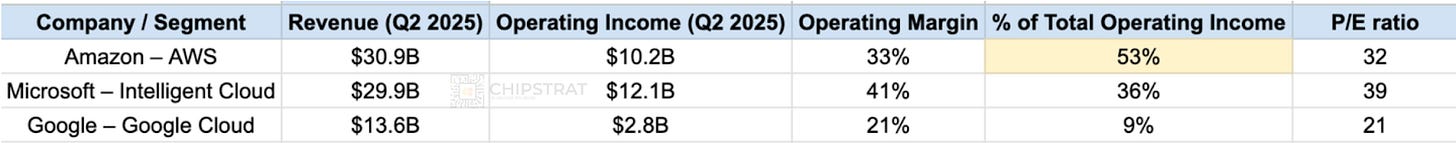

Among the three hyperscalers, Amazon is by far the most dependent on its cloud business for profit and growth:

This is a race Amazon cannot afford to lose!

Let’s unpack why, then look at the implications and next steps for AWS.

Dependence on Cloud

Amazon

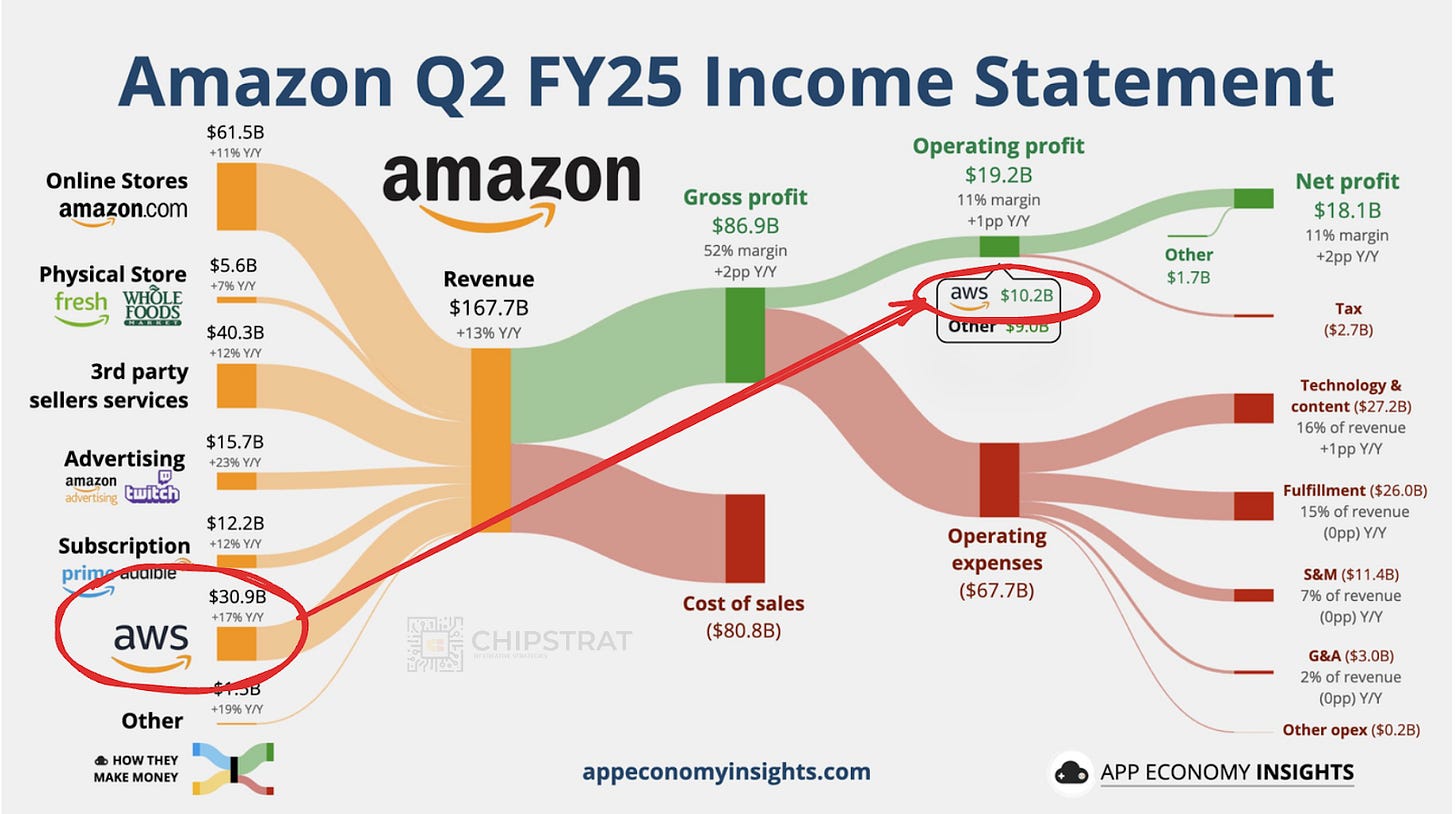

Amazon is first and foremost a retailer; 82% of Q2 revenue came from the retail business, while 18% ($30.9B) came from AWS. Yet this is a top-line illusion; half of Amazon’s profits come from AWS!

Retail businesses have slim margins. From Amazon’s recent 10Q we see paltry margins:

North America: $7.5B operating profit at ~7.5% margin

International: $1.5B operating profit at ~4.1% margin

But the cloud business is a different story:

AWS: $10.2B operating profit at ~32.9% margin

As a consequence, AWS contributes significantly to the bottom line.

AWS contributed 53% of total operating profit despite being only 18% of revenue!

I’m a visual thinker, and App Economy illustrates it nicely:

Amazon’s cloud business pulls up corporate margins and contributes significantly to operating profit.

Most think of Amazon as the world’s largest online retailer, but its operating profit suggests it’s really a cloud services company with a massive, low‑margin retail arm attached. 😅

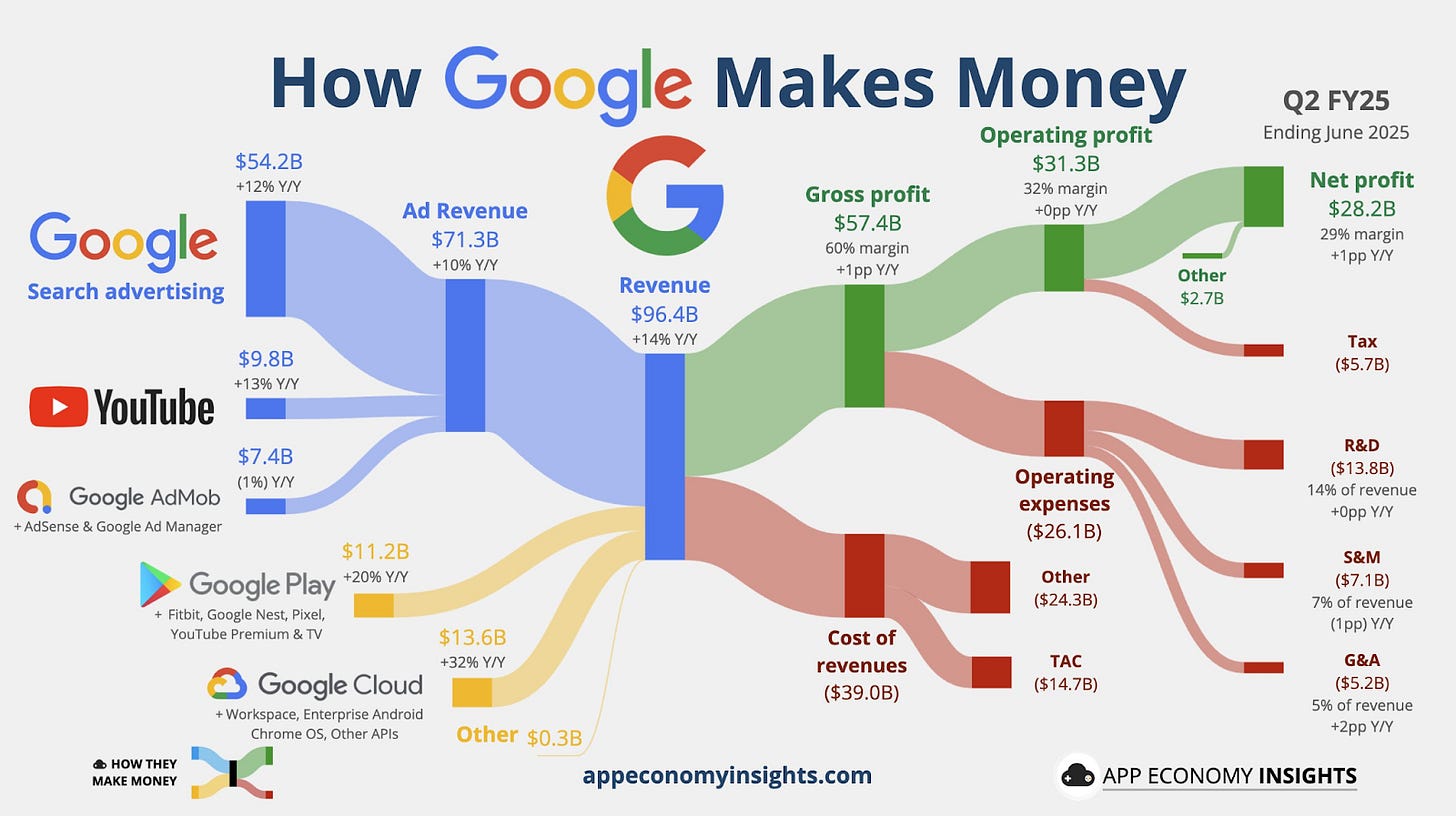

Google is an information and entertainment company built on an exceptionally profitable advertising model. Or, put another way, an advertising company with a highly effective information and entertainment distribution engine.

This “Services” division, as defined in the 10‑K, generated 86% of quarterly revenue. So, not unlike Amazon, the core business accounts for over 80% of revenues.

But Google’s core business has better margins and contributes the majority of operating profit.

Google Services: $82.5B revenue, contributing $33.1B in operating profit with margins of ~40.1%

Google Cloud: $13.6B revenue, contributing $2.8B in operating profit with margins of ~20.6%

So Google Cloud contributes only 14% of Google (Alphabet) top-line revenue and even less (~9%) of total operating income. Google is much less dependent on it’s cloud business than Amazon.

Microsoft

What about Microsoft?

Microsoft’s operating segments include Productivity and Business Processes, Intelligent Cloud, and More Personal

...This excerpt is provided for preview purposes. Full article content is available on the original publication.