Data centers & electricity - part 1: as of 2025 they haven't raising national prices

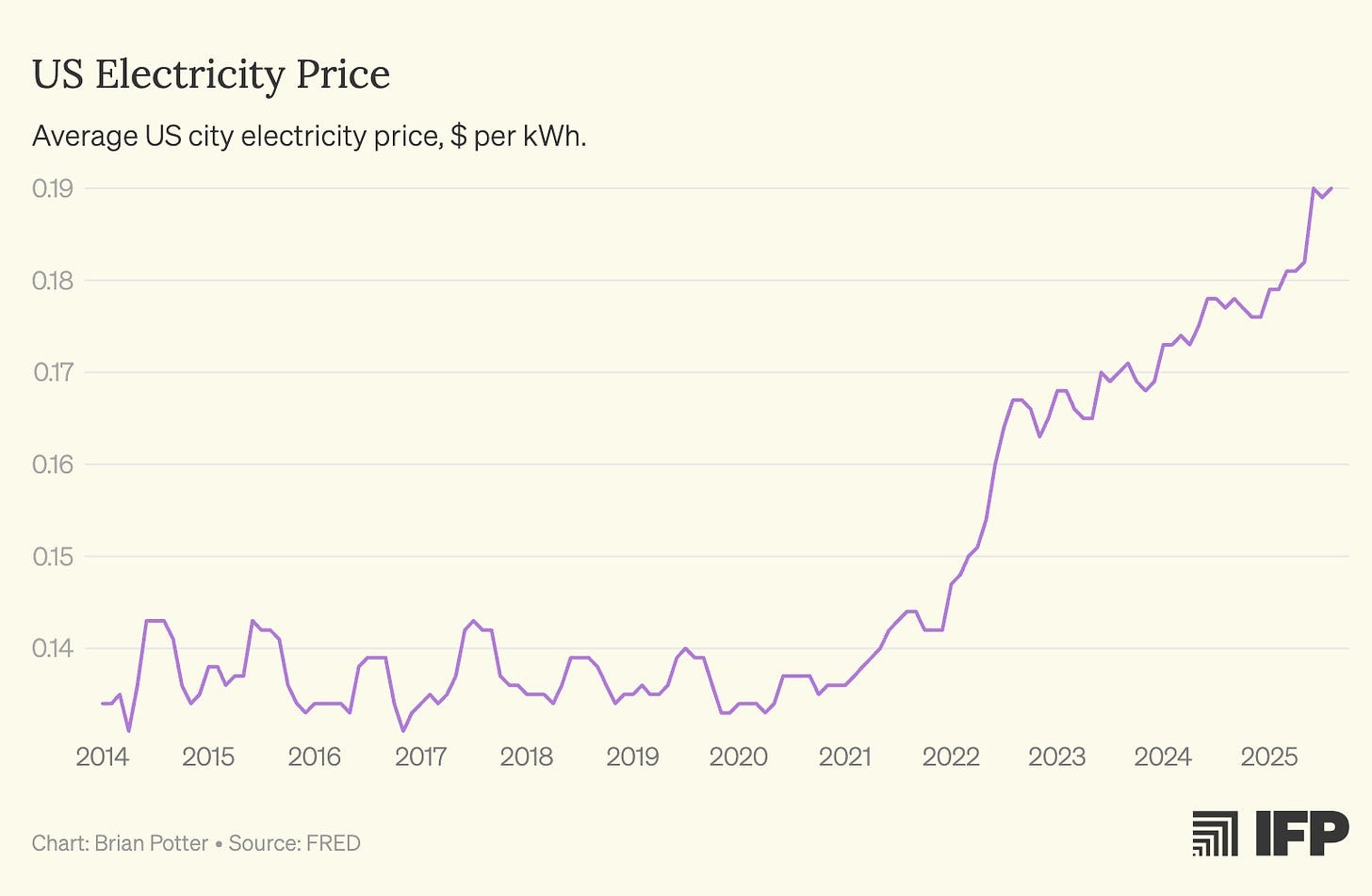

Since 2020, average American household electricity prices have risen 35%.

This jump correlates with the massive new data center buildout, which started around 2021. This has led many to conclude that data centers are the main culprit. If data centers raised electricity bills by 35%, that seems like a huge disaster!

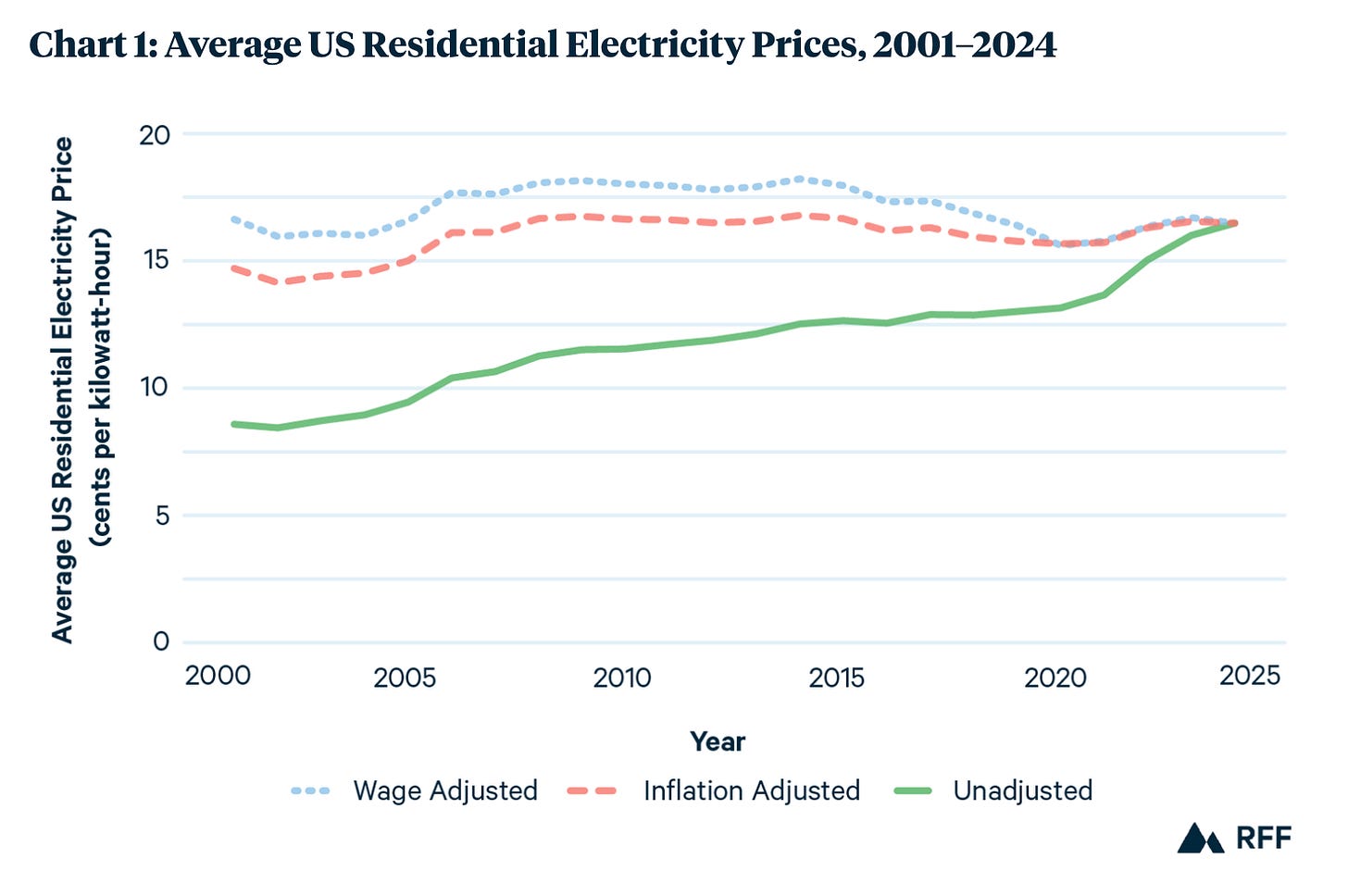

But that’s wrong. If you adjust for inflation, American household electricity costs are still historically low, and have only rebounded to where they were in 2017:

Sometime around 2022, American electricity prices started to outpace inflation. Before 2022, electricity prices closely tracked inflation. After 2022, they went ahead of it a bit.

Here’s a broader picture of inflation-adjusted household electricity rates over time. The recent spike begins in 2022, it’s this spike the red arrow’s pointing at that needs an explanation.

Did data centers cause that jump? No. The Lawrence Berkeley Laboratory found that data center activity has not contributed to changes in household electricity costs, and might even be associated with lower costs. They specifically mention data centers as one of the things that are not affecting national average inflation-adjusted electricity prices. To summarize their explanation of the price increase:

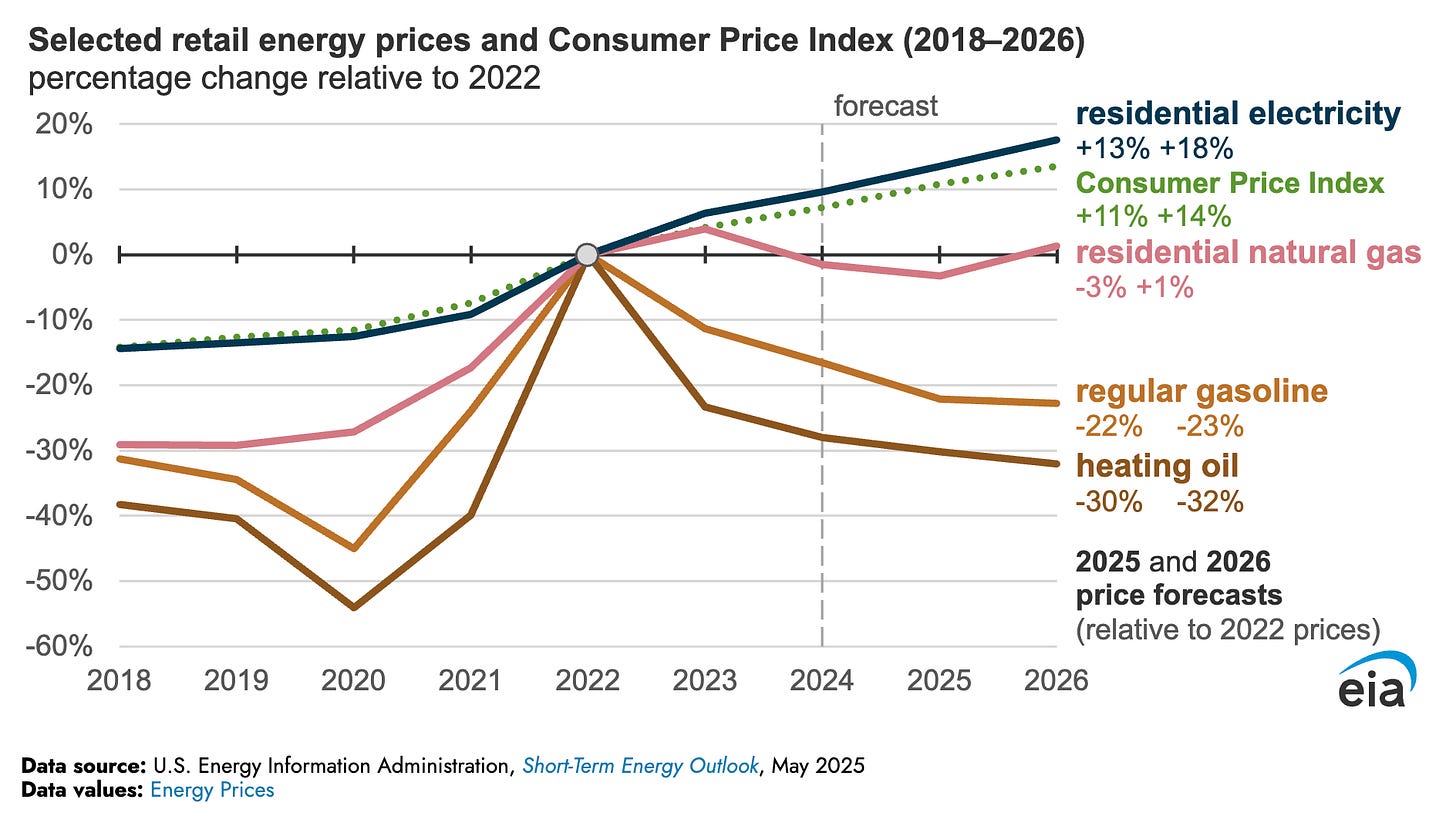

Prices rose mainly because utility costs rose. On a nominal basis, the average retail price increased about four point eight percent per year from 2019 to 2023. After inflation, the national average was mostly flat over that window, though residential prices climbed faster than inflation.

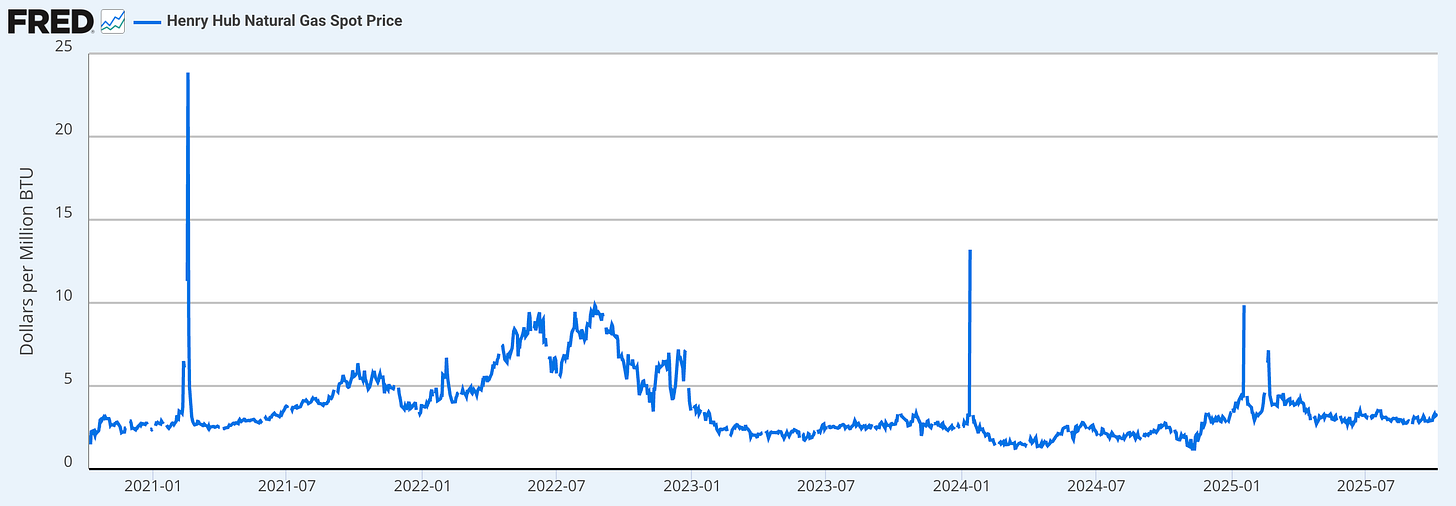

Fuel and purchased power costs were the single biggest mover. Utilities’ fuel and purchased power costs surged in step with the natural gas spike, accounting for about half of the total expense increase. Gas prices then eased, but fuel and purchased power costs in 2023 were still about thirty percent above 2019.

The rest of the cost growth came from operations and maintenance, depreciation, taxes, and other line items.

This explains why the jump happens when it did: Russia invaded Ukraine, Europe stopped buying Russian gas, America was suddenly competing with European countries more for natural gas from other places, and natural gas prices spiked for a bit. Here’s a graph of natural gas prices:

That red arrow I added to the graph of electricity prices is on the

...This excerpt is provided for preview purposes. Full article content is available on the original publication.