Tariffs are Already Stalling the Economy

Thanks for reading! If you haven’t subscribed, please click the button below:

By subscribing you’ll join over 60,000 people who read Apricitas!

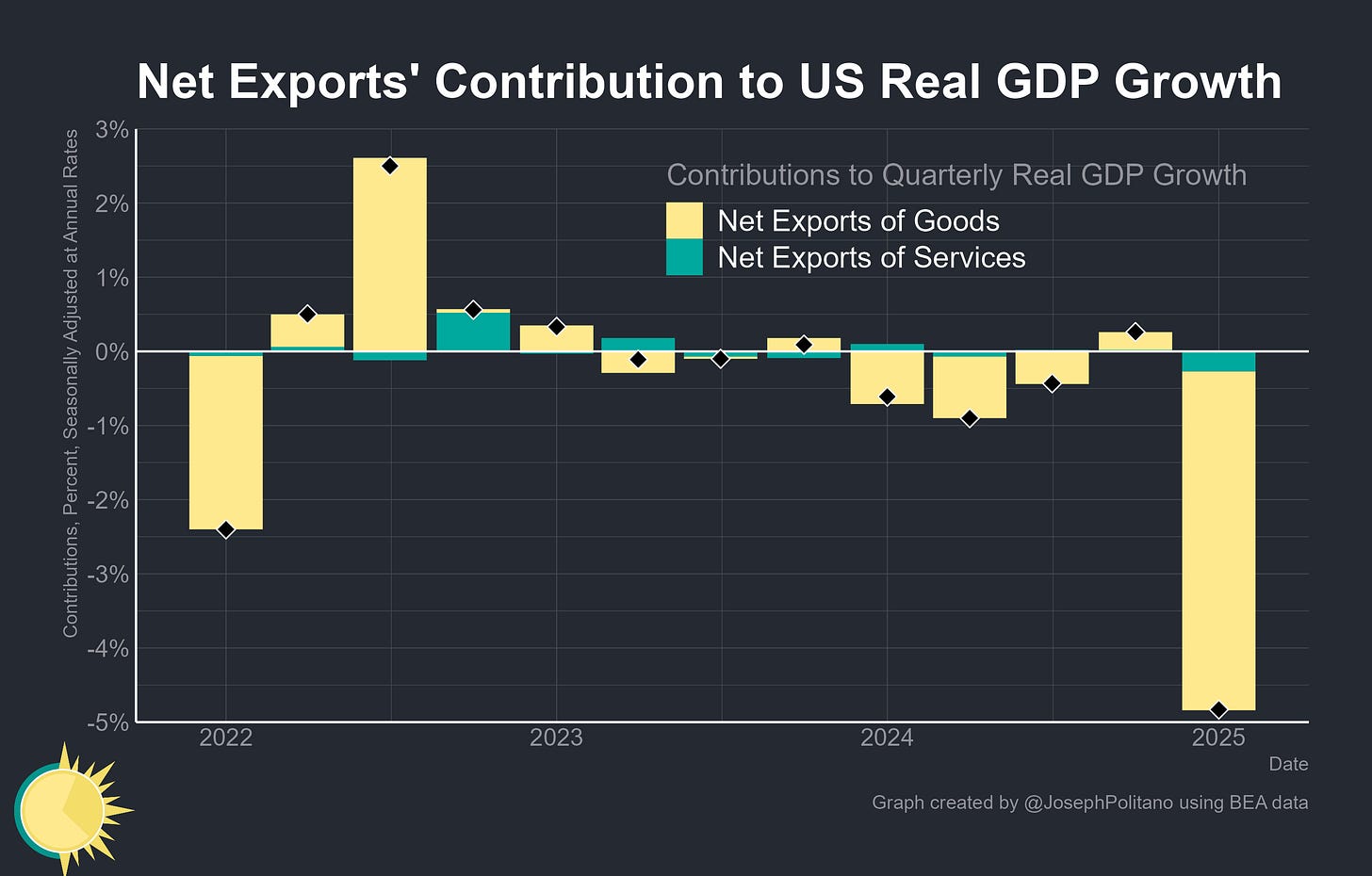

The US economy shrank at the beginning of 2025 for the first time since the recession scares of early 2022—GDP contracted at a 0.3% annualized rate, a major downgrade from the 2.4% growth registered at the end of last year. The culprit was the massive economic drag from trade wars, with companies and consumers forgoing business-as-usual to stock up on foreign goods before Trump’s massive tariffs took effect. The trade deficit expanded to record highs in Q1, with investment jumping as American businesses stored or installed their imported goods.

In fact, the trade deficit expanded at such a rapid pace that net exports notched their largest quarterly decline since records began in 1947. Now, it’s important to clarify that this import surge does not itself shrink the economy—GDP is an estimate of domestic production, and is not affected by purchases from abroad. Yet domestic production is difficult to measure directly, so GDP is estimated by summing consumption, investment, government output, and exports while subtracting imports only to prevent double-counting. Thus, consumers rushing out to buy foreign-made clothes will show up as an increase in imports (a negative “contribution” to GDP) and an increase in consumption (an equal-and-opposite positive “contribution” to GDP) and have no net effect on economic growth.

In this case, however, the surge in imports primarily manifested as a surge in business inventories—it was corporations, not consumers, doing most of the stockpiling. The positive contribution from inventory growth was the highest since late 2021, “offsetting” a bit less than half the jump in the trade deficit. Fixed investment of foreign equipment also helped significantly “offset” the increase in imports at the start of this year.

Yet it’s also important to say that the costs and uncertainty of trade policy chaos can have real negative growth effects. If a construction company rushed to buy a bunch of wood from Canada ahead of tariffs, that would show up as an increase in imports and an increase in inventories which cancel each other out. But if that company slowed down construction so it could afford to stockpile inputs, that would show up as a hidden drag on GDP in the form of lower investment. In other words, tariff front-running can indirectly slow the economy, and that’s exactly what

...This excerpt is provided for preview purposes. Full article content is available on the original publication.