#21 What Does International Trade Actually Look Like?

Donald Trump has launched an all-out trade war with China. I have given up on keeping track on where the tariffs stand now, but so far China has decided to play along with the chicken game and retaliate. Adam Posen has an excellent piece in Foreign Affairs on how China may have a structural advantage in this game because - as China is a big exporter to the US while the US exports much less to China - it’s going to be easier for China to find other markets for their products than for the US to find other places that can supply the things that China makes, as Jonathan Hopkin remarked. Moreover, what China would lose if it lost the possibility to export to the US is money: money is fungible and could be cushioned by China’s large excess savings. What the US would lose if trade with China were to stop is products, some of them irreplaceable, such as rare earth materials and the like. Not fungible.

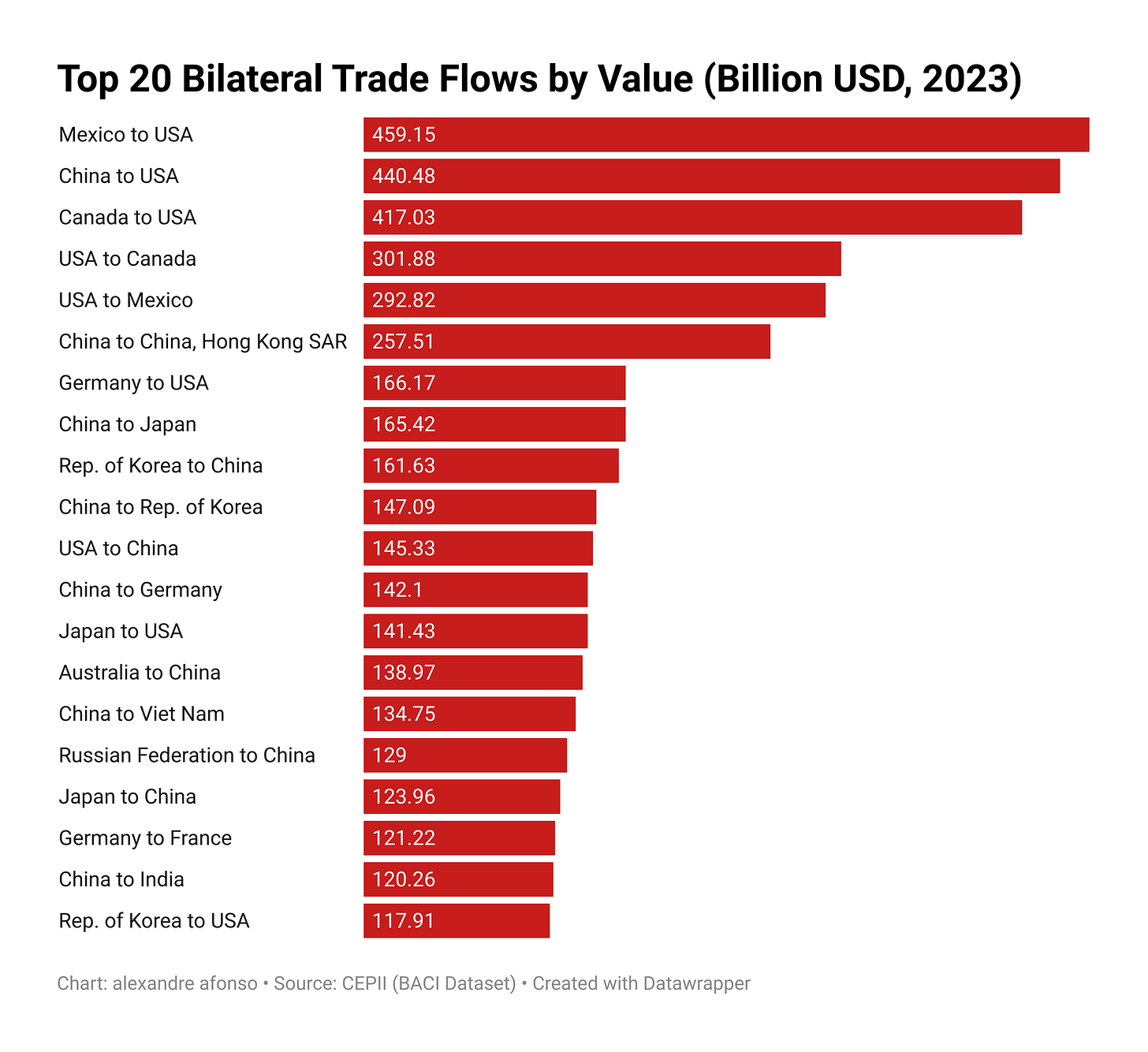

One very basic way to understand how disruptive the tariffs would be is just to look at the largest bilateral trade flows by value (source below). The 3 largest bilateral flows in the world go to the US.

But beyond this, it’s hard to get a clear picture of how global trade really works and how these tariffs would effectively disrupt the world economy as a system. Who trades with whom, and at what scale? What do these flows actually look like?

I’ve been digging into trade data and experimenting with social network analysis. By visualizing global trade as a network—based on actual bilateral flows—it’s possible to better understand how tariffs risk disrupting actual trade flows. In other words, the pause announced by Trump on all the tariffs he was planning last week seem like good news, but we may still be very screwed. Social network analysis offers a powerful lens to make sense of this. It not only generates pretty graphs, but also provides quantitative metrics that help identify the relative importance of countries in the global trading system. It shows not just trade volumes, but also the strategic positions of countries within the network. Nations that frequently appear in others’ top trading relationships wield structural influence in global trade.

I have been using the most recent

...This excerpt is provided for preview purposes. Full article content is available on the original publication.