The AI Bubble Is a Ticking Time Bomb. If It Pops, so Will the U.S. Economy.

The last section of this post is only available for paid subscribers. If you’d like to read it and all the other articles in the Reality Studies archive to help you decide if you’d like to become a paid subscriber, I encourage you to use the 7-day free trial option:

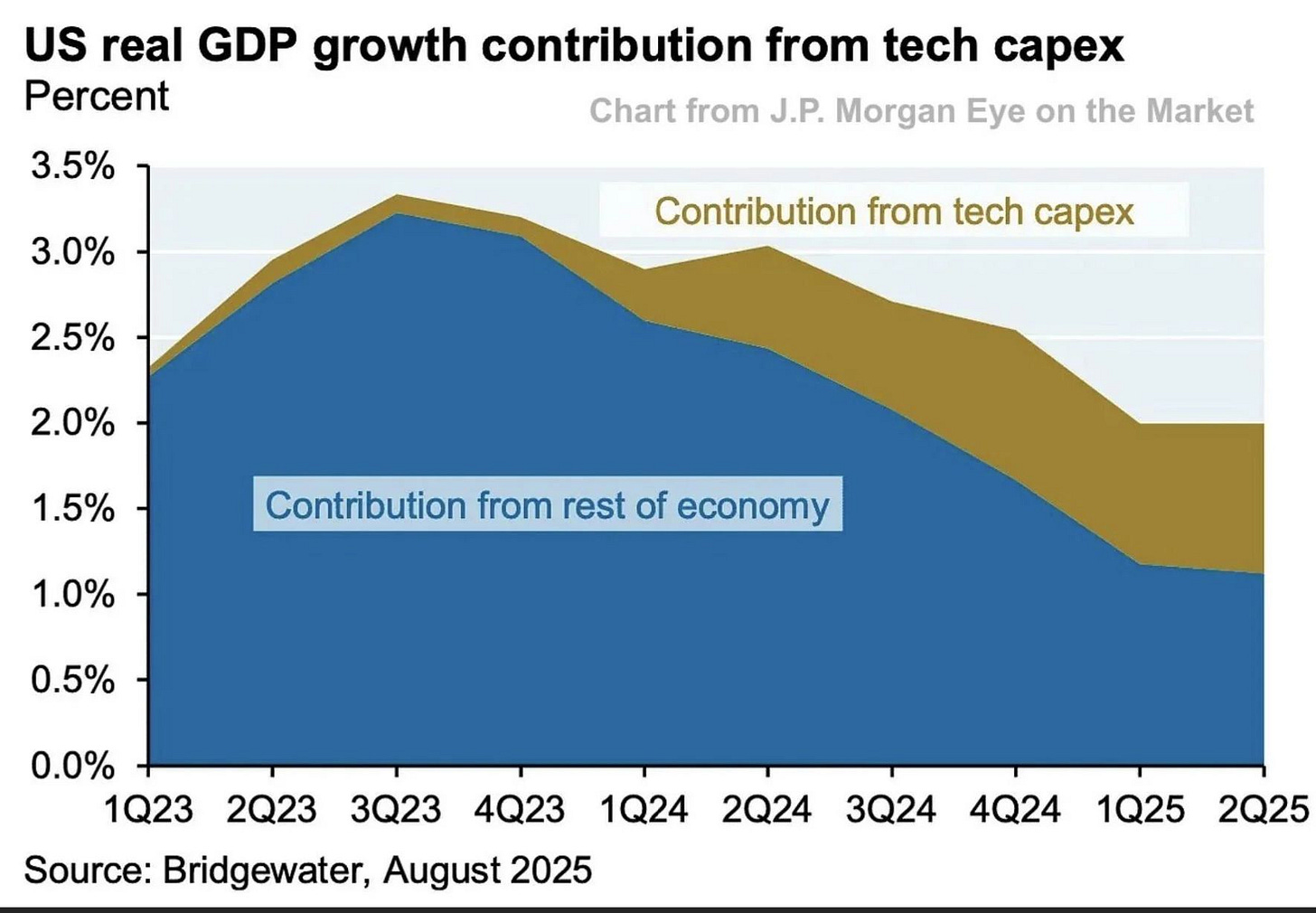

The last two years of U.S. economic outperformance have been unusually concentrated in one sector: artificial intelligence. But AI exuberance isn’t just a stock-market story; it’s a capital expenditure (capex) boom that has yanked growth onward and upward in everything from construction to utilities, semiconductors to cloud computing to venture funding.

To give you a sense of just how much of America’s growth is pegged to AI, here’s a quote from Paul Kedrosky in a July column in the Wall Street Journal:

[O]ne explanation for the U.S. economy’s ongoing strength, despite tariffs, is that spending on IT infrastructure is so big that it’s acting as a sort of private-sector stimulus program.

Capex spending for AI contributed more to growth in the U.S. economy in the past two quarters than all of consumer spending, says Neil Dutta, head of economic research at Renaissance Macro Research, citing data from the Bureau of Economic Analysis.

Understandably, this has caused many analysts to worry about the formation of an AI “bubble,” a term used to describe the phenomenon where the price of a given asset increases far above its actual value, often driven by speculation and investor euphoria. This was the case with the so-called “dot-com bubble,” in which then early Internet companies were overvalued, and ultimately crashed, as well as the 2008 housing bubble, often called the “subprime mortgage crisis,” which resulted in the Great Recession.

As with the aforementioned, if we are now witnessing an AI bubble, and that bubble bursts, the blast radius will not be contained to Silicon Valley. It will ripple through the U.S. economy, creating the kind of cascading slowdown that I believe will feel a whole lot more like a full-on crash than a small “contraction.”

To be clear: I’m not arguing that we ought to keep propping up a prospective AI bubble. I’m attempting to map what I perceive to be a looming risk on the near-ish horizon based on my foresight training, and offer strategy recommendations based on that risk. But if you want a good sense of how I think you

...This excerpt is provided for preview purposes. Full article content is available on the original publication.