Trivium Weekly Roundup | Investment Meltdown

Deep Dives

Explore related topics with these Wikipedia articles, rewritten for enjoyable reading:

-

Local government financing vehicle

14 min read

The article discusses local government hidden debt and special-purpose bonds extensively. LGFVs are the primary mechanism through which Chinese local governments accumulated this hidden debt, making this essential context for understanding the debt restructuring dynamics described.

-

Chinese property sector crisis (2020–present)

11 min read

Real estate investment decline is cited as a major driver of FAI contraction, with the article noting it accounts for one-fifth of aggregate FAI and has contracted 23% year-over-year. Understanding the broader property crisis provides crucial context.

Something funky is happening in China’s economy.

Over the past several months, we’ve seen a sudden and dramatic slump in fixed asset investment (FAI).

FAI may not sound especially sexy. But it’s a bulwark of China’s economic growth, covering everything from roads to rail, ports to bridges, and factories to homes.

And since the summer, it’s been shrinking fast.

Back in July, FAI dipped into the red, declining just 0.1% y/y.

But since then, the decline has gone into freefall — plunging 12.2% y/y in October.

This is unprecedented.

Outside of the pandemic, China has never seen this many consecutive months of contracting FAI.

Some commentators say this drop-off is an early sign of economic meltdown.

Others claim the stats bureau must have botched the numbers.

In reality, it’s neither.

As we discuss in the latest Trivium China Podcast, the drop in FAI reflects a perfect storm of local governments’ reaction to recent policy signals, economic headwinds, and shifting local priorities — all of which are hitting investment across real estate, manufacturing, and infrastructure.

Our most recent blog post lays out this research in full, but for now, here is a quick overview of what’s happening.

The anti-involution push

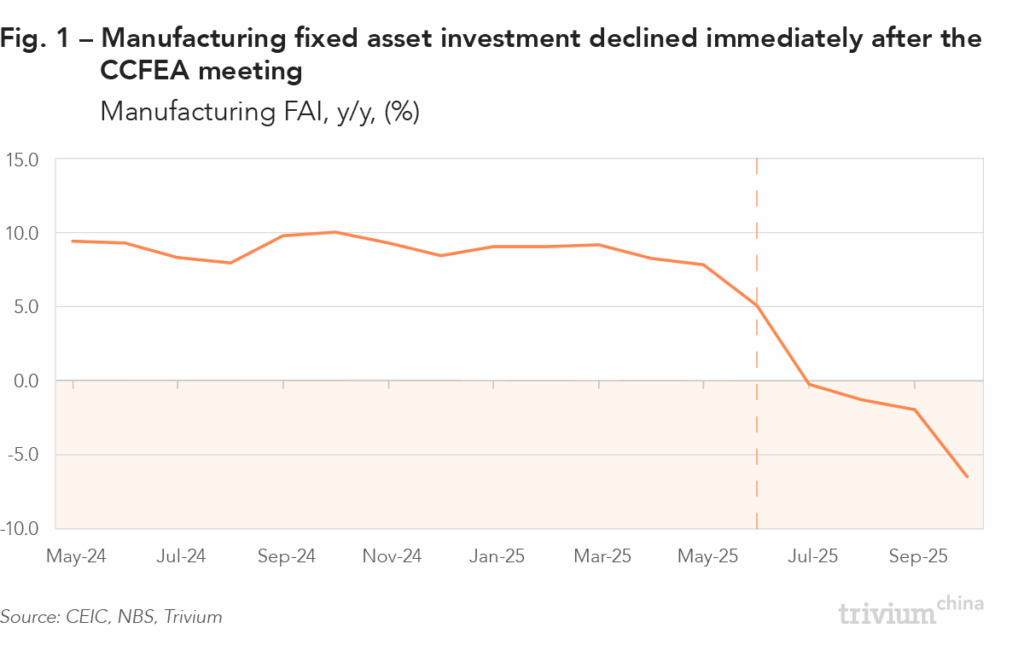

After an impressive 59 months of consecutive growth, manufacturing investment slipped into the red in July and has continued to decline — at an accelerating pace — ever since.

Much of this pullback reflects Beijing’s campaign against overcapacity.

In early July, the Central Commission for Financial and Economic Affairs (CCFEA) — the Party’s top economic policymaking body — pledged to crack down on the “involution-style” competition plaguing China’s economy, from petrochemicals to electric vehicles (NEVs), and cleantech to metals.

Since then, there has been a flurry of industry meetings, guidelines, and ministerial symposiums aimed at encouraging various sectors to reduce excess capacity.

And it’s working — since July, FAI in the plastics, chemicals, cleantech, and non-ferrous metal industries has rapidly declined.

Local government bonds and redirected investment

Since July, infrastructure spending has also declined by approximately RMB 387 billion relative to 2024 levels, representing a 4.4% drop. At the same time, issuance of government bonds — the main debt instrument used to fund public infrastructure — has soared.

So where has the money gone?

This year, the Ministry of Finance (MoF) expanded the use of local government special-purpose bonds (SPBs) — a debt instrument typically used to fund infrastructure investment

...This excerpt is provided for preview purposes. Full article content is available on the original publication.