Nvidia Q3 Earnings

Deep Dives

Explore related topics with these Wikipedia articles, rewritten for enjoyable reading:

-

Dot-com bubble

15 min read

The article repeatedly references 'AI bubble' concerns and compares current GPU demand to 'dark fiber' overcapacity from the telecom boom. Understanding the dot-com bubble provides essential historical context for evaluating whether AI infrastructure spending follows similar patterns or differs fundamentally.

-

TSMC

12 min read

TSMC is central to the article's supply chain analysis, with CEO C.C. Wei quoted extensively about capacity planning and customer verification. Understanding TSMC's unique position as the world's largest semiconductor foundry and its manufacturing monopoly at leading-edge nodes illuminates why Nvidia's demand signals matter so much.

-

Fabless manufacturing

12 min read

The article discusses the complex relationship between Nvidia (which designs chips), TSMC (which manufactures them), and ODMs/system integrators. Understanding the fabless semiconductor business model explains why Nvidia depends on TSMC and how the modern chip industry's division of labor creates the supply chain dynamics described.

Nvidia delivered a beautiful Q3 print on Wednesday, and there are several angles worth unpacking. But first, why was there any doubt about Nvidia’s earnings anyway? Yes, the AI concerns are very legitimate, but Nvidia’s earnings will be a trailing indicator of an AI bubble. We’ll discuss.

Then we can get into the call itself, including:

Networking business

Meta

China & Taiwan

Google

AI lab profitability concerns

Here we go:

Nvidia’s Earnings

From The WSJ,

Nvidia reported record sales and strong guidance Wednesday, helping soothe jitters about an artificial intelligence bubble that have reverberated in markets for the last week.

Sales in the October quarter hit a record $57 billion as demand for the company’s advanced AI data center chips continued to surge, up 62% from the year-earlier quarter and exceeding consensus estimates from analysts polled by FactSet. The company increased its guidance for the current quarter, estimating that sales will reach $65 billion—analysts had predicted revenue of $62.1 billion for the quarter.

Another incredible quarter from Nvidia and an even more impressive guide.

Of Course Nvidia Would Deliver

You didn’t expect anything less, right?

Forget the noise about stock market jitters, OpenAI profitability, or Michael Burry’s depreciation math. This quarter’s demand was locked in months ago, and Nvidia’s only job was to ship the hardware already spoken for.

After all, Nvidia’s direct and indirect customers signaled their GB300 demand quarters ago. Nothing since has altered that trajectory.

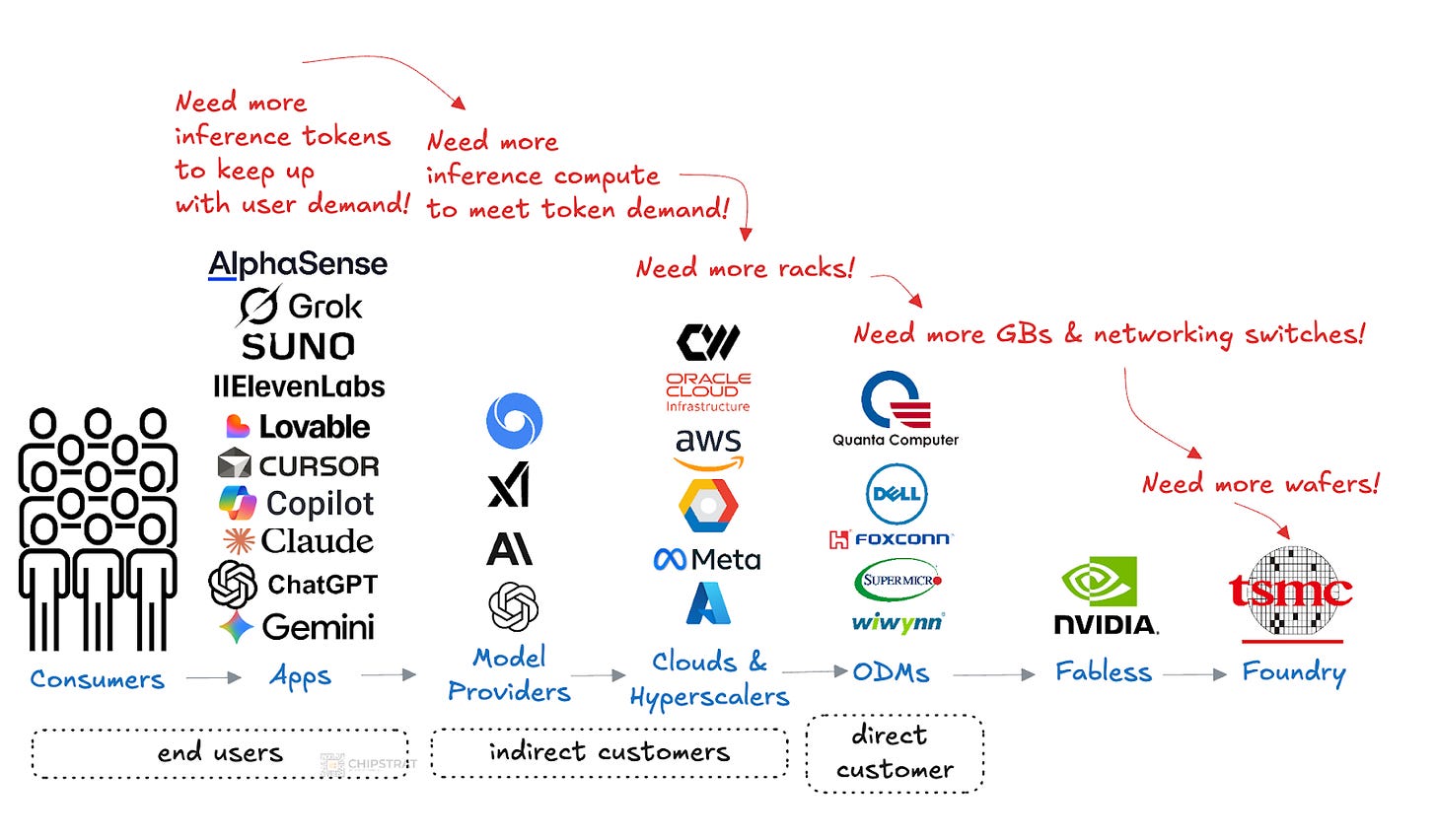

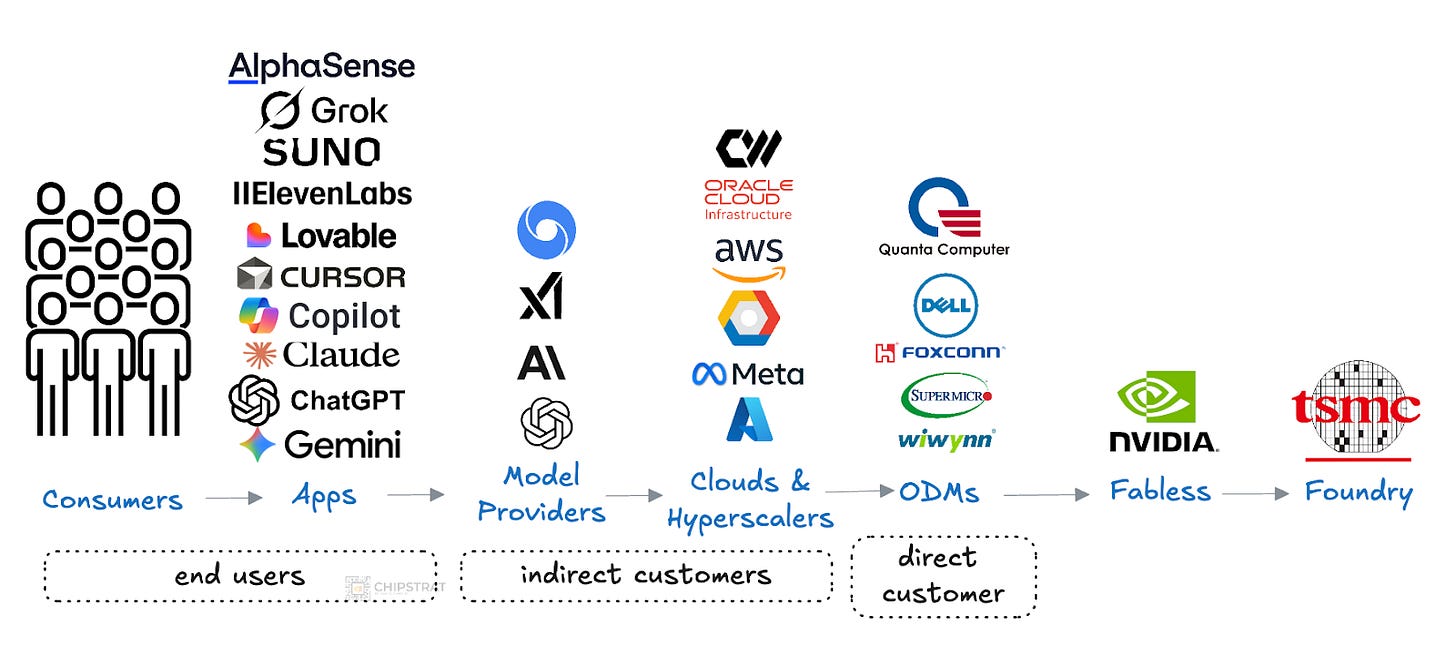

As a reminder, Nvidia mainly sells to ODMs and system integrators, who purchase the GPUs, build the racks, and deliver the AI factories to the clouds and hyperscalers:

Orders are planned well in advance of any given quarter. System builders like Dell, SuperMicro, Wiwynn, Quanta, Foxconn, are buying a ton of Grace Blackwell Ultras right now because Microsoft, Amazon, Google, Meta, Oracle, and CoreWeave already placed orders.

And we have confidence that Nvidia’s 2026 guide is legitimate because we’ve been told as much, up and down the chain:

Obviously, many GenAI-powered apps are already being used seriously day to day. Again, the illustration above only scratches the surface. All those apps are saying they need more inference tokens to meet user demand. Which means clouds, neoclouds, and hyperscalers need more AI clusters. Which means ODMs need to build more racks.

...This excerpt is provided for preview purposes. Full article content is available on the original publication.