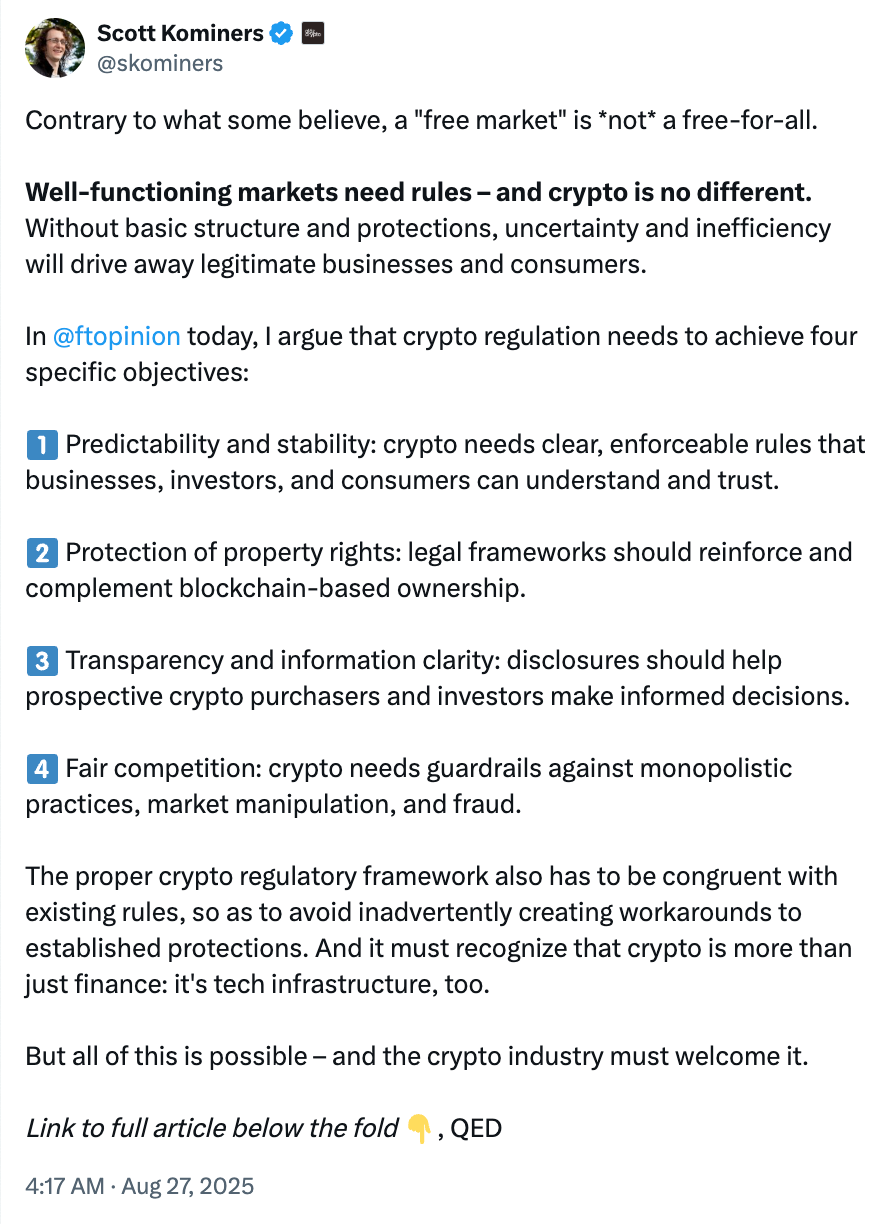

A free market isn’t a free for all

Markets need rules — and crypto is no different

Scott Kominers

For many, the crypto builder ethos is based on resistance to centralized authority: radical individualism, cypherpunk culture, and the open source software movement. As such, some may push for a regulatory free-for-all when it comes to the crypto industry. But that would be a mistake. History — and economic theory — shows that thriving markets require clear, consistent rules.

Contrary to what some believe, a “free market” isn’t a free-for-all — it’s a structured system where individuals can engage in voluntary exchanges with reasonable expectations of fairness and security. Without basic protections, markets break down. Without safeguards, uncertainty drives away serious and legitimate businesses, leaving behind only speculation and bad actors.

The crypto industry’s full potential can only be realized when it becomes broadly accepted and integrated into ordinary commerce. And for entrepreneurs and consumers to embrace crypto, they must be confident in clear rules that protect against fraud while also ensuring robust and fair access. Otherwise people hesitate to enter the market, let alone use crypto for everyday transactions. So what kind of rules does the industry need?

also appeared in The Financial Times

How blockchain startups can set prices and fees

Gérard Cachon, Tolga Dizdarer, and Gerry Tsoukalas

A key benefit of crypto is reducing reliance on intermediaries, potentially lowering fees and empowering users with greater control over their data and assets.

However, setting fees and prices is a delicate balance for platforms to get right. The most successful decentralized marketplaces can’t reject fees altogether. They must pair decentralized pricing with thoughtful, “value-adding” fee structures that help balance supply and demand.

So in this post, we share our research on:

the role pricing control and fee structures play in platform economics and governance

why zero-fee designs are destined to fail, however good their designers’ intentions

how blockchain platforms can reason about setting prices, using a new model we call “affine pricing” that’s based on volume — a mechanism that resolves the tension between private information and market coordination

Surviving the tricky startup moments

Arianna Simpson and Jacquelyn Melinek of the Talking Tokens podcast

Crypto is known for its high and low market cycles. What should founders know — and what can they do — to survive the swings? In this conversation, a16z crypto general partner Arianna Simpson shares the lessons of past crypto

...This excerpt is provided for preview purposes. Full article content is available on the original publication.