"A Rare Opportunity"

Deep Dives

Explore related topics with these Wikipedia articles, rewritten for enjoyable reading:

-

Vertical integration

15 min read

Netflix acquiring Warner Bros represents a major vertical integration play in media - owning both the distribution platform and content production. Understanding the history and economics of vertical integration (from Standard Oil to modern tech) provides essential context for evaluating this deal's strategic logic.

Note: Access all prior Netflix (NFLX) research on the TSOH website

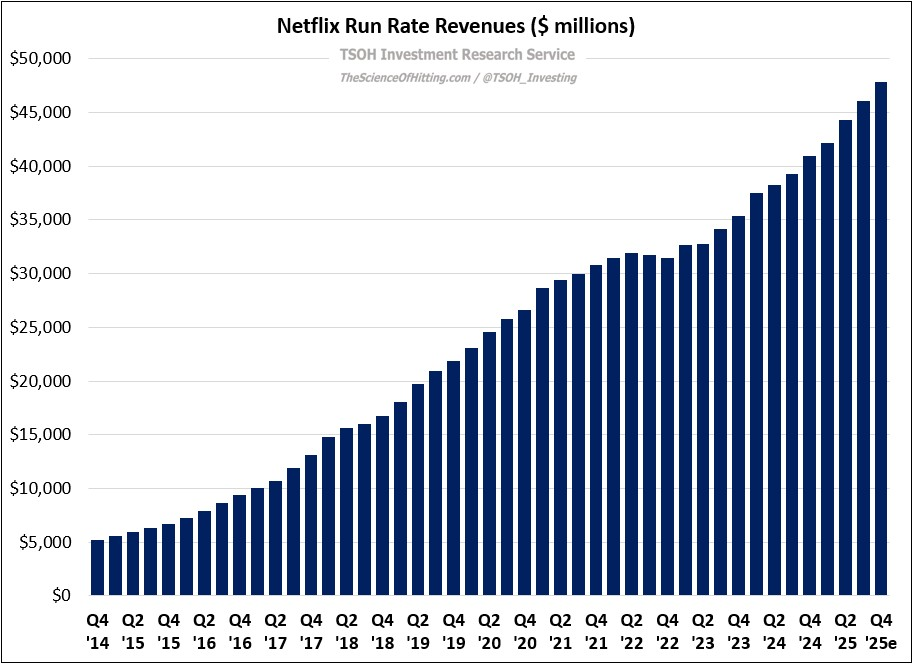

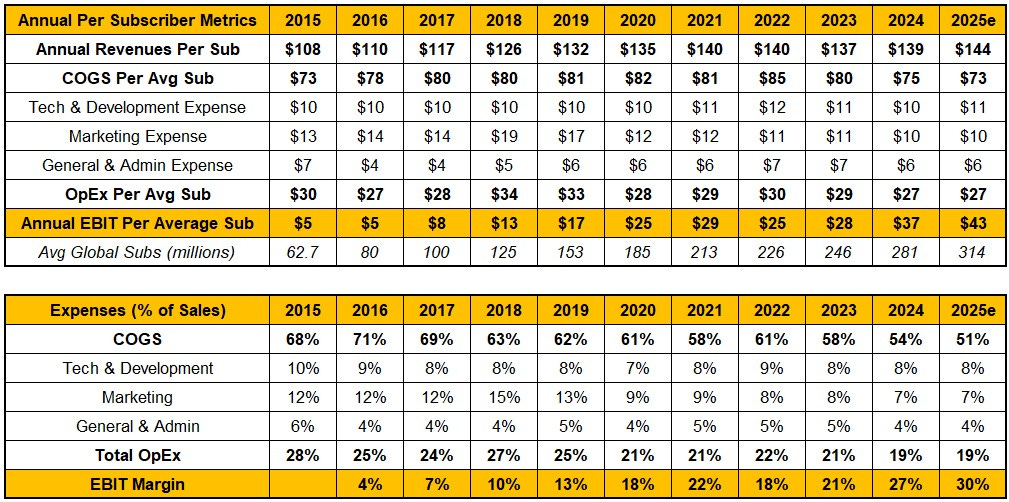

On December 5th, Netflix announced a deal to acquire Warner Bros (the Studios & Streaming / S&S business of WBD) for ~$82.7 billion. The logic of the deal, in terms of the acquired content / IP, is self-evident. Given Netflix’s unrivaled global scale in DTC video streaming, a position that supports a business with run rate revenues of ~$48 billion, I agree with co-CEO Ted Sarandos – “These assets are more valuable in our business model, and our business model is more valuable with these assets”. By virtue of Netflix’s scale, they can maximize content value to a degree others cannot replicate.

But where I think the logic of this transaction is less clear is in terms of the businesses acquired and the price to be paid (a number likely going higher).

This excerpt is provided for preview purposes. Full article content is available on the original publication.