Tang Xiaoyang: Stitch Africa’s Fragmented Supply Chains with Chinese Capacity

Deep Dives

Explore related topics with these Wikipedia articles, rewritten for enjoyable reading:

-

Forum on China–Africa Cooperation

13 min read

FOCAC is the central institutional mechanism discussed in the article for coordinating China-Africa economic relations since 2000. Understanding its structure, history, and summit outcomes provides essential context for the trade and investment patterns Tang analyzes.

-

Import substitution industrialization

14 min read

The article discusses African countries shifting from importing finished goods to local production, particularly in building materials and consumer goods. This economic development strategy has a rich historical context in Latin America and post-colonial Africa that illuminates current China-Africa industrial cooperation.

-

African Continental Free Trade Area

11 min read

The article mentions Africa's fragmented supply chains and regional markets as key challenges. The AfCFTA, launched in 2021, is the African Union's flagship initiative to address exactly this problem and complements Agenda 2063, which Tang references directly.

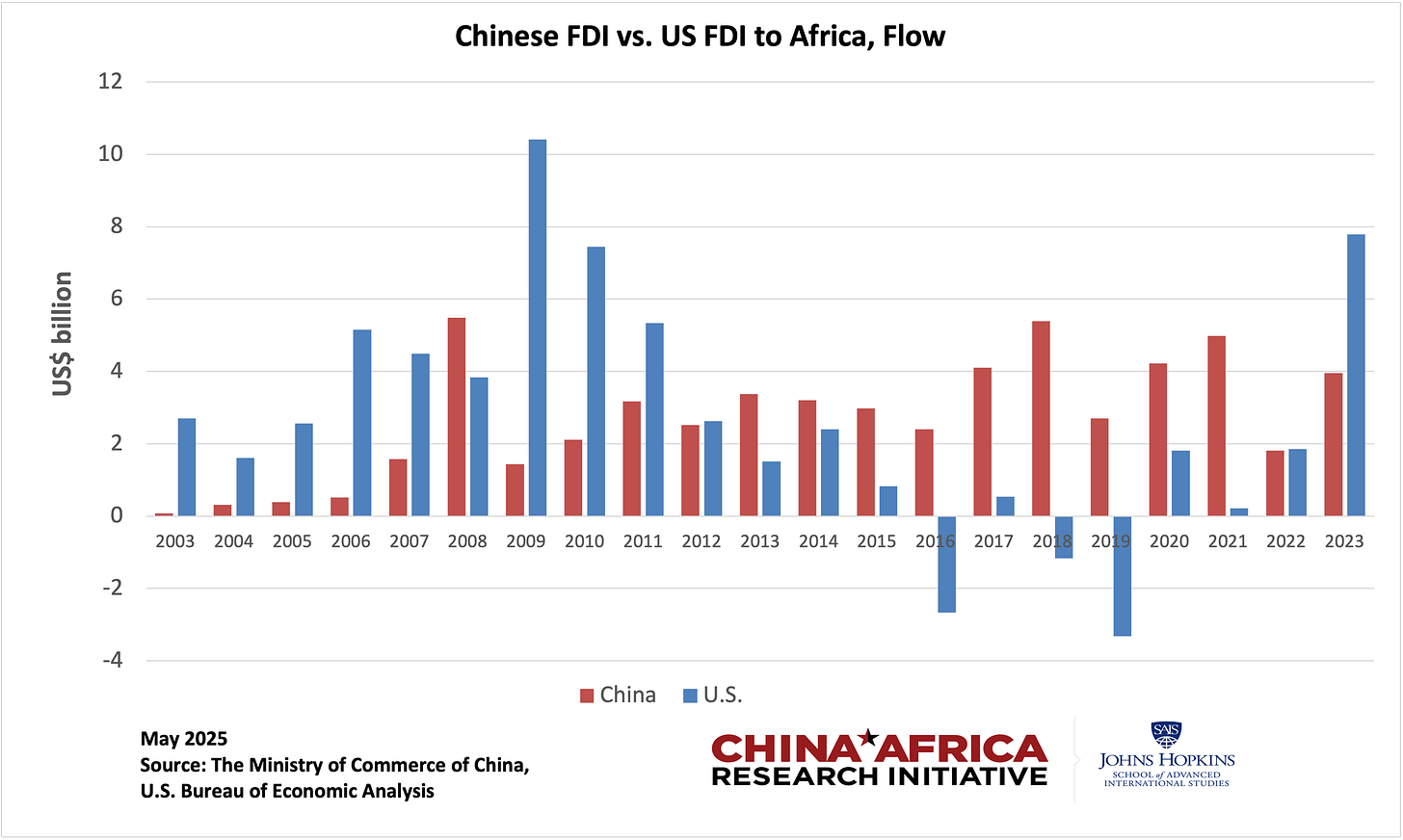

The BBC yesterday reported, citing the latest annual figures gathered by China Africa Research Initiative at Johns Hopkins University’s School of Advanced International Studies, that the US has actually quietly overtaken China as the biggest foreign direct investor in Africa in 2023.

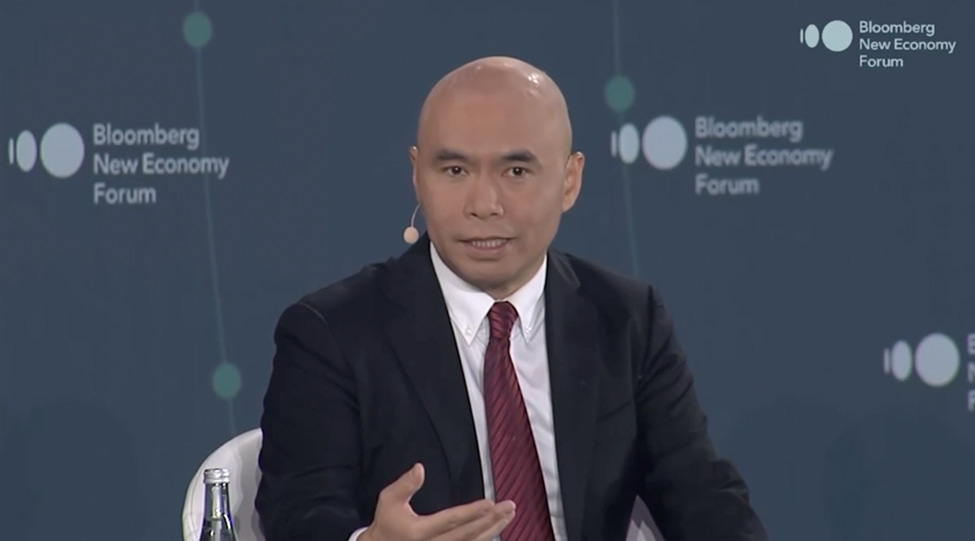

A short while ago, Tang Xiaoyang, Chair and Professor, Department of International Relations at Tsinghua University, argues that although geopolitics and softer growth have cooled headline expansion in China–Africa commerce, long-standing cooperation mechanisms and complementary industrial structures make this a window to shift from scale to integration.

Leveraging the more than a dozen agro-industrial parks and clusters of Chinese enterprises already established in Africa, the leading expert on China-Africa ties says, can build full-chain capacity in mining, agriculture, and light industry.

His following article was published on Orange News, a Hong Kong-based Chinese-language news website, on September 26, 2025.

中非經貿新動向與產供鏈投資機遇

New Trends in China–Africa Economic & Trade Ties and Investment Opportunities across Industrial and Supply Chains

Since the turn of the century, under the influence of the Forum on China–Africa Cooperation (FOCAC) and the Belt and Road Initiative (BRI), China–Africa trade has grown steadily with notable resilience. According to UN Comtrade data, total China–Africa trade increased from USD 39.668 billion in 2005 to USD 295.411 billion in 2024, an average annual growth rate of 13.96%. China has been Africa’s largest trading partner for sixteen consecutive years since 2009. In 2024, China imported USD 116.8 billion from Africa, up 6.9%, and exported USD 178.8 billion to Africa, up 3.5%.

As for the current trade structure, China mainly imports primary products from Africa, such as mineral resources and agricultural products, which provide important resource support for China’s economic development. UN Comtrade data show that in 2024, China’s top three import categories from Africa were petroleum gases (HS27), ores (HS26), and copper and copper products (HS74), accounting for 28.17%, 26.94%, and 19.14% of China’s imports from Africa, respectively.

China primarily exports manufactured goods, especially machinery and transport equipment, to Africa, meeting African countries’ needs in infrastructure, industrial equipment, and consumer welfare. In 2024, China’s top three export categories to Africa were electrical machinery and televisions (HS85), boilers and mechanical appliances (HS84), and vehicles and parts thereof (HS87), accounting for 14.39%, 14.26%, and 8.24% of China’s exports to Africa, respectively.

China and Africa have highly complementary industrial structures, ensuring steady progress and win–win outcomes, especially in

...This excerpt is provided for preview purposes. Full article content is available on the original publication.