The AI bust scenario that no one is talking about

Deep Dives

Explore related topics with these Wikipedia articles, rewritten for enjoyable reading:

-

Panic of 1873

12 min read

Linked in the article (16 min read)

-

Sears

12 min read

The article specifically uses the Sears Catalog as a key example of how transformative technologies take time to manifest their full economic value - it took 15 years after the 1873 railroad crash for Sears to revolutionize retail. Understanding this historical precedent illuminates the article's central argument about AI timing.

-

Dot-com bubble

15 min read

While the article discusses VR and railroad bubbles as analogies, the dot-com bubble is the most relevant modern parallel for AI speculation - a genuinely transformative technology that experienced a major bust before eventually delivering enormous value. This provides crucial context for understanding the 'bubble that creates lasting companies' pattern the article describes.

I’ve actually already written a number of posts about the possibility of an AI bubble and bust. Back in August, I wondered if the financing of data centers with private credit could cause a financial crisis if there was a bust. I followed that up with a post about profitability, and suggested that the AI industry might be a lot more competitive than people expect. In October, I wrote about how AI is propping up the U.S. economy.

But I feel like I need to write another post, because almost all of the discussion I see about an AI bubble seems to leave out one crucial scenario.

Since I wrote those posts, popular belief that there’s an AI bubble and impending bust has only grown. A lot of prominent people in the industry are talking about it:

“Some parts of AI are probably in a bubble,” Google DeepMind CEO Demis Hassabis told Axios’ Mike Allen at the [Axios] AI+ Summit on Dec. 4. But, he added, “It’s not a binary.”…“I, more than anyone, believe that AI is the most transformative technology ever, so I think in the fullness of time, this is all going to be more than justified,” Hassabis said…“I think it would be a mistake to dismiss [AI] as snake oil,” OpenAI Chairman and Sierra co-founder Bret Taylor said at the AI+ Summit…Taylor acknowledged that there “probably is a bubble,” but said businesses, ideas and technologies endure even after bubbles pop. “There’s going to be a handful of companies that are truly generational,” Taylor said.

And:

Every company would be affected if the AI bubble were to burst, the head of Google’s parent firm Alphabet has told the BBC…Speaking exclusively to BBC News, Sundar Pichai said while the growth of artificial intelligence (AI) investment had been an “extraordinary moment”, there was some “irrationality” in the current AI boom.

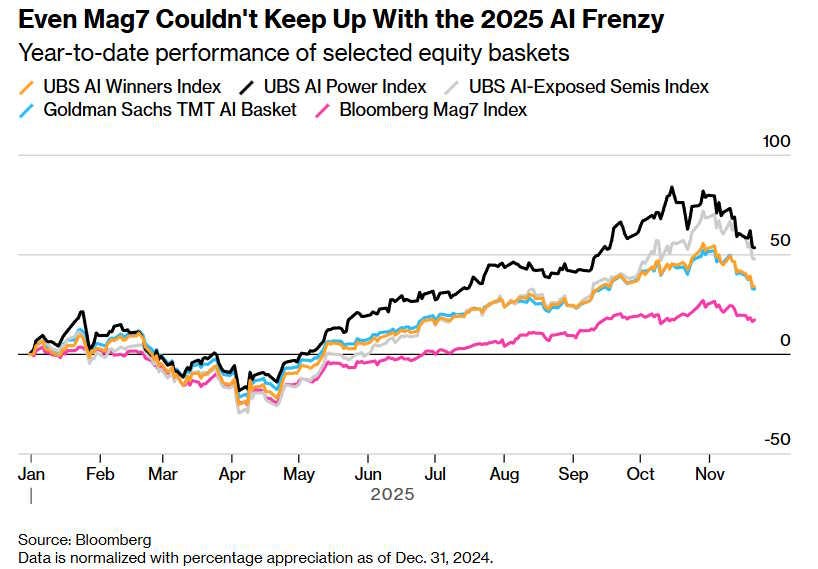

The market is also starting to get skeptical. Here’s a chart from Bloomberg:

Almost everyone I read is basically talking about two scenarios for an AI bust. I call these the Virtual Reality Scenario and the Railroad Scenario. I’ll go over these, and then talk about the third scenario

The Virtual Reality Scenario

What I call the Virtual Reality Scenario is if AI, in its current form, turns out to just not be a very useful technology

...This excerpt is provided for preview purposes. Full article content is available on the original publication.