Lessons for Debt Control from Clinton's Success in the 1990s

Deep Dives

Explore related topics with these Wikipedia articles, rewritten for enjoyable reading:

-

Omnibus Budget Reconciliation Act of 1993

11 min read

Linked in the article (7 min read)

-

Earned income tax credit

14 min read

The article repeatedly highlights the EITC expansion as 'the single biggest pro-working-poor social-insurance expansion' and central to OBRA 93's success. Understanding the mechanics and history of this specific tax credit would give readers crucial context for why DeLong considers it so significant.

-

Crowding out (economics)

11 min read

The article's central thesis revolves around 'crowding in' private investment through deficit reduction - the opposite of crowding out. Understanding this economic concept and the debate around government borrowing's effect on private investment is essential to grasping the article's argument about why OBRA 93 worked.

Time to fly my left-neoliberal freak flag! For a failure to get the history right may well lead us to inaccurate conclusions about what our government-debt outlook really is, & mistake how resulting economic & political-economic problems should be dealt with:

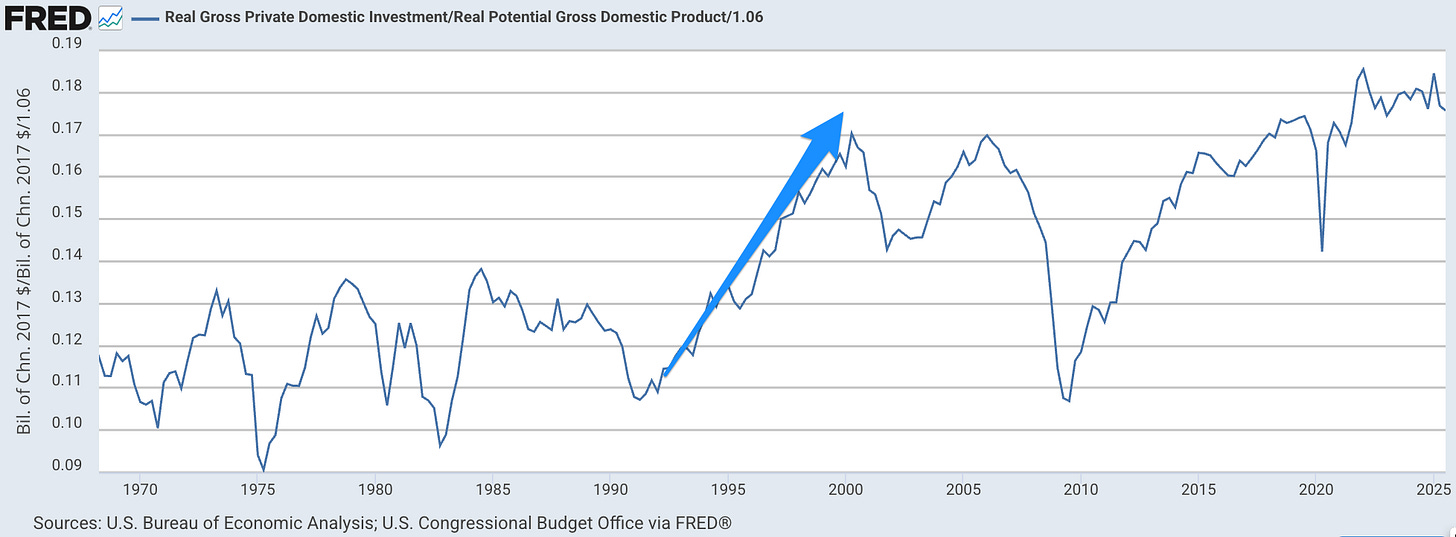

Credible fiscal anchors crowd in private investment when the central bank leans against demand shortfalls and technology makes capital cheaper. Clinton’s OBRA 93 deficit-reduction Reconciliation package accelerated the economy, because macro reality beats tribal signaling. Fiscal credibility, pro-work redistribution, and a supportive Fed plus falling ICT prices crowded in investment, the 1994 yield-curve shift move reflected growth strength and MBS mechanics, not fears of “austerity gone wrong.” The Clinton 1990s really were a fabulous decade that delivered rising employment, low inflation, and real wage gains, with the EITC expansion the single biggest pro–working-poor social-insurance expansion. Labeling this “austerity” misses how structure + demand + technology produced more capital, higher productivity, and a richer America.

And taking claims that Clinton’s OBRA 93 would tank the economy as real fears by credible macroeconomic analysts is to mistake political bullshit for real analytical judgements and warranted fears.

I write because I think the very sharp Marcus Nunes gets this one wrong here.

He is reviewing the the fiscal adjustment that was the Clinton 1993 Reconciliation deficit-reduction bill—OBRA 93 <https://en.wikipedia.org/wiki/Omnibus_Budget_Reconciliation_Act_of_1993>

It crowded-in a truly extraordinary boost to investment in America, which was further amplified by the secular fall in the relative price of information-communications capital goods that was the internet boom. And American economic growth was, thereafter, stronger by perhaps 0.5%-points per year. Figure that America today is 15% richer because of Bill Clinton and those of us who worked for and supported him.

OBRA 93 was viewed by us left-neoliberals—us Rubin Democrats—who pushed this in 1993 as very much a second installment of what had been OBRA 90: the George H.W. Bush-Mitchell-Foley deficit-reduction package of three years before. OBRA 93 did have more tax increases and fewer spending cuts in the mix, but by a narrow margin. OBRA 93 was more progressive than OBRA 90, but again by a narrow margin. But both combined revenue increases with spending restraint rather than relying on one side of the ledger alone, both raised top‑bracket income tax liabilities and closed loopholes/preferences to broaden the base and increase progressivity, both tightened discretionary spending caps and enforced them with sequestration/PayGo‑style budget rules to deter backsliding,

...This excerpt is provided for preview purposes. Full article content is available on the original publication.