Mantic Monday: The Monkey's Paw Curls

The Monkey’s Paw Curls

Isn’t “may you get exactly what you asked for” one of those ancient Chinese curses?

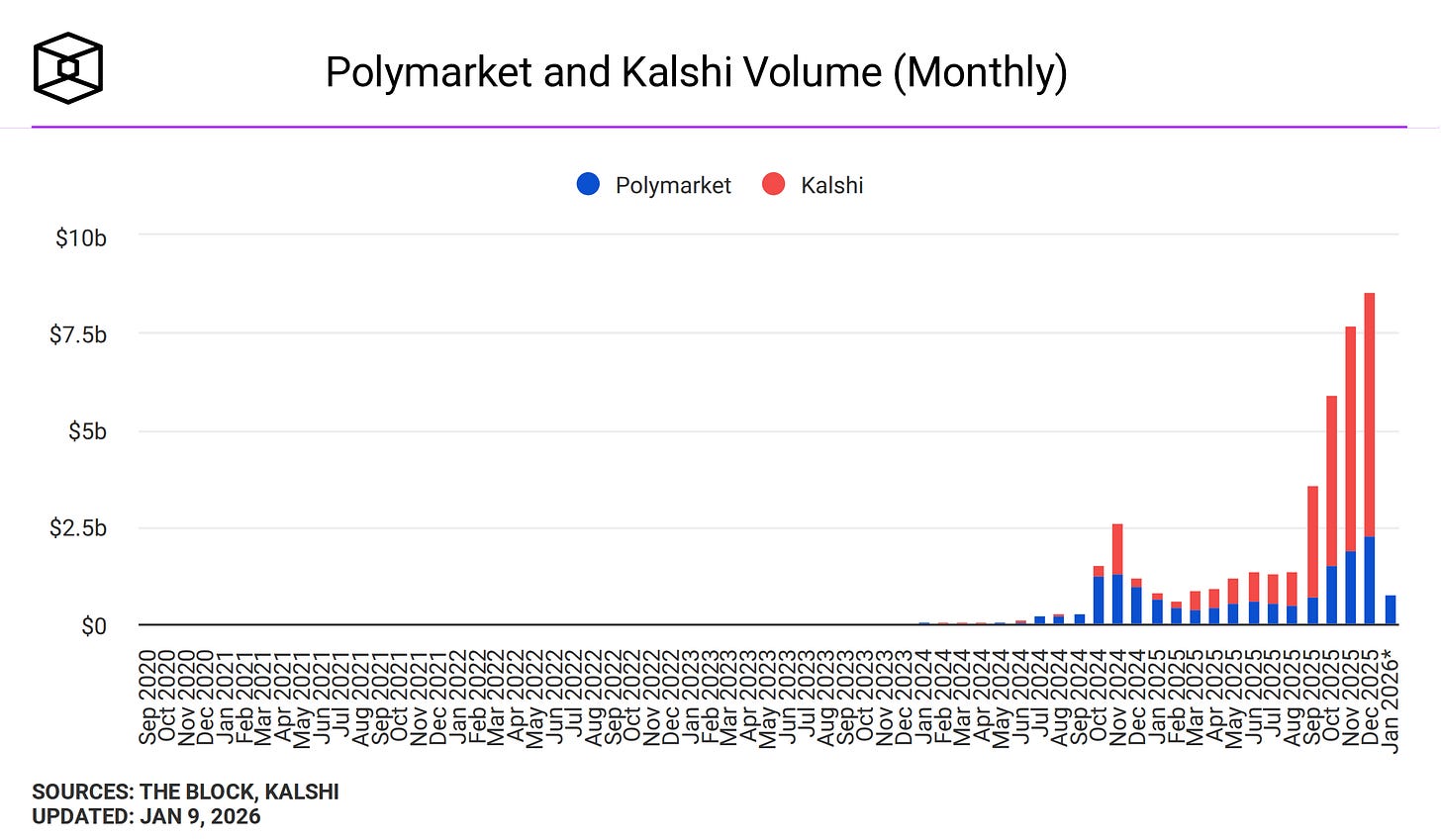

Since we last spoke, prediction markets have gone to the moon, rising from millions to billions in monthly volume.

For a few weeks in October, Polymarket founder Shayne Coplan was the world’s youngest self-made billionaire (now it’s some AI people). Kalshi is so accurate that it’s getting called a national security threat.

The catch is, of course, that it’s mostly degenerate gambling, especially sports betting. Kalshi is 81% sports by monthly volume. Polymarket does better - only 37% - but some of the remainder is things like this $686,000 market on how often Elon Musk will tweet this week - currently dominated by the “140 - 164 times” category.

(ironically, this seems to be a regulatory difference - US regulators don’t mind sports betting, but look unfavorably on potentially “insensitive” markets like bets about wars. Polymarket has historically been offshore, and so able to concentrate on geopolitics; Kalshi has been in the US, and so stuck mostly to sports. But Polymarket is in the process of moving onshore; I don’t know if this will affect their ability to offer geopolitical markets)

Degenerate gambling is bad. Insofar as prediction markets have acted as a Trojan Horse to enable it, this is bad. Insofar as my advocacy helped make this possible, I am bad. I can only plead that it didn’t really seem plausible, back in 2021, that a presidential administration would keep all normal restrictions on sports gambling but also let prediction markets do it as much as they wanted. If only there had been some kind of decentralized forecasting tool that could have given me a canonical probability on this outcome!

Still, it might seem that, whatever the degenerate gamblers are doing, we at least have some interesting data. There are now strong, minimally-regulated, high-volume prediction markets on important global events. In this column, I previously claimed this would revolutionize society. Has it?

I don’t feel revolutionized. Why not?

The problem isn’t that the prediction markets are bad. There’s been a lot of noise about insider trading and disputed resolutions. But insider trading should only increase accuracy - it’s bad for traders, but good for information-seekers - and my impression is that the disputed resolutions were handled as well as possible. When I say I don’t feel revolutionized,

...This excerpt is provided for preview purposes. Full article content is available on the original publication.