Warning: The Fed Can’t Rescue AI

Deep Dives

Explore related topics with these Wikipedia articles, rewritten for enjoyable reading:

-

Dot-com bubble

15 min read

Krugman explicitly draws parallels between the current AI investment boom and the 1990s tech bubble. Understanding the dot-com bubble's causes, progression, and aftermath provides essential historical context for evaluating his argument about whether AI represents a similar speculative excess.

-

Greenspan put

14 min read

The article directly references the 'Greenspan put' - the belief that Fed Chairman Alan Greenspan would intervene to prevent market crashes. This concept is central to Krugman's argument that investors mistakenly believe the Fed can rescue AI stocks, just as they believed during the tech bubble.

-

Present value

13 min read

Krugman's core economic argument hinges on present value calculations - explaining why interest rate changes affect long-lived assets differently than short-lived tech investments. Understanding this financial concept is crucial to grasping why he believes Fed rate cuts cannot sustainably support AI valuations.

While everything feels political now – a kind of fin de siècle chaos politics – I want to take a brief break from the political today. Instead I want to talk about asset markets and the Fed.

We could say that the US economy in 2025 was schizoid. On the one hand Donald Trump abruptly reversed 90 years of U.S. trade policy, breaking all our international agreements, and pushed tariffs to levels not seen since the 1930s. Worse, the tariffs keep changing unpredictably. This uncertainty is clearly bad for business and is depressing the economy. On the other hand, there has simultaneously been a huge boom in AI-related investment, which is boosting the economy.

As many people have already noted, the AI boom bears an unmistakable resemblance to the tech boom of the late 1990s — a boom that turned out to be a huge bubble. The Nasdaq didn’t regain its 2000 peak until 2014.There’s intense debate about whether AI investment is similarly a bubble, which I would summarize as a shoving match: “Is not!” “Is too!” “Is not!” “Is too!”

While my personal guess is that AI is indeed in the midst of a bubble, I won’t devote today’s post to that debate. Instead, I want to talk about one recent aspect of market behavior that is very striking and carries strong echoes of the tech bubble a generation ago. Namely, AI-related stocks, like tech stocks back then, are reacting very strongly to perceptions about the Fed’s short-term interest rate policy.

Now as then, these strong reactions don’t make sense.

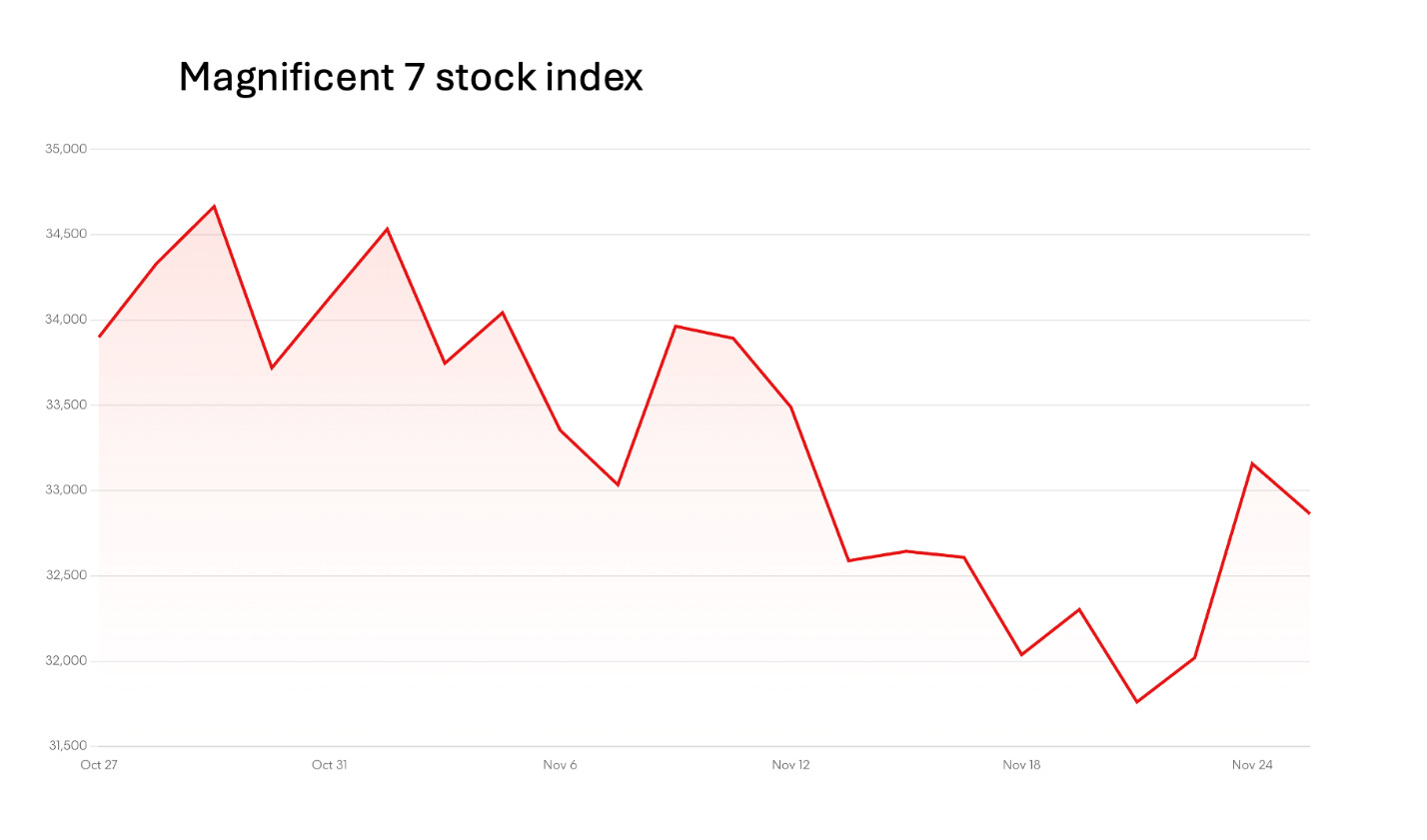

To see what I’m talking about, consider recent moves in stock prices closely related to AI. This chart shows movement over the last month of Bloomberg’s “magnificent 7” stock index:

Source: Bloomberg

During most of that month, these stocks were falling, as concerns that AI is a bubble increased. But on Monday the Mag7 index surged, erasing a large fraction of the losses. Why? Analyst chatter about supposed causes of stock market swings should always be taken with many grains of salt. But it’s clear that this surge was catalyzed by remarks by Fed officials which the market interpreted as making a cut in the Fed Funds rate next month more likely.

Some of us have seen this movie before. For those who haven’t, there is a pervasive view that the deflation of the 90s tech bubble

...This excerpt is provided for preview purposes. Full article content is available on the original publication.