Weight Loss Drugs Continue to Power Denmark's Economy

Thanks for reading! If you haven’t subscribed, please click the button below:

By subscribing you’ll join over 47,000 people who read Apricitas!

This Thanksgiving, many Americans ended up with more leftovers than usual—the use of recently discovered GLP-1 drugs is rapidly increasing as millions of people turn to them for help in battling obesity and cardiovascular diseases. These drugs work as appetite suppressants, helping patients regulate food intake by reducing feelings of hunger, and they are one of few medications able to reliably induce long-run weight loss and its downstream health benefits. Thus, prescriptions for Ozempic (a GLP-1 diabetes medication often sought for weight loss despite not being FDA-approved for that purpose) and Wegovy (an explicitly obesity-treating drug) are both on the rise—and that’s been great news for the drugs’ manufacturer, Danish pharmaceutical giant Novo Nordisk.

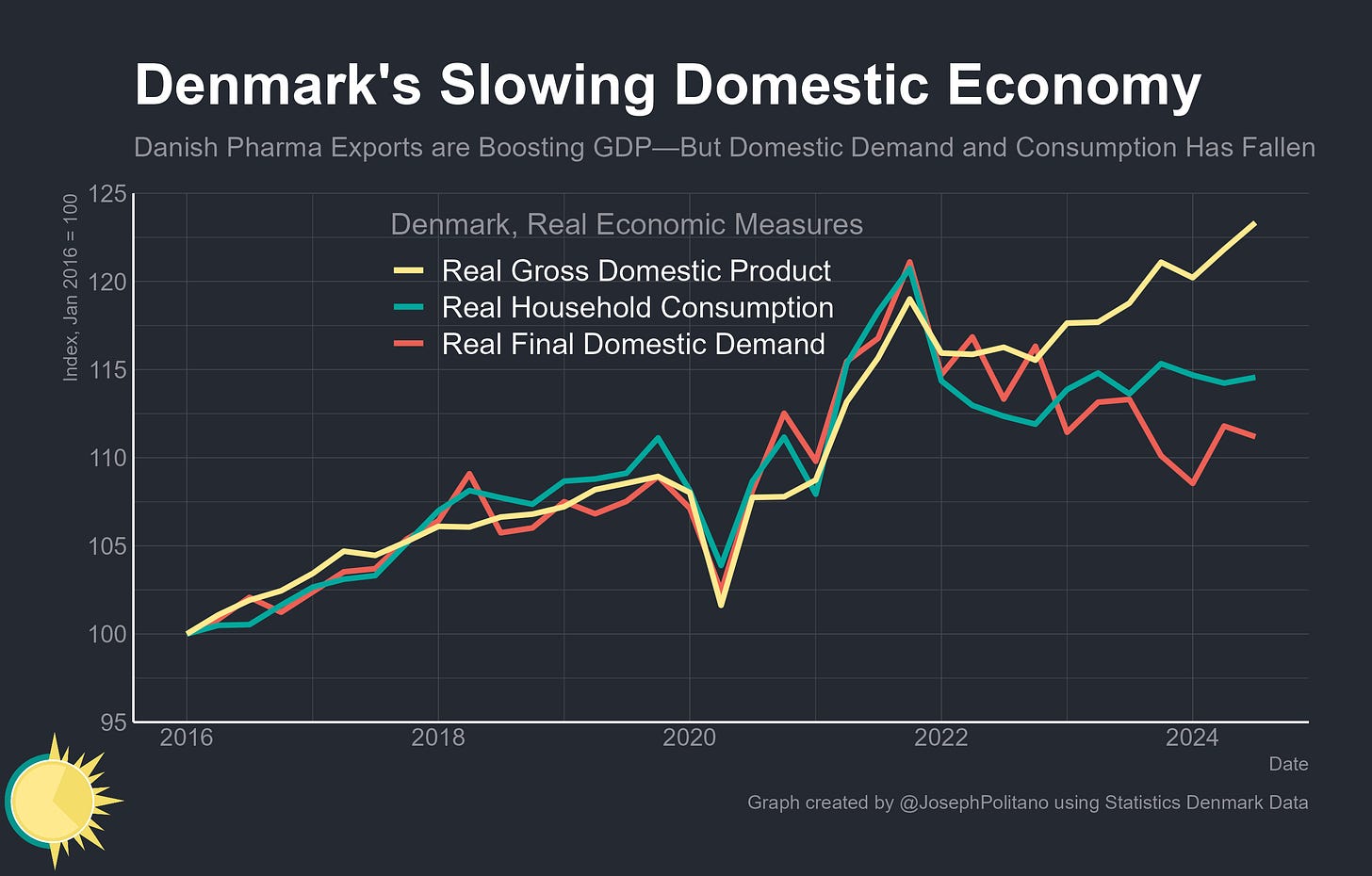

In fact, the GLP-1 boom has been such good news for Novo Nordisk that rising drug exports are currently driving the majority of Denmark’s GDP growth—since late 2021, Danish GDP has increased by 3.6%, but economic growth would have been 0% without the contribution of rapid increases in pharmaceutical manufacturing output. In fact, the pharmaceutical boom has been so strong that it has almost singlehandedly made Denmark one of the fastest-growing economies in the European Union.

In total, the real output of Danish drugmakers has increased by 47% over the last year and has cumulatively risen by 167% since late 2019. That growth broke Danish industry out from a long period of relative stagnation, with total real manufacturing output growing by more in the last four years than it did during the prior 20.

Most of that pharmaceutical production boom has gone towards meeting foreign demand for GLP-1 drugs, especially in the United States. Real Danish goods exports have increased by roughly 37% over the last four years, easily dwarfing the comparatively tepid growth in imports and thus netting Denmark a large increase in its trade surplus.

Yet despite the country’s increase in economic output over the last two years, Denmark has struggled to fully translate the GLP-1 boom into rising personal spending or domestic investment. Real Danish household consumption and capital formation have both been stagnant for more than three years, mirroring many of the economic struggles seen in Germany and many other parts of the EU.

To some extent, that should not be particularly surprising—pharmaceutical manufacturing is not a labor-intensive industry

...This excerpt is provided for preview purposes. Full article content is available on the original publication.