Can Large Tech Companies Be 'Bad' for the Economy but Good for Workers?

Thank you for reading our work! Nominal News is an email newsletter read by over 4,000 readers that focuses on the application of economic research on current issues. Subscribe for free to stay-up-to-date with Nominal News directly in your inbox:

Our updated goal for 2025 is to hit 10,000 subscribers:

If you would like to support us further with reaching our subscriber goal, please consider sharing and liking this article!

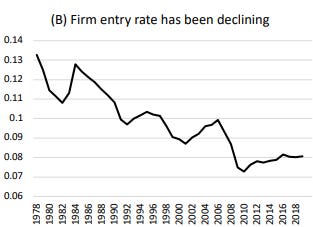

In recent decades, the US (and other countries) have experienced a decline innovation as measured by the formation of new firms:

Many have often pointed blame at the lack of competition and the monopolization of certain sectors. Large companies, especially in tech and pharmaceuticals, have become dominant entities. Opinions on whether such large companies are good or bad are mixed. A recently released paper has looked at how a monopoly, or more precisely a monopsony1, can impact economy-wide technological growth. But interestingly, it may benefit workers in the industry. Let’s dive in.

Modelling a Monopsony Market

Defensive Hiring

Fernández-Villaverde, Yu and Zanetti (2025) (“FYZ”) looked at how market-dominant firms may choose to ‘defensively’ hire in order to prevent being replaced by an incumbent. This question has been often discussed in the context of ‘defensive acquisitions’, where a large firm buys a small firm that is developing a new technology. For example, Ederer and Pellegrino (2023) argued that many start-ups are being acquired by large companies to reduce direct competition.

FYZ have a similar idea, but rather than acquiring companies, large firms may have an incentive to hire more research and development (R&D) workers to make it harder for other companies to innovate. In order to hire more research workers, large firms have to offer higher wages. Since large firms account for most of the hiring of research workers, these large firms are de facto setting the industry-wide wage for research workers. By setting the wage higher, new entrant firms will find it expensive to enter the market.

Does this happen?

The above idea seems plausible, but do we have data potentially supporting such behavior of ‘defensive hiring’. FYZ present several facts that point to such behavior:

In industries where incumbent firms spend a lot on R&D, there are fewer new firms created;

Incumbents that spend more on R&D survive for longer;

Higher incumbent spending on R&D appears to

This excerpt is provided for preview purposes. Full article content is available on the original publication.