Disney: Rewiring The Earnings Engine

Deep Dives

Explore related topics with these Wikipedia articles, rewritten for enjoyable reading:

-

ESPN

16 min read

The article centers on Disney's negotiating leverage through ESPN and its transition to direct-to-consumer streaming. Understanding ESPN's history, its dominance in sports broadcasting, and its evolution from cable to streaming provides essential context for the carriage dispute dynamics discussed.

-

Cord-cutting

12 min read

The article discusses the shrinking pay-TV audience from 85 million to 60 million households over five years. Understanding the cord-cutting phenomenon explains why traditional cable distributors like YouTube TV are under pressure and why Disney's sports content has become more valuable as the remaining audience is concentrated.

-

Carriage dispute

17 min read

The entire article analyzes Disney's carriage disputes with YouTube TV and Charter. Understanding how these negotiations work, their history in the media industry, and typical resolution patterns provides the reader with deeper context about the power dynamics between content providers and distributors.

Happy Thanksgiving! TSOH Investment Research will be off on Thursday for the holiday, but I’ll be back Monday, December 1st, with an update on Airbnb.

From “The Turning Point, Revisited” (November 2024): “With the launch of ESPN DTC flagship, and with proper alignment of the strategy across the DTC apps / the U.S. Disney bundle and more aggressive negotiations with (v)MVPD’s that reflect the essential content that Disney supplies, I think they will start to do a better job at fending off the pressure from more expensive sports rights. After six-plus years of a largely defensive strategy that did not address the core ESPN issue, Disney is shifting to an offensive posture...”

At the stroke of midnight on October 30th, Disney’s U.S. TV channels went dark on YouTube TV, the leading vMVPD with a subscriber base estimated at roughly 10 million households (not accounting for what I suspect is millions of users who are taking advantage of loose password sharing restrictions). The stalemate lasted more than two weeks, with a resolution on November 14th.

This is the second Disney carriage dispute I’ve covered at TSOH, with the first being the Charter blackout in late 2023. I won’t rehash that discussion, but it’s important to note that Charter was primarily focused on packaging flexibility, including customer access to Disney’s DTC apps; the dispute wasn’t centered on a disagreement about affiliate fees / pricing (Charter CEO Chris Winfrey: “we agreed to Disney’s supposed market rate increases”).

Based on WSJ reporting, the YouTube TV negotiations primarily stalled on pricing - “the fees Disney was seeking to carry ESPN and other networks”. If so, I think Disney’s negotiating position was clear: hold firm (I think that’s the right answer even before considering MFN clauses with other distributors).

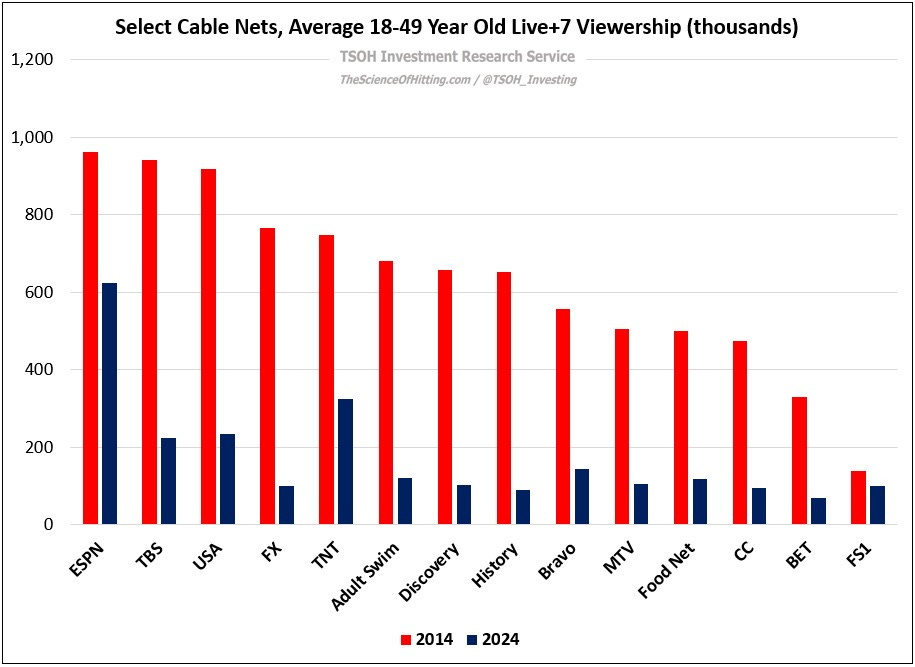

My view is Disney’s position as the leading supplier of marquee U.S. sports rights has greatly improved its relative importance as the U.S. pay-TV audience shrank from ~85 million households five years ago to ~60 million today; they are the most important content provider, and they need to aggressively defend their economics (as shown on page 44 of the 10-K, ESPN’s domestic programming and production costs were up 8% in FY25).

While this wasn’t true for many years - the ESPN+ diversion - Disney is now in a position where their business can be truly indifferent

...This excerpt is provided for preview purposes. Full article content is available on the original publication.