The Invention of "Climate Risk" - Politically Brilliant but Fatally Flawed

Deep Dives

Explore related topics with these Wikipedia articles, rewritten for enjoyable reading:

-

2015 United Nations Climate Change Conference

12 min read

The Paris Agreement is central to this article's argument about how 'climate risk' was invented to compel specific policy outcomes. Understanding the conference's negotiations, key players, and political dynamics provides essential context for the author's claim that climate risk was a tactical invention.

-

Intergovernmental Panel on Climate Change

12 min read

The article repeatedly references the IPCC's SREX report and its conclusions about extreme weather trends as scientific authority that was allegedly bypassed by climate risk advocates. Understanding the IPCC's structure, methodology, and role in climate policy helps readers evaluate the author's claims.

-

Causes of climate change

15 min read

The article criticizes World Weather Attribution and event attribution science as 'scientifically dubious.' This Wikipedia article explains the actual methodology behind attributing specific weather events to climate change, allowing readers to independently assess the author's skepticism.

Today’s post is Part 3 in the THB series on climate change and insurance.

Part 1 focused on the surprising recent financial performance of the insurance industry in the context of fevered claims of its looming collapse due to climate-fueled extreme events.

Part 2 explained that the insurance industry was a small part of a larger emphasis on “climate risk” by the global financial community. “Climate risk” — a concept bespoke to the industry — was defined in terms of the economic impacts of extreme weather. Because “climate risk” was novel and missed by the scientific community, the argument went, new methods and models were needed to assess that risk.

That’s where we pick things back up today — today’s Part 3 looks closer at how “climate risk” was created in global finance, representing a fatally flawed but arguably brilliant political tactic seemingly aimed at compelling the outcomes of the 2015 Paris Agreement. The larger story here is the rise of a climate-risk industrial complex in the global financial community.

Today’s installment looks at three issues:

Extreme weather became the focal point, but the real world did not play along;

Physical “climate risk” and “transition risk” became self-justifying rationales for transformation of the global economy, led by the global financial community;

“Climate risk” was to be assessed via scenario analyses and new types of risks models — Both deeply flawed.

Let’s go . . .

Extreme weather became the focal point, but the real world did not play along

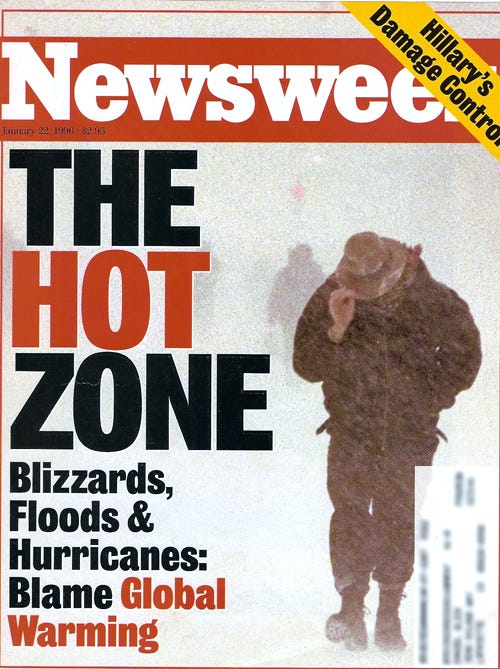

In popular discourse, climate change and extreme weather have long been associated with one another. For instance, 30 years ago, when I was a post-doc at NCAR working on hurricanes and floods, my boss brought to me the magazine1 below.

Efforts to connect climate change and extreme weather really took off in the mid-aughts around the time that Al Gore’s movie An Inconvenient Truth came out, hyping the connection in apocalyptic fashion — especially via 2005’s Hurricane Katrina.2 The climate advocacy community wanted to bring climate change home to people and extreme weather seemed the perfect vehicle. In many ways it is a renewable political resource, as photogenic (and sometimes destructive and tragic) weather extremes happen daily, somewhere.

There was a

...This excerpt is provided for preview purposes. Full article content is available on the original publication.