Getting Ready to Party Like It’s 2008

Deep Dives

Explore related topics with these Wikipedia articles, rewritten for enjoyable reading:

-

Panic of 1907

13 min read

The article discusses the 2008 financial crisis and references the 1930s bank runs, but the Panic of 1907 was the crisis that directly led to the creation of the Federal Reserve System in 1913 - essential context for understanding why the Fed exists and its role in financial stability

-

Wildcat banking

12 min read

Krugman explicitly compares stablecoins to 19th century wildcat banking, where banks were established in remote locations to avoid note redemption. Understanding this historical phenomenon illuminates his critique of modern crypto

-

Shadow banking system

17 min read

The article emphasizes that the 2008 crisis was primarily a run on shadow banks rather than traditional banks, but doesn't fully explain what shadow banking entails - this Wikipedia article provides crucial context for understanding the systemic risks discussed

On Sept. 15, 2008 Lehman Brothers failed. Within weeks the whole U.S. financial system was caught in the downward spiral of a massive bank run, on a scale not seen since the 1930s. Yet there was an important difference from the 1930s bank runs: in 2008, the panic mainly resulted in flight from “shadow banks,” nonbank institutions that performed bank-like functions. Conventional banks were largely immune from the 2008 panic because deposit insurance and federal regulations – a consequence of the 1930s bank runs – protected them.

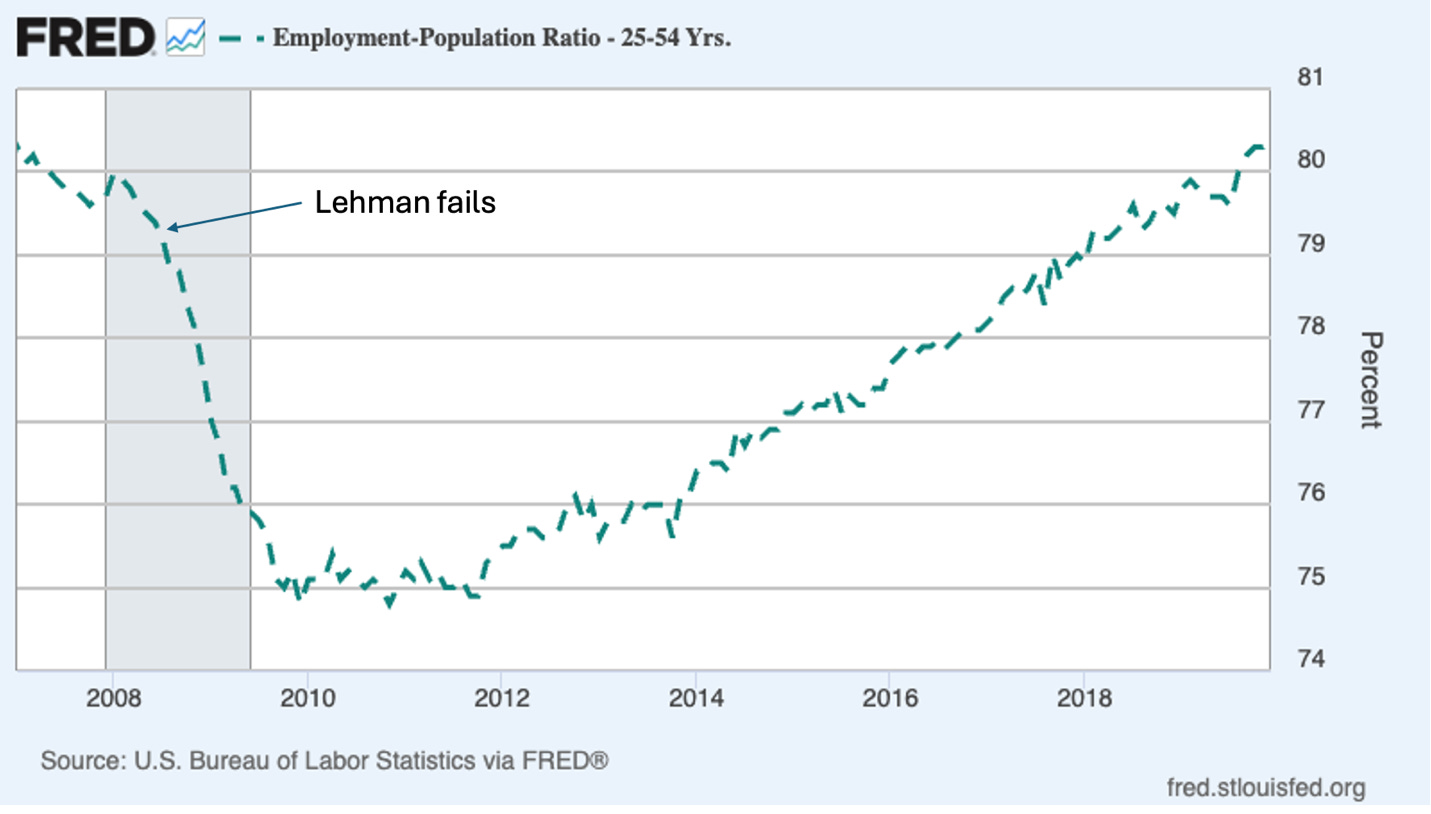

While the U.S. economy was already in recession when Lehman fell, the financial crisis pushed it off a cliff into a deep recession. Despite frantic efforts to stabilize the financial markets, including large bailouts and huge lending by the Federal Reserve, America lost 6 million jobs in the year following Lehman’s fall. Total employment didn’t return to pre-recession levels until 2014. The share of prime-working-age adults with jobs remained depressed until the late 2010s:

The clear lesson of 2008 is that effective financial regulation is essential. For three generations after the great bank runs of 1930-31, America avoided “systemic” banking crises — crises that threaten the whole financial system, as opposed to individual institutions. This era, which Yale’s Gary Gorton calls the Quiet Period, was the result of New-Deal-era protections — especially deposit insurance — and regulations that limited banks’ risk-taking.

But post 1980, finance was increasingly deregulated. In particular, the government failed to extend bank-type regulation to shadow banks that posed systemic bank-type risks. And the crisis came.

In a way, the laxity that made the 2008 crisis possible was understandable. By the 2000s nobody in government or the financial markets remembered what a real financial crisis was like. And no, watching “It’s a Wonderful Life” on Christmas Day doesn’t count.

But here we are in 2025, and 2008 wasn’t that long ago. Many of us still have vivid memories of the gut-wrenching panic that gripped the world when Lehman fell. Yet Donald Trump’s allies and cronies are now moving rapidly to dismantle the precautionary regulations introduced after 2008 to reduce the risk of future financial crises. I say “allies and cronies” advisedly. There’s no indication that Trump himself has any idea what’s happening on his watch. But key players in Congress, within the administration, and, alas, at the Federal Reserve, are apparently determined to make a 2008 rerun possible.

The

...This excerpt is provided for preview purposes. Full article content is available on the original publication.