Q2 2025 Update: Equanimity Investing

Welcome to the Q2 2025 update of Interconnected Capital.

To new and old readers alike, a friendly reminder: I run a global technology long-only fund focused on investing in both the hardware and software “picks and shovels” of the interconnected global digital AI economy. I draw on my technology business operator's experience and geopolitical antennas to bring an edge to how I assess a tech company’s rhythm and prospects in a constantly changing world [1]. (If you are an accredited investor as defined by the US SEC or equivalent standard in your country of residence, and interested in getting more information about the fund, e.g. audited performance report from 2023 and 2024, feel free fill out this short Google form.)

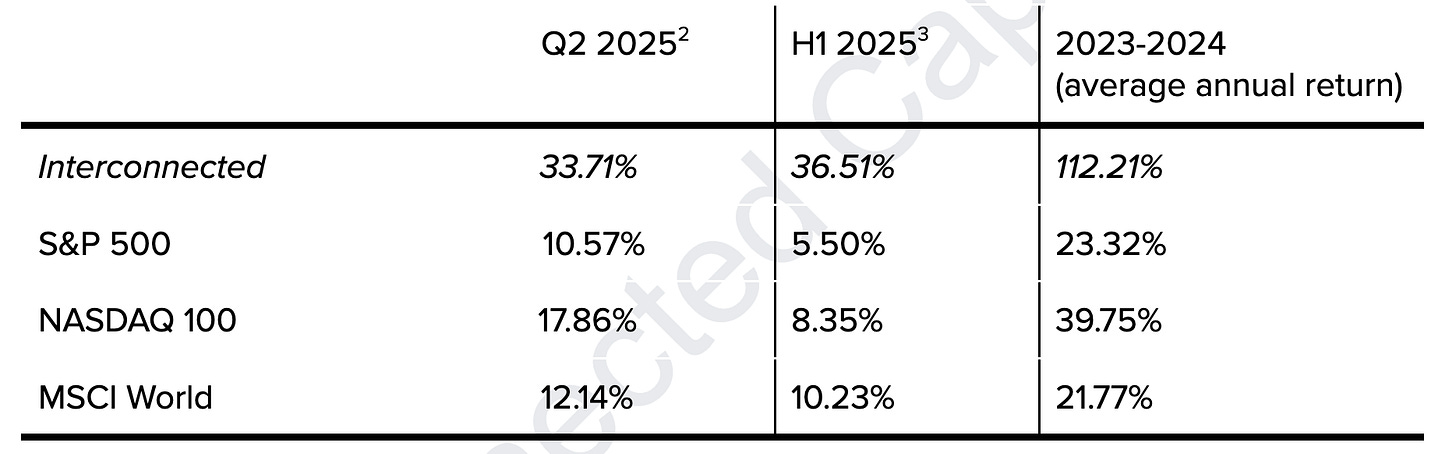

As always, first the numbers, then the reflection.

[1] My past experiences include: senior leadership position at GitHub (the world’s largest developer and open source technology platform, now owned by Microsoft), a unicorn database startup, early stage VC, and the White House and Department of Commerce during the Obama administration. I studied law and computer science at Stanford; international relations at Brown.

[2] Includes April 1 - June 30, 2025 gross returns. Unaudited.

[3] Includes January 1 - June 30, 2025 gross returns. Unaudited.

Portfolio positions listed in random order (as of July 1, 2025):

INTEL CORP

NEBIUS GROUP NV

OKTA INC

WERIDE INC ADR

ALIBABA GROUP ADR

Equanimity

Q2 was a helluva quarter.

Reflecting back on all the ups and downs (and ups), the one word that keeps popping into my head is “equanimity”. The Wikipedia definition is: “a state of psychological stability and composure which is undisturbed by the experience of or exposure to emotions, pain, or other phenomena that may otherwise cause a loss of mental balance.” The Latin root of the word is a combination of two concepts: aequus or “equal” and animus or “mind”.

An equal mind.

Had we all known everything that was about to happen during Q2, maintaining an equal mind would’ve been easy. But no one knows what the future holds, especially these days. That’s part of the fun of investing, and living. Experiencing and navigating all the emotions, turbulence, and a (hopefully temporary) loss of mental balance is a necessary path to forging a stronger sense of equanimity. There is only so much that reading books on bubbles, crashes, and wars can do for you; you

...This excerpt is provided for preview purposes. Full article content is available on the original publication.