Amazon Web Services Had a Very Bad Day, Amazon's Stock Price Did Not

Yesterday, Amazon Web Services, the cloud services backbone of the internet, had a serious glitch that took down a large chunk of the internet. How much did this outage cost? That’s not clear. But it was certainly a big number, with some estimates in the hundreds of billions of dollars.

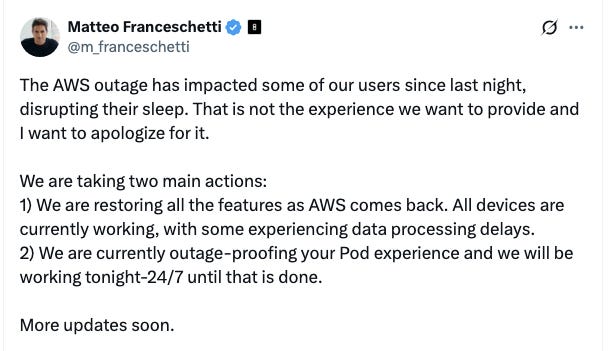

Many people experienced the AWS outage in terms of time wasted, Zoom meetings not working, random services breaking, or apps hanging up or not launching. I had trouble dealing with Verizon, their customer service team took 15 minutes to respond to a chat query, and explained they were having “technical issues” on their end. The outage affected everyone from Netflix to Snapchat to Venmo to thousands of other vital products and services. Here’s the CEO of Eight Sleep, which makes internet-connected beds, apologizing for the outage and its affect on the sleep of its customers.

Leaving aside why beds need to be connected to the internet, let’s just stipulate that some sleep got messed up. And all of these costs were incurred because of dysfunction at AWS. We don’t have a name for the externalities induced by the market power here.

In 2022, Cory Doctorow described the cycle of decay of tech platforms, where they lock you in and then decrease overall quality. He deemed it “enshittification.” I think it’s worth offering a cousin to this term, which I’ll call “Corporate Sludge.” Corporate sludge is the cost, or costs, of an excessively monopolized and financialized economy, that do not show up on a balance sheet.

Here’s what I mean. According to Amazon’s internal financials, AWS has a high profit margin. In 2024 it had $107 billion in revenue, and generated $39.8 billion in profit, with is a 37% operating income. A normal product or service, when faced with a catastrophe like the AWS outage, would take a financial hit. Yet here’s the stock of Amazon yesterday.

In other words, the costs of the AWS outage did not show up on the balance sheet directly responsible for it, or in the equity markets supposedly measuring long-term expectations of corporate profits. Economists would call the wasted time a “negative externality,” it’s the equivalent of pollution. And while that cost doesn’t show up anywhere we can affirmatively identify, someone has to pay for it. Those missed meetings, that lost production, it raises costs for virtually everyone, a little. This cost is what

...This excerpt is provided for preview purposes. Full article content is available on the original publication.