The case for progressive austerity

Deep Dives

Explore related topics with these Wikipedia articles, rewritten for enjoyable reading:

-

Deficit reduction in the United States

12 min read

The article's central argument revolves around using deficit reduction as a tool to combat inflation. This Wikipedia article provides historical context on past deficit reduction efforts under Clinton and Obama that the author references, and explains the policy mechanisms involved.

-

Paul Volcker

16 min read

The article references how historically inflation has been ended by recession. The Volcker shock is the canonical example of this - when Fed Chair Paul Volcker deliberately induced a recession to break 1970s-80s inflation. This provides crucial historical context for the monetary policy tradeoffs discussed.

-

Federal Reserve Act

12 min read

The article discusses Fed monetary policy, the 2% inflation target, and Trump's pressure on the Fed. Understanding the legal framework that established the Fed's independence and dual mandate helps readers understand why presidential pressure on the Fed is controversial and what constraints exist.

Today is Day One of a two-week break from public school during which time we have two major federal holidays that will occur on Thursdays. Slow Boring is committed to keeping everyone entertained and informed during the holiday season, but with a somewhat reduced pace of work activity from our staff. So there will be no posts on Christmas Day or New Year’s Day, the comment section is going to be more lightly moderated than usual (but behave yourselves because if people have to take time away from their families to intervene it’ll probably be by bringing the hammer down), and all our posts are going to be for paid subscribers only and a little bit more off the news than usual.

Hope everyone has a Merry Christmas or an enjoyable observance of the War on Christmas according to your personal tastes and family traditions.

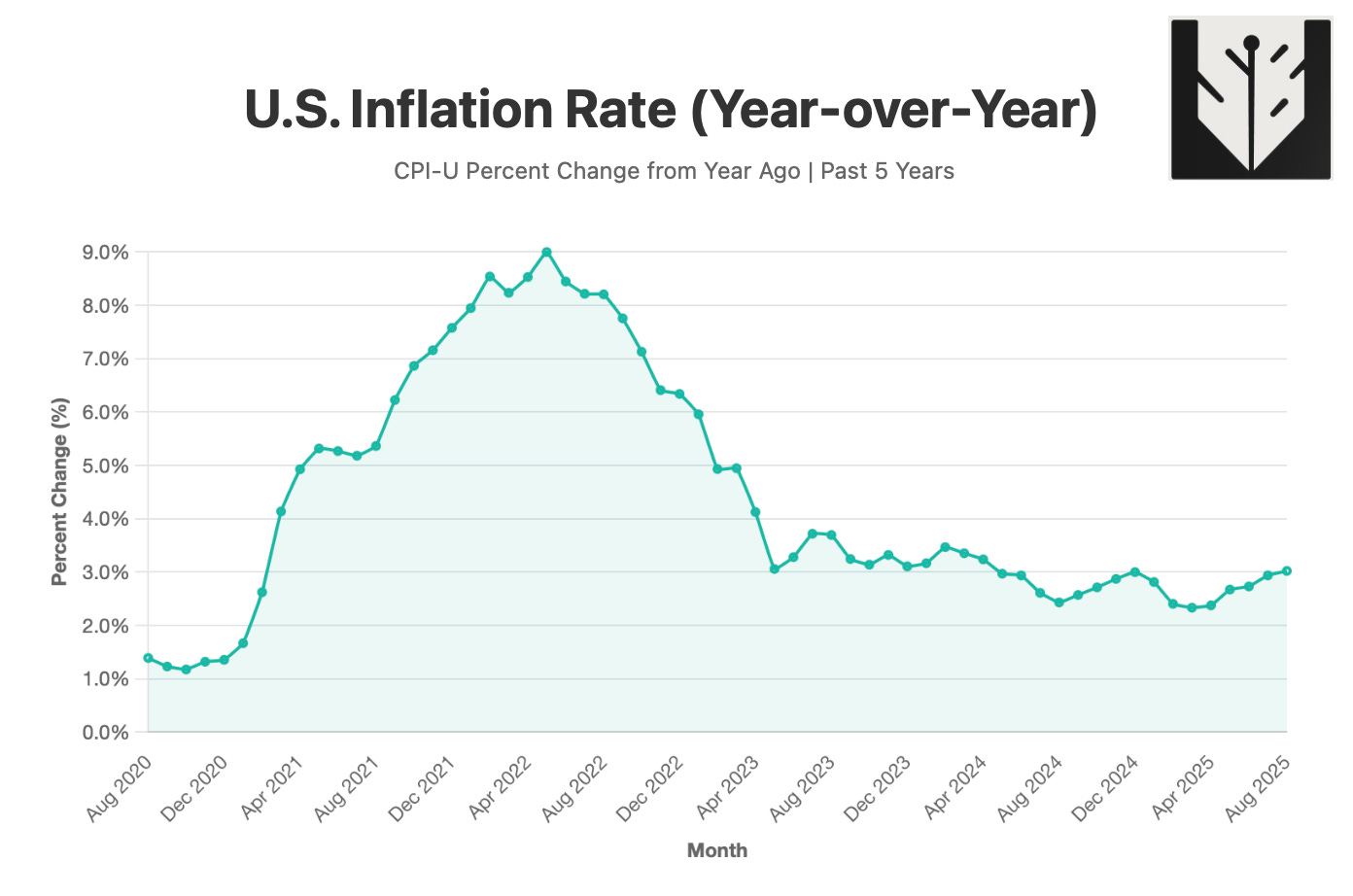

Inflation was very high in 2021 and 2022, and while it was definitely lower and falling in 2023 and 2024, it didn’t go all the way back down to the Fed’s target rate of 2 percent. Then in 2025, inflation stayed above target and if anything picked up a little.

Given how central inflation was to the politics of the Biden era, I think this basic set of facts has received too little attention.

Democrats have decided that talking about “affordability” is better than talking about “inflation,” which is fine by me. But this has spun out in ways that are slightly odd, with progressives both overthinking the true meaning of the cost-of-living crisis (as in this Roosevelt Institute report) and also underthinking the boring question of what Democrats are prepared to do on policy to generate lower inflation.

And I want to be clear that I’m talking about a governance problem more than a messaging one.

The mass public’s understanding of macroeconomic issues is poor, so plenty of things that sound persuasive to voters won’t work and vice versa. How to cope with that is a hard question. But to answer it, Democrats need to start with what would actually work to bring inflation down. This isn’t a huge mystery that requires us to reinvent the wheel in terms of public policy. The Federal Reserve could run tighter monetary policy, but that has a lot of well-known downsides. Or, we could lower the budget deficit.

“We should reduce the budget deficit” is

...This excerpt is provided for preview purposes. Full article content is available on the original publication.